Form Ds-2 Instructions

ADVERTISEMENT

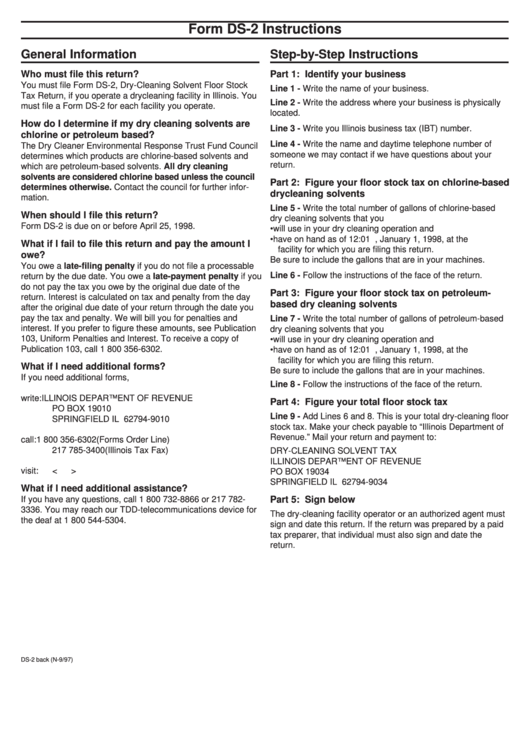

Form DS-2 Instructions

General Information

Step-by-Step Instructions

Who must file this return?

Part 1: Identify your business

You must file Form DS-2, Dry-Cleaning Solvent Floor Stock

Line 1 - Write the name of your business.

Tax Return, if you operate a drycleaning facility in Illinois. You

Line 2 - Write the address where your business is physically

must file a Form DS-2 for each facility you operate.

located.

How do I determine if my dry cleaning solvents are

Line 3 - Write you Illinois business tax (IBT) number.

chlorine or petroleum based?

Line 4 - Write the name and daytime telephone number of

The Dry Cleaner Environmental Response Trust Fund Council

someone we may contact if we have questions about your

determines which products are chlorine-based solvents and

return.

which are petroleum-based solvents. All dry cleaning

solvents are considered chlorine based unless the council

Part 2: Figure your floor stock tax on chlorine-based

determines otherwise. Contact the council for further infor-

drycleaning solvents

mation.

Line 5 - Write the total number of gallons of chlorine-based

When should I file this return?

dry cleaning solvents that you

Form DS-2 is due on or before April 25, 1998.

• will use in your dry cleaning operation and

• have on hand as of 12:01 a.m., January 1, 1998, at the

What if I fail to file this return and pay the amount I

facility for which you are filing this return.

owe?

Be sure to include the gallons that are in your machines.

You owe a late-filing penalty if you do not file a processable

Line 6 - Follow the instructions of the face of the return.

return by the due date. You owe a late-payment penalty if you

do not pay the tax you owe by the original due date of the

Part 3: Figure your floor stock tax on petroleum-

return. Interest is calculated on tax and penalty from the day

based dry cleaning solvents

after the original due date of your return through the date you

pay the tax and penalty. We will bill you for penalties and

Line 7 - Write the total number of gallons of petroleum-based

interest. If you prefer to figure these amounts, see Publication

dry cleaning solvents that you

103, Uniform Penalties and Interest. To receive a copy of

• will use in your dry cleaning operation and

Publication 103, call 1 800 356-6302.

• have on hand as of 12:01 a.m., January 1, 1998, at the

facility for which you are filing this return.

What if I need additional forms?

Be sure to include the gallons that are in your machines.

If you need additional forms,

Line 8 - Follow the instructions of the face of the return.

write:

ILLINOIS DEPARTMENT OF REVENUE

Part 4: Figure your total floor stock tax

PO BOX 19010

Line 9 - Add Lines 6 and 8. This is your total dry-cleaning floor

SPRINGFIELD IL 62794-9010

stock tax. Make your check payable to “Illinois Department of

Revenue.” Mail your return and payment to:

call:

1 800 356-6302 (Forms Order Line)

217 785-3400 (Illinois Tax Fax)

DRY-CLEANING SOLVENT TAX

ILLINOIS DEPARTMENT OF REVENUE

visit:

<

PO BOX 19034

SPRINGFIELD IL 62794-9034

What if I need additional assistance?

If you have any questions, call 1 800 732-8866 or 217 782-

Part 5: Sign below

3336. You may reach our TDD-telecommunications device for

The dry-cleaning facility operator or an authorized agent must

the deaf at 1 800 544-5304.

sign and date this return. If the return was prepared by a paid

tax preparer, that individual must also sign and date the

return.

DS-2 back (N-9/97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1