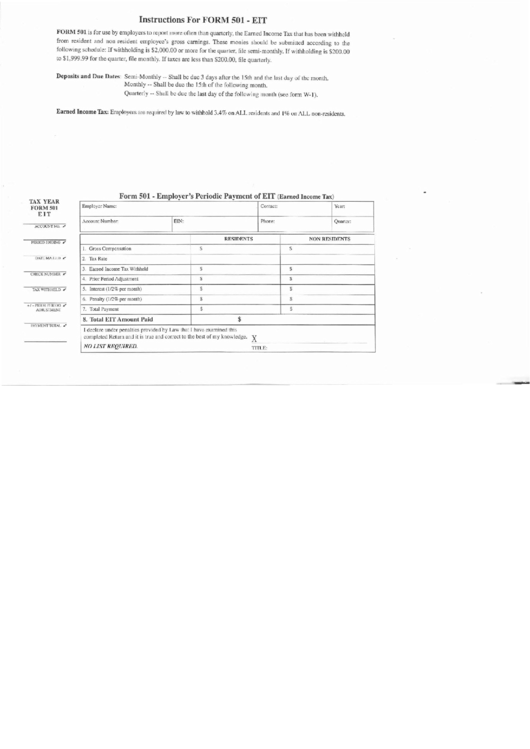

Form 501 - Employer'S Periodic Payment Of Eit (Earned Income Tax)

ADVERTISEMENT

Instructions For FORM 501 - EIT

FORM 501 is for use by employers to report more often than quarterly, the Earned Income Tax that has been withheld

from resident and non-resident employee's gross earnings. These monies should be submiued according to the

following schedule: If withholding is $2,000.00 or more for the quarter, file semi-monthly. If withholding is $200.00

to $1,999.99 for the quarter, file monthly. If taxes are less than $200.00, file quarterly.

Deposits and Due Dates: Semi-Monthly -- Shall be due 3 days after the 15th and the last day of the month.

Monthly -- Shall be due the 15th of the following month.

Quarterly -- Shall be due the last day of the following month (see form W-I).

Earned Income Tax: Employers are required by law to withhold 3.4% on ALL residents and I% on ALL non-residents.

Form SOl Employer's Periodic Payment of EIT

(Earned Income Tax)

-

Employer Name:

Contact:

Year:

Account Number:

[EtN:

Phone:

Quarter:

RESIDENTS

NON RESIDENTS

l. Gross Compensation

$

$

2. Tax Rate

3.

Earned Income Tax Withheld

S

S

4. Prior Period Adjustment

S

$

5. Interest

(lf2% per momh)

S

$

6. Penalty (1/2% per month)

$

$

7. TOlal Payment

$

$

8. Total EIT Amount Paid

$

I declare under penalties provided "by Law that I have examined this

completed Return and it is true and correct to the best of my knowledge.

X

NO LIST REQUIRED.

TITLE:

TAX WITIiHELD

II'

DATE MAILED

It'

ACCOUNT NO.

It'

PERIOD ENDING ,...

l'AYMENTlUfAL

Ii'

CHECK NUMlJER

II'

TAX YEAR

FORM 501

EIT

+/_

PRIOR PERIOD

II'

AI)JU!>TMENT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1