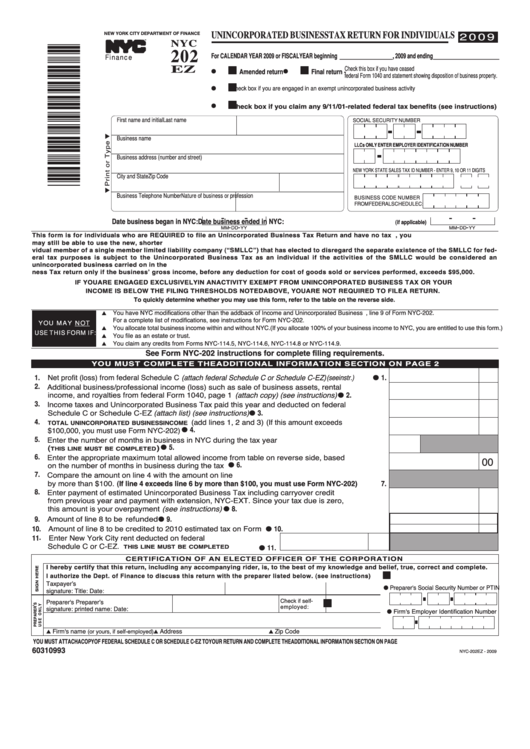

UNINCORPORATED BUSINESS TAX RETURN FOR INDIVIDUALS

202

NYC

2009

NEW YORK CITY DEPARTMENT OF FINANCE

TM

For CALENDAR YEAR 2009 or FISCAL YEAR beginning ________________, 2009 and ending____________________

E Z

Finance

I I

I I

Check this box if you have ceased operations. Attach a copy of your entire

Amended return

Final return -

G

G

federal Form 1040 and statement showing disposition of business property.

I I

Check box if you are engaged in an exempt unincorporated business activity

G

I I

Check box if you claim any 9/11/01-related federal tax benefits (see instructions)

G

First name and initial

Last name

SOCIAL SECURITY NUMBER

Business name

LLCs ONLY ENTER EMPLOYER IDENTIFICATION NUMBER

Business address (number and street)

NEW YORK STATE SALES TAX ID NUMBER - ENTER 9, 10 OR 11 DIGITS

City and State

Zip Code

Business Telephone Number

Nature of business or profession

BUSINESS CODE NUMBER

FROM FEDERAL SCHEDULE C:

-

-

-

-

Date business began in NYC:

Date business ended in NYC:

(if applicable)

-

-

-

-

MM

DD

YY

MM

DD

YY

This form is for individuals who are REQUIRED to file an Unincorporated Business Tax Return and have no tax due. If you have a tax due, you

may still be able to use the new, shorter NYC-202S. Check the NYC-202S form and instructions to determine if you can use that form. An indi-

vidual member of a single member limited liability company (“SMLLC”) that has elected to disregard the separate existence of the SMLLC for fed-

eral tax purposes is subject to the Unincorporated Business Tax as an individual if the activities of the SMLLC would be considered an

unincorporated business carried on in the City. An individual engaged in an unincorporated business is required to file an Unincorporated Busi-

ness Tax return only if the businessʼ gross income, before any deduction for cost of goods sold or services performed, exceeds $95,000.

IF YOU ARE ENGAGED EXCLUSIVELY IN AN ACTIVITY EXEMPT FROM UNINCORPORATED BUSINESS TAX OR YOUR

INCOME IS BELOW THE FILING THRESHOLDS NOTED ABOVE, YOU ARE NOT REQUIRED TO FILE A RETURN.

To quickly determine whether you may use this form, refer to the table on the reverse side.

You have NYC modifications other than the addback of Income and Unincorporated Business Taxes. See Schedule B, line 9 of Form NYC-202.

L

For a complete list of modifications, see instructions for Form NYC-202.

YOU MAY NOT

You allocate total business income within and without NYC. (If you allocate 100% of your business income to NYC, you are entitled to use this form.)

L

You file as an estate or trust.

USE THIS FORM IF:

L

You claim any credits from Forms NYC-114.5, NYC-114.6, NYC-114.8 or NYC-114.9.

See Form NYC-202 instructions for complete filing requirements.

L

YOU MUST COMPLETE THE ADDITIONAL INFORMATION SECTION ON PAGE 2

1. Net profit (loss) from federal Schedule C (attach federal Schedule C or Schedule C-EZ) (see instr.) ........ G 1.

2. Additional business/professional income (loss) such as sale of business assets, rental

income, and royalties from federal Form 1040, page 1 (attach copy) (see instructions) ............... G 2.

3. Income taxes and Unincorporated Business Tax paid this year and deducted on federal

Schedule C or Schedule C-EZ (attach list) (see instructions) ........................................................ G 3.

(add lines 1, 2 and 3) (If this amount exceeds

4.

TOTAL UNINCORPORATED BUSINESS INCOME

$100,000, you must use Form NYC-202) ....................................................................................... G 4.

5. Enter the number of months in business in NYC during the tax year

(

) ................................................................................................. G 5.

THIS LINE MUST BE COMPLETED

00

6. Enter the appropriate maximum total allowed income from table on reverse side, based

on the number of months in business during the tax year ........................................................... G 6.

7. Compare the amount on line 4 with the amount on line 6. Line 4 must not exceed line 6

by more than $100. (If line 4 exceeds line 6 by more than $100, you must use Form NYC-202).......... 7.

8. Enter payment of estimated Unincorporated Business Tax including carryover credit

from previous year and payment with extension, NYC-EXT. Since your tax due is zero,

this amount is your overpayment (see instructions) .................................................................... G 8.

9. Amount of line 8 to be refunded.................................................................................................. G 9.

10. Amount of line 8 to be credited to 2010 estimated tax on Form NYC-5UBTI............................ G 10.

Enter New York City rent deducted on federal

11 .

Schedule C or C-EZ.

........... G 11.

THIS LINE MUST BE COMPLETED

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I I

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) ............................................YES

Taxpayerʼs

G Preparer's Social Security Number or PTIN

signature:

Title:

Date:

I I

Check if self-

Preparer's

Preparerʼs

employed:

signature:

printed name:

Date:

G Firm's Employer Identification Number

Firm's name

Address

Zip Code

(or yours, if self-employed)

L

L

L

YOU MUST ATTACH A COPY OF FEDERAL SCHEDULE C OR SCHEDULE C-EZ TO YOUR RETURN AND COMPLETE THE ADDITIONAL INFORMATION SECTION ON PAGE 2. SEE OVER FOR MAILING INSTRUCTIONS.

60310993

NYC-202EZ - 2009

1

1 2

2