t

-

t

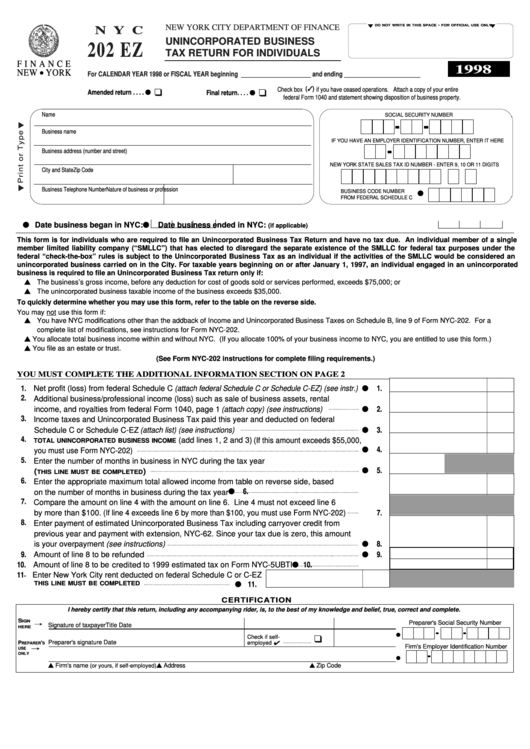

NEW YORK CITY DEPARTMENT OF FINANCE

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

N Y C

UNINCORPORATED BUSINESS

202 EZ

TAX RETURN FOR INDIVIDUALS

F I N A N C E

1998

NEW

YORK

l

For CALENDAR YEAR 1998 or FISCAL YEAR beginning ______________________ and ending ________________________

q

q

Check box (3) if you have ceased operations. Attach a copy of your entire

Amended return . . . . l

Final return. . . . l

federal Form 1040 and statement showing disposition of business property.

Name

SOCIAL SECURITY NUMBER

Business name

IF YOU HAVE AN EMPLOYER IDENTIFICATION NUMBER, ENTER IT HERE

Business address (number and street)

NEW YORK STATE SALES TAX ID NUMBER - ENTER 9, 10 OR 11 DIGITS

City and State

Zip Code

Business Telephone Number

Nature of business or profession

l

BUSINESS CODE NUMBER

FROM FEDERAL SCHEDULE C

l Date business began in NYC:

l

Date business ended in NYC:

(if applicable)

This form is for individuals who are required to file an Unincorporated Business Tax Return and have no tax due. An individual member of a single

member limited liability company (“SMLLC”) that has elected to disregard the separate existence of the SMLLC for federal tax purposes under the

federal “check-the-box” rules is subject to the Unincorporated Business Tax as an individual if the activities of the SMLLC would be considered an

unincorporated business carried on in the City. For taxable years beginning on or after January 1, 1997, an individual engaged in an unincorporated

business is required to file an Unincorporated Business Tax return only if:

s The business’s gross income, before any deduction for cost of goods sold or services performed, exceeds $75,000; or

s The unincorporated business taxable income of the business exceeds $35,000.

To quickly determine whether you may use this form, refer to the table on the reverse side.

You may not use this form if:

s You have NYC modifications other than the addback of Income and Unincorporated Business Taxes on Schedule B, line 9 of Form NYC-202. For a

complete list of modifications, see instructions for Form NYC-202.

s You allocate total business income within and without NYC. (If you allocate 100% of your business income to NYC, you are entitled to use this form.)

s You file as an estate or trust.

(See Form NYC-202 instructions for complete filing requirements.)

YOU MUST COMPLETE THE ADDITIONAL INFORMATION SECTION ON PAGE 2

1. Net profit (loss) from federal Schedule C (attach federal Schedule C or Schedule C-EZ) (see instr.) l

1.

2. Additional business/professional income (loss) such as sale of business assets, rental

l

income, and royalties from federal Form 1040, page 1 (attach copy) (see instructions)

2.

3. Income taxes and Unincorporated Business Tax paid this year and deducted on federal

l

Schedule C or Schedule C-EZ (attach list) (see instructions)

3.

4.

(add lines 1, 2 and 3) (If this amount exceeds $55,000,

TOTAL UNINCORPORATED BUSINESS INCOME

l

4.

you must use Form NYC-202)

5. Enter the number of months in business in NYC during the tax year

l

5.

(

)

THIS LINE MUST BE COMPLETED

6. Enter the appropriate maximum total allowed income from table on reverse side, based

l

6.

on the number of months in business during the tax year

7. Compare the amount on line 4 with the amount on line 6. Line 4 must not exceed line 6

by more than $100. (If line 4 exceeds line 6 by more than $100, you must use Form NYC-202)

7.

8. Enter payment of estimated Unincorporated Business Tax including carryover credit from

previous year and payment with extension, NYC-62. Since your tax due is zero, this amount

l

is your overpayment (see instructions)

8.

l

9. Amount of line 8 to be refunded

9.

l 10.

10. Amount of line 8 to be credited to 1999 estimated tax on Form NYC-5UBTI

11 . Enter New York City rent deducted on federal Schedule C or C-EZ

l 11.

THIS LINE MUST BE COMPLETED

CERTIFICATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

S

IGN

Õ

Preparer's Social Security Number

Signature of taxpayer

Title

Date

HERE

l

q

Check if self-

employed 4

Preparer's signature

Date

P

'

REPARER

S

Õ

Firm's Employer Identification Number

USE

ONLY

l

s Firm's name

s Address

s Zip Code

(or yours, if self-employed)

1

1 2

2