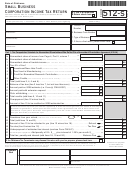

Form 512-S - Page 4

Part 5:

Shareholders’ Pro Rata Share of Income

1

2

3

4

5

Check

Net distributable income as reported on

if

Name and address

SSN or

Number

Shareholders

federal return (Part 3, Column A, line

non-

applicable %

of shareholder

FEIN

of Shares

resident

15, times Part 5, Column 4**)

(a)

(b)

(c)

(d)

(e)

(f)

6

7

8

9

10

If nonresident agreement (Form 512-

Resident share of Oklahoma

Nonresident share of

Shareholder’s

SA) is NOT attached, check box and

net distributable income

Okla. net distributable income

portion of

enter the amount shown in column 7.

Withholding

(Part 3, Column B, line 15

(Part 3, Column B, line 15

Oklahoma credit

The S corporation will be taxed on

or type of credit

times Part 5, Column 4**)

times Part 5, Column 4**)

or withholding

the income reported in this column.

(a)

(b)

(c)

(d)

(e)

(f)

Total: Nonresident share of income to tax (add amounts shown in column 8).

Enter here and on Page 1, Part 1, line 1a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

**NOTE: The amount shown in Part 3, Column B, line 15, Oklahoma net distributable income, may not be the amount to be entered on the shareholder ’s Oklahoma

income tax return. This amount includes all allowable shareholder’s income, losses, and deductions; however, some of these items may be limited on the

federal return. If these items are allowed in full or part on your federal income tax return, they will be allowed to the same extent on your Oklahoma return.

Enclose a copy of your federal return.

1. Kind of Business: _______________________________________________________________________

2. Is this return on cash or accrual basis?______________________________________________________

3. Name of Business (if different from that of corporation): _________________________________________

4. Corporation books are kept by: ____________________________________________________________

5. Address at which books are kept: __________________________________________________________

6. Date business began in Oklahoma: _________________________________________________________

7. Did you make a return of information on Oklahoma Forms 500, 500-A or 500-B for the calendar year 2005?

(The Forms 500/500-A may be filed in lieu of the Federal Form 1099)

yes

no

(The Form 500-B is filed when there is a distribution to a nonresident shareholder)

8. Were you notified this year of a change in your federal taxable income for prior year(s)?

yes

no

If you answered “yes” to #8, please list the year(s) here: ________________________________________

9. Did you file amended returns for the years stated above?

yes

no

1

1 2

2 3

3 4

4