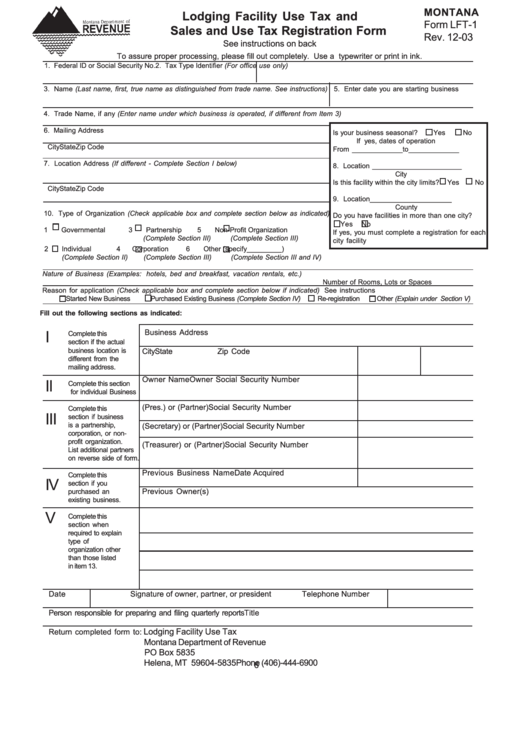

MONTANA

Lodging Facility Use Tax and

Form LFT-1

Sales and Use Tax Registration Form

Rev. 12-03

See instructions on back

To assure proper processing, please fill out completely. Use a typewriter or print in ink.

1. Federal ID or Social Security No.

2. Tax Type Identifier (For office use only)

3. Name (Last name, first, true name as distinguished from trade name. See instructions)

5. Enter date you are starting business

4. Trade Name, if any (Enter name under which business is operated, if different from Item 3)

6. Mailing Address

Is your business seasonal?

Yes

No

If yes, dates of operation

City

State

Zip Code

From _____________to_____________

7. Location Address (If different - Complete Section I below)

8. Location _______________________

City

Is this facility within the city limits?

Yes

No

City

State

Zip Code

9. Location_____________________

County

10. Type of Organization (Check applicable box and complete section below as indicated)

Do you have facilities in more than one city?

Yes

No

1

Governmental

3

Partnership

5

Non-Profit Organization

If yes, you must complete a registration for each

(Complete Section III)

(Complete Section III)

city facility

2

Individual

4

Corporation

6

Other (specify_________)

(Complete Section II)

(Complete Section III)

(Complete Section III and IV)

Nature of Business (Examples: hotels, bed and breakfast, vacation rentals, etc.)

Number of Rooms, Lots or Spaces

Reason for application (Check applicable box and complete section below if indicated) See instructions

Started New Business

Purchased Existing Business (Complete Section IV)

Re-registration

Other (Explain under Section V)

Fill out the following sections as indicated:

I

Business Address

Complete this

section if the actual

business location is

City

State

Zip Code

different from the

mailing address.

Owner Name

Owner Social Security Number

II

Complete this section

for individual Business

(Pres.) or (Partner)

Social Security Number

Complete this

III

section if business

is a partnership,

(Secretary) or (Partner)

Social Security Number

corporation, or non-

profit organization.

(Treasurer) or (Partner)

Social Security Number

List additional partners

on reverse side of form.

Previous Business Name

Date Acquired

Complete this

IV

section if you

Previous Owner(s)

purchased an

existing business.

V

Complete this

section when

required to explain

type of

organization other

than those listed

in item 13.

Date

Signature of owner, partner, or president

Telephone Number

Person responsible for preparing and filing quarterly reports

Title

Lodging Facility Use Tax

Return completed form to:

Montana Department of Revenue

PO Box 5835

Helena, MT 59604-5835

Phone (406)-444-6900

6

1

1 2

2