Clear This Page

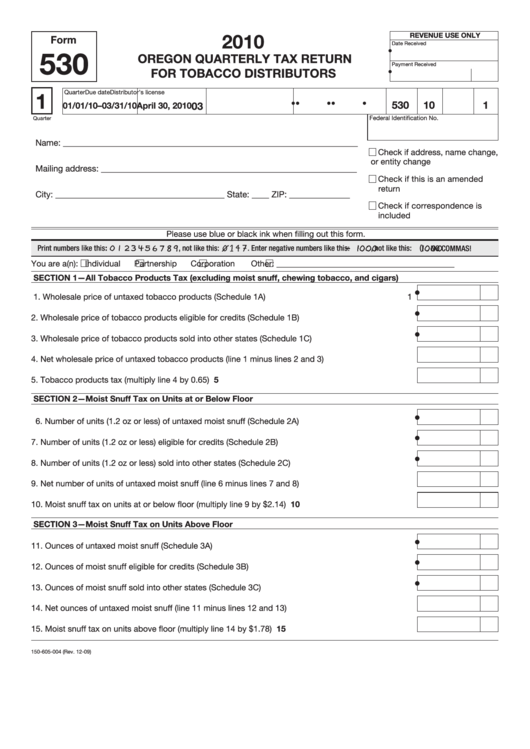

2010

REVENUE USE ONLY

Form

Date Received

•

530

OREGON QUARTERLY TAX RETURN

Payment Received

FOR TOBACCO DISTRIBUTORS

•

1

Quarter

Due date

Distributor’s license no.

Business ID no.

Program

Year

Period

Liability

•

•

•

•

•

530

10

1

03

01/01/10–03/31/10 April 30, 2010

Federal Identification No.

Quarter

Name: _ ___________________________________________________________________

Check if address, name change,

or entity change

Mailing address: ___________________________________________________________

Check if this is an amended

return

City: _______________________________________ State: ____ ZIP: ______________

Check if correspondence is

included

Please use blue or black ink when filling out this form.

, not like this: (

) . NO COMMAS!

Print numbers like this:

, not like this:

. Enter negative numbers like this:

–

You are a(n): Individual Partnership Corporation Other: ___________________________________________

SECTION 1—All Tobacco Products Tax (excluding moist snuff, chewing tobacco, and cigars)

•

1. Wholesale price of untaxed tobacco products (Schedule 1A) . .................................................................. 1

•

2. Wholesale price of tobacco products eligible for credits (Schedule 1B) ............................................ 2

•

3. Wholesale price of tobacco products sold into other states (Schedule 1C)....................................... 3

4. Net wholesale price of untaxed tobacco products (line 1 minus lines 2 and 3) ................................. 4

5. Tobacco products tax (multiply line 4 by 0.65) ................................................................................... 5

SECTION 2—Moist Snuff Tax on Units at or Below Floor

•

6. Number of units (1.2 oz or less) of untaxed moist snuff (Schedule 2A) . ............................................... 6

•

7. Number of units (1.2 oz or less) eligible for credits (Schedule 2B) ....................................................... 7

•

8. Number of units (1.2 oz or less) sold into other states (Schedule 2C) .................................................. 8

9. Net number of units of untaxed moist snuff (line 6 minus lines 7 and 8) .............................................. 9

1 0. Moist snuff tax on units at or below floor (multiply line 9 by $2.14) .................................................. 10

SECTION 3—Moist Snuff Tax on Units Above Floor

•

11. Ounces of untaxed moist snuff (Schedule 3A) . ................................................................................. 11

•

1 2. Ounces of moist snuff eligible for credits (Schedule 3B) ................................................................. 12

•

1 3. Ounces of moist snuff sold into other states (Schedule 3C)............................................................. 13

1 4. Net ounces of untaxed moist snuff (line 11 minus lines 12 and 13) ..................................................... 14

1 5. Moist snuff tax on units above floor (multiply line 14 by $1.78) . ........................................................ 15

150-605-004 (Rev. 12-09)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9