Withholding Tax Tables And Methods Form - City Of New York Page 22

ADVERTISEMENT

City of New York

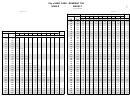

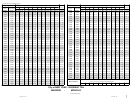

T-38

Special Table for Deduction and Exemption Allowances

Applicable to Method II, Exact Calculation Method

Applicable to Dollar to Dollar Withholding Tables

for city of New York; see pages T-39 and T-40

for city of New York; see pages T-41 - T-44

Using the tables below, compute the total deduction and exemption allowance to subtract from wages.

Table A

Combined Deduction and Exemption Allowance (full year)

Using Payroll Type, Marital Status, and the Number of Exemptions, locate the combined deduction and exemption allowance

amount in the chart below and subtract that amount from wages, before using the exact calculation method (or dollar to

dollar withholding tables) to determine the amount to be withheld.

(Use Tables B and C below if more than 10 exemptions are claimed.)

Number of Exemptions

Payroll

Marital

Type

Status

0

1

2

3

4

5

6

7

8

9

10

Daily or

Single

$19.25

$23.10

$26.95

$30.80

$34.65

$38.50

$42.35

$46.20

$50.05

$53.90

$57.75

Miscellaneous

Married

21.15

25.00

28.85

32.70

36.55

40.40

44.25

48.10

51.95

55.80

59.65

Weekly

Single

96.15

115.40

134.65

153.90

173.15

192.40

211.65

230.90

250.15

269.40

288.65

Married

105.75

125.00

144.25

163.50

182.75

202.00

221.25

240.50

259.75

279.00

298.25

Biweekly

Single

192.30

230.80

269.30

307.80

346.30

384.80

423.30

461.80

500.30

538.80

577.30

Married

211.50

250.00

288.50

327.00

365.50

404.00

442.50

481.00

519.50

558.00

596.50

Semimonthly

Single

208.35

250.00

291.65

333.30

374.95

416.60

458.25

499.90

541.55

583.20

624.85

Married

229.15

270.80

312.45

354.10

395.75

437.40

479.05

520.70

562.35

604.00

645.65

Monthly

Single

416.70

500.00

583.30

666.60

749.90

833.20

916.50

999.80

1,083.10

1,166.40

1,249.70

Married

458.30

541.60

624.90

708.20

791.50

874.80

958.10

1,041.40

1,124.70

1,208.00

1,291.30

Annual

Single

5,000

6,000

7,000

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

Married

5,500

6,500

7,500

8,500

9,500

10,500

11,500

12,500

13,500

14,500

15,500

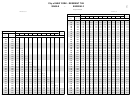

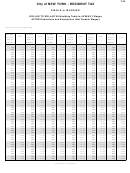

Table B

Table C

Table D

Adjustment for Difference Between Federal*

Deduction Allowance

Exemption Allowance

and New York Exemption Allowances

Use payroll period and marital

Based on a full year

status of employee to find the

exemption of $1,000.

For employers who elect to use the federal exemption amounts*

deduction allowance. Then

in computing wages after exemptions, the following adjustments

see Table C.

Multiply the number of

correct for the difference between the federal exemption of

exemptions claimed by the

$2,750* and the New York State exemption of $1,000 according

Payroll

Marital

Deduction

applicable amount from the

to the particular payroll period.

table below and add the

Period

Status

Amount

Daily or

To correct for the lower New York State exemption allowances:

Single

$19.25

result to the deduction

Miscellaneous

Married

21.15

amount from Table B.

Multiply the amount below for one exemption by the number

Weekly

Single

96.15

of exemptions claimed. Add the product to the federally

Married

105.75

computed wages after exemptions.

Biweekly

Single

192.30

Payroll

Value of one

Adjustment for each

Married

211.50

Period

exemption

Payroll Period

federal exemption

Daily/miscellaneous

Semi-

Single

208.35

$3.85

Daily/miscellaneous

$6.75

monthly

Married

229.15

Weekly

19.25

Weekly

33.65

Monthly

Single

416.70

Biweekly

38.50

Biweekly

67.30

Married

458.30

Semimonthly

41.65

Semimonthly

72.90

Annual

Single

5,000.00

Monthly

83.30

Monthly

145.80

Married

5,500.00

Annual

1,000.00

Quarterly

437.50

875.00

Semiannual

1,750.00

Annual

* The adjustments in Table D are based on the 1999 federal exemption amount of $2,750. The federal exemption amount may be adjusted for

inflation as prescribed by the Internal Revenue Code. For an annual payroll period, the adjustment for each federal exemption should be

changed by subtracting $1,000 from the current federal exemption amount. Other payroll periods should be recalculated accordingly.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32