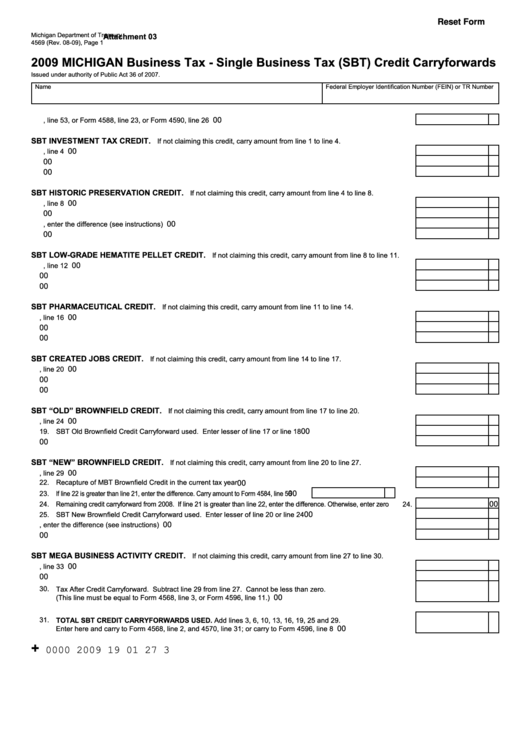

Reset Form

Michigan Department of Treasury

Attachment 03

4569 (Rev. 08-09), Page 1

2009 MICHIGAN Business Tax - Single Business Tax (SBT) Credit Carryforwards

Issued under authority of Public Act 36 of 2007.

Name

Federal Employer Identification Number (FEIN) or TR Number

00

1. Tax before credit from Form 4567, line 53, or Form 4588, line 23, or Form 4590, line 26 ....................................

1.

SBT INVESTMENT TAX CREDIT.

If not claiming this credit, carry amount from line 1 to line 4.

00

2. Enter any unused credit carryforward from the 2008 Form 4569, line 4 ...............................................................

2.

00

3. SBT Investment Tax Credit Carryforward used. Enter lesser of line 1 or line 2 ....................................................

3.

00

4. Tax After Credit Carryforward. Subtract line 3 from line 1. Cannot be less than zero .........................................

4.

SBT HISTORIC PRESERVATION CREDIT.

If not claiming this credit, carry amount from line 4 to line 8.

00

5. Enter any unused credit carryforward from the 2008 Form 4569, line 8 ...............................................................

5.

00

6. SBT Historic Preservation Credit Carryforward used. Enter lesser of line 4 or line 5 ...........................................

6.

00

7. SBT Credit Carryforward to 2010. If line 5 is greater than line 4, enter the difference (see instructions) .............

7.

00

8. Tax After Credit Carryforward. Subtract line 6 from line 4. Cannot be less than zero .........................................

8.

SBT LOW-GRADE HEMATITE PELLET CREDIT.

If not claiming this credit, carry amount from line 8 to line 11.

00

9. Enter any unused credit carryforward from the 2008 Form 4569, line 12 .............................................................

9.

00

10. SBT Low-Grade Hematite Pellet Credit Carryforward used. Enter lesser of line 8 or line 9 .................................

10.

00

11. Tax After Credit Carryforward. Subtract line 10 from line 8. Cannot be less than zero .......................................

11.

SBT PHARMACEUTICAL CREDIT.

If not claiming this credit, carry amount from line 11 to line 14.

00

12. Enter any unused credit carryforward from the 2008 Form 4569, line 16 .............................................................

12.

00

13. SBT Pharmaceutical Credit Carryforward used. Enter lesser of line 11 or line 12 ...............................................

13.

00

14. Tax After Credit Carryforward. Subtract line 13 from line 11. Cannot be less than zero ......................................

14.

SBT CREATED JOBS CREDIT.

If not claiming this credit, carry amount from line 14 to line 17.

00

15. Enter any unused credit carryforward from the 2008 Form 4569, line 20 .............................................................

15.

00

16. SBT Created Jobs Credit Carryforward used. Enter lesser of line 14 or line 15 ..................................................

16.

00

17. Tax After Credit Carryforward. Subtract line 16 from line 14. Cannot be less than zero .....................................

17.

SBT “OLD” BROWNFIELD CREDIT.

If not claiming this credit, carry amount from line 17 to line 20.

00

18. Enter any unused credit carryforward from the 2008 Form 4569, line 24 .............................................................

18.

00

19. SBT Old Brownfield Credit Carryforward used. Enter lesser of line 17 or line 18 ................................................

19.

00

20. Tax After Credit Carryforward. Subtract line 19 from line 17. Cannot be less than zero .....................................

20.

SBT “NEW” BROWNFIELD CREDIT.

If not claiming this credit, carry amount from line 20 to line 27.

00

21. Enter any unused credit carryforward from the 2008 Form 4569, line 29 .............................................................

21.

22. Recapture of MBT Brownfield Credit in the current tax year .................................................................................

22.

00

00

23. If line 22 is greater than line 21, enter the difference. Carry amount to Form 4584, line 56 .... 23.

00

24. Remaining credit carryforward from 2008. If line 21 is greater than line 22, enter the difference. Otherwise, enter zero ....

24.

00

25. SBT New Brownfield Credit Carryforward used. Enter lesser of line 20 or line 24 ...............................................

25.

00

26. SBT Credit Carryforward to 2010. If line 24 is greater than line 20, enter the difference (see instructions) .........

26.

00

27. Tax After Credit Carryforward. Subtract line 25 from line 20. Cannot be less than zero .....................................

27.

SBT MEGA BUSINESS ACTIVITY CREDIT.

If not claiming this credit, carry amount from line 27 to line 30.

00

28. Enter any unused credit carryforward from the 2008 Form 4569, line 33 .............................................................

28.

00

29. SBT MEGA Business Activity Credit Carryforward used. Enter lesser of line 27 or line 28 ..................................

29.

30. Tax After Credit Carryforward. Subtract line 29 from line 27. Cannot be less than zero.

00

(This line must be equal to Form 4568, line 3, or Form 4596, line 11.) .................................................................

30.

31. TOTAL SBT CREDIT CARRYFORWARDS USED. Add lines 3, 6, 10, 13, 16, 19, 25 and 29.

00

Enter here and carry to Form 4568, line 2, and 4570, line 31; or carry to Form 4596, line 8 ................................

31.

+

0000 2009 19 01 27 3

1

1