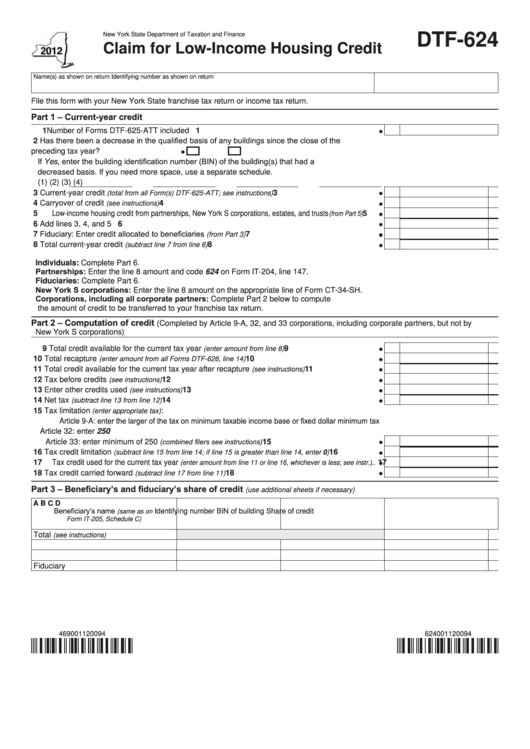

New York State Department of Taxation and Finance

DTF-624

Claim for Low-Income Housing Credit

Name(s) as shown on return

Identifying number as shown on return

File this form with your New York State franchise tax return or income tax return.

Part 1 – Current-year credit

1 Number of Forms DTF-625-ATT included ...................................................................................

1

2 Has there been a decrease in the qualified basis of any buildings since the close of the

preceding tax year? ............... Yes

No

If Yes, enter the building identification number (BIN) of the building(s) that had a

decreased basis. If you need more space, use a separate schedule.

(1)

(2)

(3)

(4)

3 Current-year credit

..........................................

3

(total from all Form(s) DTF-625-ATT; see instructions)

4 Carryover of credit

..............................................................................................

4

(see instructions)

5 Low-income housing credit from partnerships, New York S corporations, estates, and trusts

.....

5

(from Part 5)

6 Add lines 3, 4, and 5 ...................................................................................................................

6

7 Fiduciary: Enter credit allocated to beneficiaries

......................................................

7

(from Part 3)

8 Total current-year credit

........................................................................

8

(subtract line 7 from line 6)

Individuals: Complete Part 6.

Partnerships: Enter the line 8 amount and code 624 on Form IT-204, line 147.

Fiduciaries: Complete Part 6.

New York S corporations: Enter the line 8 amount on the appropriate line of Form CT-34-SH.

Corporations, including all corporate partners: Complete Part 2 below to compute

the amount of credit to be transferred to your franchise tax return.

Part 2 – Computation of credit

(Completed by Article 9-A, 32, and 33 corporations, including corporate partners, but not by

New York S corporations)

9 Total credit available for the current tax year

.........................................

9

(enter amount from line 8)

10 Total recapture

.........................................................

10

(enter amount from all Forms DTF-626, line 14)

11 Total credit available for the current tax year after recapture

.............................

11

(see instructions)

12 Tax before credits

...............................................................................................

12

(see instructions)

13 Enter other credits used

.....................................................................................

13

(see instructions)

14 Net tax

...............................................................................................

14

(subtract line 13 from line 12)

15 Tax limitation

:

(enter appropriate tax)

Article 9-A: enter the larger of the tax on minimum taxable income base or fixed dollar minimum tax

Article 32: enter 250

(combined filers see instructions)

Article 33: enter minimum of 250

..............................................

15

16 Tax credit limitation

..................

16

(subtract line 15 from line 14; if line 15 is greater than line 14, enter 0)

17 Tax credit used for the current tax year

..

17

(enter amount from line 11 or line 16, whichever is less; see instr.)

18 Tax credit carried forward

..................................................................

18

(subtract line 17 from line 11)

Part 3 – Beneficiary’s and fiduciary’s share of credit

(use additional sheets if necessary)

A

B

C

D

Beneficiary’s name

Identifying number

BIN of building

Share of credit

(same as on

Form IT-205, Schedule C)

Total

(see instructions)

Fiduciary

469001120094

624001120094

1

1 2

2