Withholding Tax Tables And Methods Form - City Of New York Page 30

ADVERTISEMENT

T-47 (1/00)

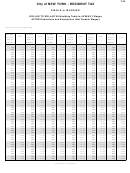

City of New York - Nonresident Earnings Tax

Method VII -- Exact Calculation Method

This method is for nonresident employees who earn wages in New York City paid by an employer maintaining an office or

transacting business within New York State.

This method applies the tax rate of 0.25% (.0025) to the wages remaining after the allowed exclusion is subtracted. It includes a provision

for no withholding if wages are less than an indicated amount of wages.

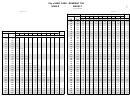

Table II - A Weekly Payroll

Table II - D Monthly Payroll

If wages are:

The

If wages are:

The

Line

At

But less

exemption

Line

At

But less

exemption

number

least

than

amount is

number

least

than

amount is

Column 1

Column 2

Column 3

Column 1

Column 2

Column 3

No tax

No tax

1

$0

$77

1

$0

$333

withheld

withheld

2

77

192

$58

2

333

833

$250

3

192

385

38

3

833

1,667

167

4

385

577

19

4

1,667

2,500

83

5

577

.

0

5

2,500 ....................

0

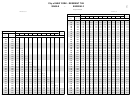

Table II - B Biweekly Payroll

Table II - E Daily Payroll

If wages are:

The

If wages are:

The

Line

At

But less

exemption

Line

At

But less

exemption

number

least

than

amount is

number

least

than

amount is

Column 1

Column 2

Column 3

Column 1

Column 2

Column 3

No tax

No tax

1

$0

$154

1

$0

$15

withheld

withheld

2

154

385

$115

2

15

38

$12

3

385

769

77

3

38

77

8

4

769

1,154

38

4

77

115

4

5

1,154

.

0

5

115

.

0

Steps for computing the amount of nonresident

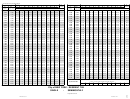

Table II - C Semimonthly Payroll

earnings tax to be withheld:

If wages are:

The

Step 1

Find the proper table in the Table II series above,

Line

At

But less

exemption

according to the payroll period. Find the line on which

number

least

than

amount is

Column 1

Column 2

Column 3

the amount of gross wages is equal to at least

Column 1 and less than Column 2.

No tax

1

$0

$167

withheld

If the wages are found on line 1, there is no

2

167

417

$125

withholding (no further steps are needed).

3

417

833

83

Step 2

Subtract the Column 3 exemption amount on the line

found in Step 1 from the gross wages.

4

833

1,250

42

Multiply the result of Step 2 by 0.25% (.0025). The product

Step 3

5

1,250

.

0

is the amount of tax to withhold each pay period.

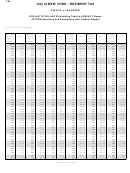

Example 1:

Example 2:

Example 3:

Weekly payroll, $75 gross wages

Weekly payroll, $200 gross wages

Semimonthly payroll, $400 gross wages

Step 1

Use Table II - A for weekly

Step 1

Use Table II - A for weekly

Step 1

Use Table II - C for semimonthly

payroll. Wages of $75 are found

payroll. Use line 3 ($200 is at

payroll. Use line 2 ($400 is at

on line 1, since $75 is at least

least $193 and less than $385).

least $167 and less than $417).

$0 and less than $77. No tax is

to be withheld from these

Step 2

$200 - $38 (exemption) = $162

Step 2

$400 - $125 (exemption) = $275

wages.

Step 3

$162 x .0025 = $0.41

Step 3

$275 x .0025 = $0.69

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32