Instructions For Single Business Tax (Sbt) Credit Carryforwards Form 4569

ADVERTISEMENT

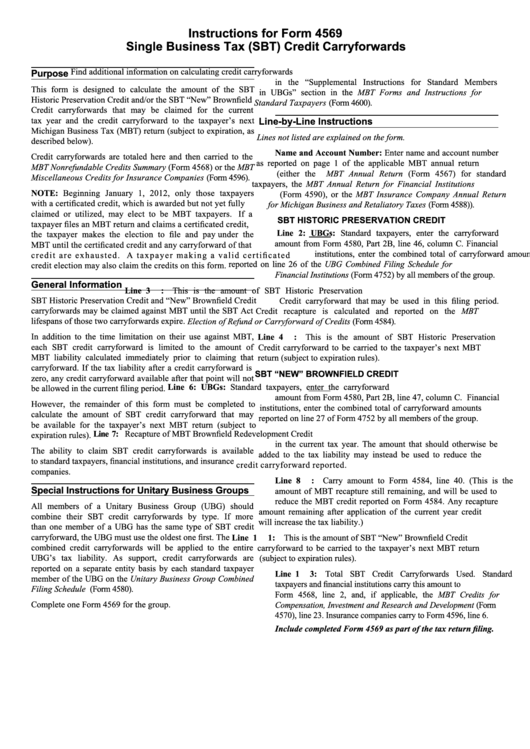

Instructions for Form 4569

Single Business Tax (SBT) Credit Carryforwards

Find additional information on calculating credit carryforwards

Purpose

in the “Supplemental Instructions for Standard Members

This form is designed to calculate the amount of the SBT

in UBGs” section in the MBT Forms and Instructions for

Historic Preservation Credit and/or the SBT “New” Brownfield

Standard Taxpayers (Form 4600).

Credit carryforwards that may be claimed for the current

tax year and the credit carryforward to the taxpayer’s next

Line-by-Line Instructions

Michigan Business Tax (MBT) return (subject to expiration, as

Lines not listed are explained on the form.

described below).

Name and Account Number: Enter name and account number

Credit carryforwards are totaled here and then carried to the

as reported on page 1 of the applicable MBT annual return

MBT Nonrefundable Credits Summary (Form 4568) or the MBT

(either the MBT Annual Return (Form 4567) for standard

Miscellaneous Credits for Insurance Companies (Form 4596).

taxpayers, the MBT Annual Return for Financial Institutions

NOTE: Beginning January 1, 2012, only those taxpayers

(Form 4590), or the MBT Insurance Company Annual Return

with a certificated credit, which is awarded but not yet fully

for Michigan Business and Retaliatory Taxes (Form 4588)).

claimed or utilized, may elect to be MBT taxpayers. If a

SBT HISTORIC PRESERVATION CREDIT

taxpayer files an MBT return and claims a certificated credit,

Line 2: UBGs: Standard taxpayers, enter the carryforward

the taxpayer makes the election to file and pay under the

amount from Form 4580, Part 2B, line 46, column C. Financial

MBT until the certificated credit and any carryforward of that

institutions, enter the combined total of carryforward amounts

credit are exhausted. A taxpayer making a valid certificated

reported on line 26 of the UBG Combined Filing Schedule for

credit election may also claim the credits on this form.

Financial Institutions (Form 4752) by all members of the group.

General Information

Line 3 : This is the amount of SBT Historic Preservation

SBT Historic Preservation Credit and “New” Brownfield Credit

Credit carryforward that may be used in this filing period.

carryforwards may be claimed against MBT until the SBT Act

Credit recapture is calculated and reported on the MBT

lifespans of those two carryforwards expire.

Election of Refund or Carryforward of Credits (Form 4584).

In addition to the time limitation on their use against MBT,

Line 4 : This is the amount of SBT Historic Preservation

each SBT credit carryforward is limited to the amount of

Credit carryforward to be carried to the taxpayer’s next MBT

MBT liability calculated immediately prior to claiming that

return (subject to expiration rules).

carryforward. If the tax liability after a credit carryforward is

SBT “NEW” BROWNFIELD CREDIT

zero, any credit carryforward available after that point will not

Line 6: UBGs: Standard taxpayers, enter the carryforward

be allowed in the current filing period.

amount from Form 4580, Part 2B, line 47, column C. Financial

However, the remainder of this form must be completed to

institutions, enter the combined total of carryforward amounts

calculate the amount of SBT credit carryforward that may

reported on line 27 of Form 4752 by all members of the group.

be available for the taxpayer’s next MBT return (subject to

Line 7: Recapture of MBT Brownfield Redevelopment Credit

expiration rules).

in the current tax year. The amount that should otherwise be

The ability to claim SBT credit carryforwards is available

added to the tax liability may instead be used to reduce the

to standard taxpayers, financial institutions, and insurance

credit carryforward reported.

companies.

Line 8 : Carry amount to Form 4584, line 40. (This is the

Special Instructions for Unitary Business Groups

amount of MBT recapture still remaining, and will be used to

reduce the MBT credit reported on Form 4584. Any recapture

All members of a Unitary Business Group (UBG) should

amount remaining after application of the current year credit

combine their SBT credit carryforwards by type. If more

will increase the tax liability.)

than one member of a UBG has the same type of SBT credit

carryforward, the UBG must use the oldest one first. The

Line 1 1: This is the amount of SBT “New” Brownfield Credit

combined credit carryforwards will be applied to the entire

carryforward to be carried to the taxpayer’s next MBT return

UBG’s tax liability. As support, credit carryforwards are

(subject to expiration rules).

reported on a separate entity basis by each standard taxpayer

Line 1 3: Total SBT Credit Carryforwards Used. Standard

member of the UBG on the Unitary Business Group Combined

taxpayers and financial institutions carry this amount to

Filing Schedule (Form 4580).

Form 4568, line 2, and, if applicable, the MBT Credits for

Complete one Form 4569 for the group.

Compensation, Investment and Research and Development (Form

4570), line 23. Insurance companies carry to Form 4596, line 6.

Include completed Form 4569 as part of the tax return filing.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1