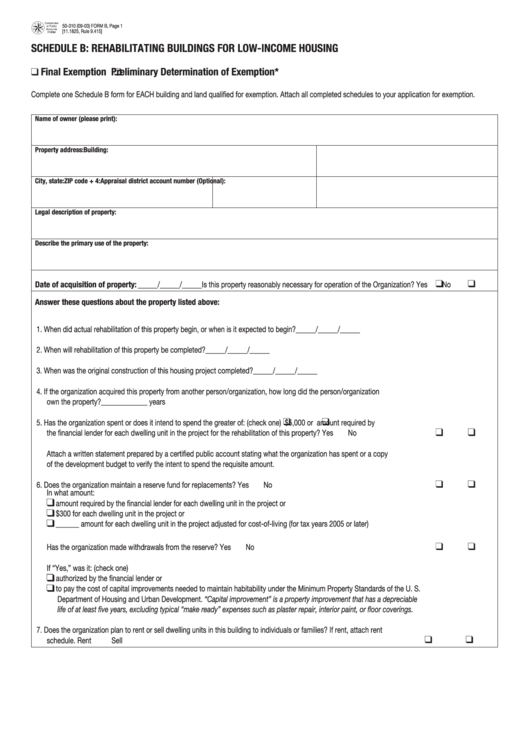

50-310 (09-03) FORM B, Page 1

[11.1825, Rule 9.415]

SCHEDULE B: REHABILITATING BUILDINGS FOR LOW-INCOME HOUSING

Final Exemption

Preliminary Determination of Exemption*

Complete one Schedule B form for EACH building and land qualified for exemption. Attach all completed schedules to your application for exemption.

Name of owner (please print):

Property address:

Building:

City, state:

ZIP code + 4:

Appraisal district account number (Optional):

Legal description of property:

Describe the primary use of the property:

Date of acquisition of property: ______/______/______

Is this property reasonably necessary for operation of the Organization?

Yes

No

Answer these questions about the property listed above:

1. When did actual rehabilitation of this property begin, or when is it expected to begin?

______/______/______

2. When will rehabilitation of this property be completed?

______/______/______

3. When was the original construction of this housing project completed?

______/______/______

4. If the organization acquired this property from another person/organization, how long did the person/organization

own the property?

______________ years

5. Has the organization spent or does it intend to spend the greater of: (check one)

$5,000 or

amount required by

the financial lender for each dwelling unit in the project for the rehabilitation of this property?

Yes

No

Attach a written statement prepared by a certified public account stating what the organization has spent or a copy

of the development budget to verify the intent to spend the requisite amount.

6. Does the organization maintain a reserve fund for replacements?

Yes

No

In what amount:

amount required by the financial lender for each dwelling unit in the project or

$300 for each dwelling unit in the project or

_______ amount for each dwelling unit in the project adjusted for cost-of-living (for tax years 2005 or later)

Has the organization made withdrawals from the reserve?

Yes

No

If “Yes,” was it: (check one)

authorized by the financial lender or

to pay the cost of capital improvements needed to maintain habitability under the Minimum Property Standards of the U. S.

Department of Housing and Urban Development. “Capital improvement” is a property improvement that has a depreciable

life of at least five years, excluding typical “make ready” expenses such as plaster repair, interior paint, or floor coverings.

7. Does the organization plan to rent or sell dwelling units in this building to individuals or families? If rent, attach rent

schedule.

Rent

Sell

1

1 2

2