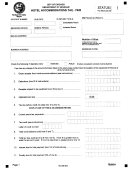

Form 7520 - Hotel Accommodations Tax Page 4

ADVERTISEMENT

•

•

ACCOUNT NUMBER

Line 8.

Determine the amount of interest owed based on tax past due.

8a.

Enter number of days late (August 16 being one day late, etc.) ...... .....

ITIIJ

8b.

Enter the amount from line 7

•

~

8c.

Total amount of interest (8b

*

[8a /365])

*

12%.................................

•

~

EXAMPLE: If you determine that you owe $100,000 on the due date (August 15) and you file and pay the tax on August 26, then

you are 11 days late in making the payment. The calculation of the interest owed is as follows: [$100,000

*

(11/365)]

*

12%

=

$361.64.

Line 9.

Late penalties: Compute penalty based on 1 of the 2 requirements listed below:

a) If the return is being filed timely, but payment is late, compute 5% of line 7.

b) If the return is filed late, co mpute the greater of 1) 1% of line 5 (up to a maxim urn of $5,000) or 2) 5% of line 7.

The tax return is due on or before the 15th day of the second month following the fiscal year in which taxable receipts are

received.

Line 10.

Enter the total tax. interest, and penalty due (add lines 7,8, and 9).

Line 11.

Overpayment. If line 7 is less than 0, enter the amount of overpayment.

Line 12.

If you want the amount of overpayment to be credited to next year's estimated tax, enter a check in the credit box.

Otherwise, check the refund box.

NOTE: Any amounts overpaid will first be applied to deficiencies outstanding for this tax and to deficiencies for any other

City of Chicago tax for which you are registered.

FOR ADDITIONAL INFORMATION, CALL 312-747-IRIS (4747) (TTY 312-742-1974)

NOTE: YOU MUST COMPLETE ALL INFORMATION ON THIS PAGE FOR THIS RETURN TO BE CONSIDERED COMPLETE.

•

Page 2

V1 010509

752002209

•

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5