Form Icb-2 Instructions

ADVERTISEMENT

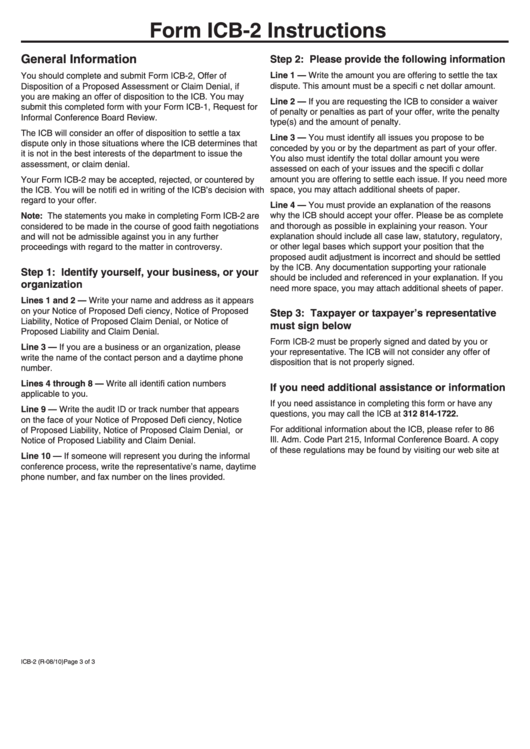

Form ICB-2 Instructions

General Information

Step 2: Please provide the following information

You should complete and submit Form ICB-2, Offer of

Line 1 — Write the amount you are offering to settle the tax

dispute. This amount must be a specifi c net dollar amount.

Disposition of a Proposed Assessment or Claim Denial, if

you are making an offer of disposition to the ICB. You may

Line 2 — If you are requesting the ICB to consider a waiver

submit this completed form with your Form ICB-1, Request for

of penalty or penalties as part of your offer, write the penalty

Informal Conference Board Review.

type(s) and the amount of penalty.

The ICB will consider an offer of disposition to settle a tax

Line 3 — You must identify all issues you propose to be

dispute only in those situations where the ICB determines that

conceded by you or by the department as part of your offer.

it is not in the best interests of the department to issue the

You also must identify the total dollar amount you were

assessment, or claim denial.

assessed on each of your issues and the specifi c dollar

amount you are offering to settle each issue. If you need more

Your Form ICB-2 may be accepted, rejected, or countered by

the ICB. You will be notifi ed in writing of the ICB’s decision with

space, you may attach additional sheets of paper.

regard to your offer.

Line 4 — You must provide an explanation of the reasons

why the ICB should accept your offer. Please be as complete

Note: The statements you make in completing Form ICB-2 are

and thorough as possible in explaining your reason. Your

considered to be made in the course of good faith negotiations

explanation should include all case law, statutory, regulatory,

and will not be admissible against you in any further

or other legal bases which support your position that the

proceedings with regard to the matter in controversy.

proposed audit adjustment is incorrect and should be settled

by the ICB. Any documentation supporting your rationale

Step 1: Identify yourself, your business, or your

should be included and referenced in your explanation. If you

organization

need more space, you may attach additional sheets of paper.

Lines 1 and 2 — Write your name and address as it appears

on your Notice of Proposed Defi ciency, Notice of Proposed

Step 3: Taxpayer or taxpayer’s representative

Liability, Notice of Proposed Claim Denial, or Notice of

must sign below

Proposed Liability and Claim Denial.

Form ICB-2 must be properly signed and dated by you or

Line 3 — If you are a business or an organization, please

your representative. The ICB will not consider any offer of

write the name of the contact person and a daytime phone

disposition that is not properly signed.

number.

Lines 4 through 8 — Write all identifi cation numbers

If you need additional assistance or information

applicable to you.

If you need assistance in completing this form or have any

Line 9 — Write the audit ID or track number that appears

questions, you may call the ICB at 312 814-1722.

on the face of your Notice of Proposed Defi ciency, Notice

For additional information about the ICB, please refer to 86

of Proposed Liability, Notice of Proposed Claim Denial, or

Ill. Adm. Code Part 215, Informal Conference Board. A copy

Notice of Proposed Liability and Claim Denial.

of these regulations may be found by visiting our web site at

Line 10 — If someone will represent you during the informal

tax.illnois.gov.

conference process, write the representative’s name, daytime

phone number, and fax number on the lines provided.

ICB-2 (R-08/10)

Page 3 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1