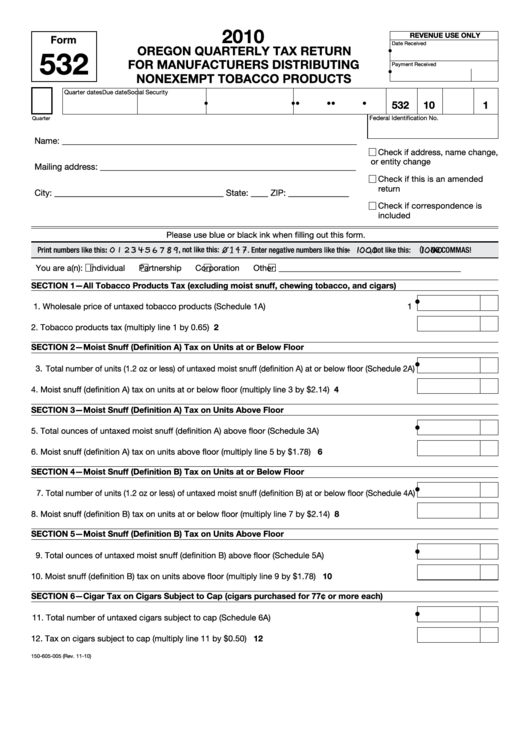

Form 532-Oregon Quarterly Tax Return-For Manufacturers Distributing-2010

ADVERTISEMENT

Clear This Page

2010

REVENUE USE ONLY

Form

Date Received

OREGON QUARTERLY TAX RETURN

•

532

FOR MANUFACTURERS DISTRIBUTING

Payment Received

•

NONEXEMPT TOBACCO PRODUCTS

Quarter dates

Due date

Social Security no.

Business ID no.

Program

Year

Period

Liability

•

•

•

•

•

•

532

10

1

Federal Identification No.

Quarter

Name: _ ___________________________________________________________________

Check if address, name change,

or entity change

Mailing address: ___________________________________________________________

Check if this is an amended

return

City: _______________________________________ State: ____ ZIP: ______________

Check if correspondence is

included

Please use blue or black ink when filling out this form.

, not like this: (

) . NO COMMAS!

Print numbers like this:

, not like this:

. Enter negative numbers like this:

–

You are a(n): Individual Partnership Corporation Other: ____________________________________________

SECTION 1—All Tobacco Products Tax (excluding moist snuff, chewing tobacco, and cigars)

•

1. Wholesale price of untaxed tobacco products (Schedule 1A) . ................................................................ 1

2. Tobacco products tax (multiply line 1 by 0.65) ................................................................................... 2

SECTION 2—Moist Snuff (Definition A) Tax on Units at or Below Floor

•

3. Total number of units (1.2 oz or less) of untaxed moist snuff (definition A) at or below floor (Schedule 2A) . ... 3

4. Moist snuff (definition A) tax on units at or below floor (multiply line 3 by $2.14) ............................... 4

SECTION 3—Moist Snuff (Definition A) Tax on Units Above Floor

•

5. Total ounces of untaxed moist snuff (definition A) above floor (Schedule 3A) ................................... 5

6. Moist snuff (definition A) tax on units above floor (multiply line 5 by $1.78) ...................................... 6

SECTION 4—Moist Snuff (Definition B) Tax on Units at or Below Floor

•

7. Total number of units (1.2 oz or less) of untaxed moist snuff (definition B) at or below floor (Schedule 4A).... 7

8. Moist snuff (definition B) tax on units at or below floor (multiply line 7 by $2.14) ............................... 8

SECTION 5—Moist Snuff (Definition B) Tax on Units Above Floor

•

9. Total ounces of untaxed moist snuff (definition B) above floor (Schedule 5A) ................................... 9

1 0. Moist snuff (definition B) tax on units above floor (multiply line 9 by $1.78) .................................... 10

SECTION 6—Cigar Tax on Cigars Subject to Cap (cigars purchased for 77¢ or more each)

•

11. Total number of untaxed cigars subject to cap (Schedule 6A) ......................................................... 11

1 2. Tax on cigars subject to cap (multiply line 11 by $0.50) . .................................................................. 12

150-605-005 (Rev. 11-10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4