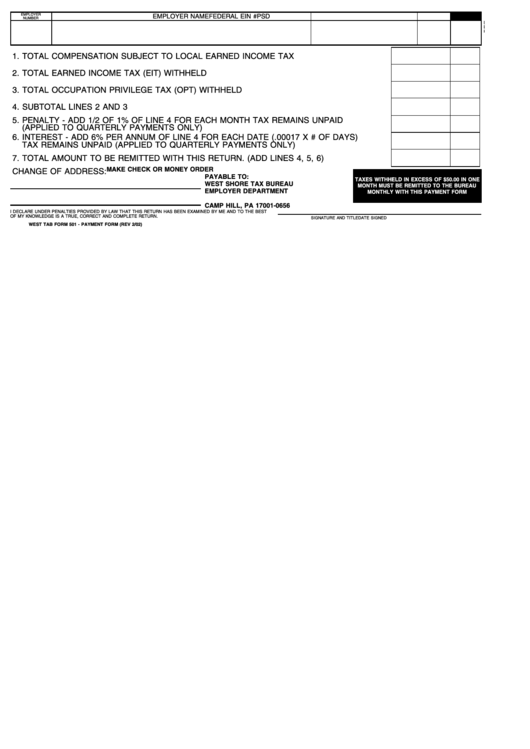

Form 501 - Employer'S Deposit Statement Of Withholding Tax - 2002

ADVERTISEMENT

EMPLOYER

EMPLOYER NAME

FEDERAL EIN #

PSD

TAX YEAR

NUMBER

1. TOTAL COMPENSATION SUBJECT TO LOCAL EARNED INCOME TAX

2. TOTAL EARNED INCOME TAX (EIT) WITHHELD

3. TOTAL OCCUPATION PRIVILEGE TAX (OPT) WITHHELD

4. SUBTOTAL LINES 2 AND 3

5. PENALTY - ADD 1/2 OF 1% OF LINE 4 FOR EACH MONTH TAX REMAINS UNPAID

(APPLIED TO QUARTERLY PAYMENTS ONLY)

6. INTEREST - ADD 6% PER ANNUM OF LINE 4 FOR EACH DATE (.00017 X # OF DAYS)

TAX REMAINS UNPAID (APPLIED TO QUARTERLY PAYMENTS ONLY)

7. TOTAL AMOUNT TO BE REMITTED WITH THIS RETURN. (ADD LINES 4, 5, 6)

MAKE CHECK OR MONEY ORDER

CHANGE OF ADDRESS:

PAYABLE TO:

TAXES WITHHELD IN EXCESS OF $50.00 IN ONE

WEST SHORE TAX BUREAU

MONTH MUST BE REMITTED TO THE BUREAU

EMPLOYER DEPARTMENT

MONTHLY WITH THIS PAYMENT FORM

P.O. BOX 656

CAMP HILL, PA 17001-0656

I DECLARE UNDER PENALTIES PROVIDED BY LAW THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST

OF MY KNOWLEDGE IS A TRUE, CORRECT AND COMPLETE RETURN.

SIGNATURE AND TITLE

DATE SIGNED

WEST TAB FORM 501 - PAYMENT FORM (REV 2/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1