Instructions For Form Nyc-8b - 1998

ADVERTISEMENT

Form NYC-8B - 1998

Page 2

Make remittance payable to the order of:

MAIL

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

Payment must be made in U.S.dollars, drawn on a U.S. bank.

BOX 3921 CHURCH STREET STATION

TO:

NEW YORK, NY 10008

To receive proper credit, you must enter your correct Employer

Identification Number on your tax return and remittance.

LINE 17 - PRIOR PAYMENTS

G

I

E N E R A L

N F O R M A T I O N

Enter at line 17, columns 1 and 3 the sum of: a) all estimated tax payments made

for the period covered by this return, including the 25% first installment; b) all

PURPOSE OF FORM

amounts paid with any application for extension to file the original return; c) all

overpayments from prior tax periods credited towards the tax for the period cov-

Use Form NYC-8B to amend Form NYC-1 or NYC-1A, as originally filed or as it

ered by this return; and d) all amounts paid with the original return or previously

was later adjusted by an amended return, or to claim a refund of Banking

filed amended return.

Corporation Tax.

An amended New York City return must be filed within 90 days after filing an

LINES 18 AND 19 - PRIOR APPLICATION OF OVERPAYMENT

amended federal or New York State return.

Enter at line 18 columns 1 and 3 the amount of any overpayment shown on the

If a change or correction of federal or New York State taxable income or other tax

original return or previous refund claim (for the same period) previously refund-

base is made by the Internal Revenue Service and/or the New York State

ed to you.

Department of Taxation and Finance, report the change on Form NYC-3360B or

Enter at line 19, columns 1 and 3 the amount of any overpayment shown on the

3360F (Report of Federal/State Change).

Do not use Form NYC-8B.

original return or previous refund claim (for the same period) that you requested

FILING REQUIREMENTS FOR REFUND OR CREDIT

to be credited towards tax for a subsequent period.

1.

A separate Form NYC-8B must be filed for each tax period for which a credit

LINE 23 - INTEREST

or refund is claimed.

Enter at line 23, column 3 interest owed on the additional tax due computed at

2.

This claim must be filed within three years from the time the return was filed

the rate prescribed in the interest rate table from the due date of the Banking

or two years from the time the tax was paid, whichever expires the later, or,

Corporation Tax Return (without regard to any extension of time for payment) to

if no return was filed, within two years from the time the tax was paid. If the

the date of payment. (Section 11-675 of the Administrative Code)

claim is filed within the three-year period, the amount of the credit or refund

For the rate of interest on overpayments, for a rate of interest not shown in the

cannot exceed the portion of the tax paid within the three years immediately

table below and for interest calculations, contact Taxpayer Assistance at (718)

preceding the filing of the claim plus the period of any extension of time for

935-6000.

filing the return. If the claim is not filed within the three-year period, but is

filed within the two-year period, the amount of credit or refund cannot

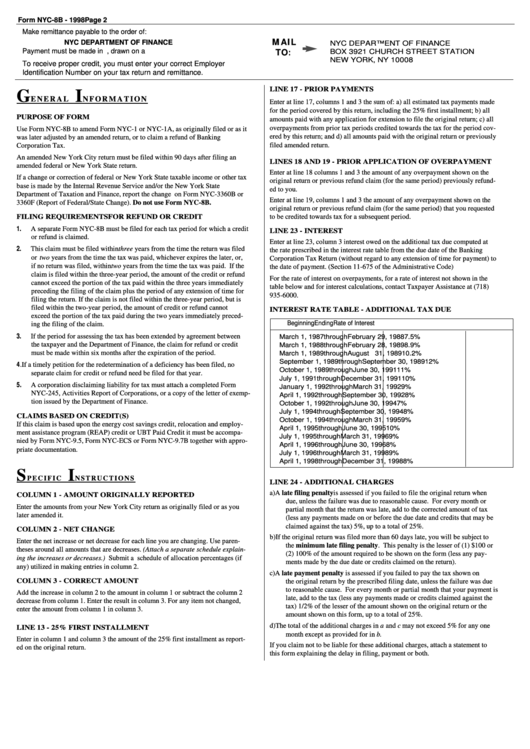

INTEREST RATE TABLE - ADDITIONAL TAX DUE

exceed the portion of the tax paid during the two years immediately preced-

Beginning

Ending

Rate of Interest

ing the filing of the claim.

3.

If the period for assessing the tax has been extended by agreement between

March 1, 1987

through

February 29, 1988

7.5%

the taxpayer and the Department of Finance, the claim for refund or credit

March 1, 1988

through

February 28, 1989

8.9%

must be made within six months after the expiration of the period.

March 1, 1989

through

August 31, 1989

10.2%

September 1, 1989

through

September 30, 1989

12%

4.

If a timely petition for the redetermination of a deficiency has been filed, no

October 1, 1989

through

June 30, 1991

11%

separate claim for credit or refund need be filed for that year.

July 1, 1991

through

December 31, 1991

10%

5.

A corporation disclaiming liability for tax must attach a completed Form

January 1, 1992

through

March 31, 1992

9%

NYC-245, Activities Report of Corporations, or a copy of the letter of exemp-

April 1, 1992

through

September 30, 1992

8%

tion issued by the Department of Finance.

October 1, 1992

through

June 30, 1994

7%

July 1, 1994

through

September 30, 1994

8%

CLAIMS BASED ON CREDIT(S)

October 1, 1994

through

March 31, 1995

9%

If this claim is based upon the energy cost savings credit, relocation and employ-

April 1, 1995

through

June 30, 1995

10%

ment assistance program (REAP) credit or UBT Paid Credit it must be accompa-

July 1, 1995

through

March 31, 1996

9%

nied by Form NYC-9.5, Form NYC-ECS or Form NYC-9.7B together with appro-

April 1, 1996

through

June 30, 1996

8%

priate documentation.

July 1, 1996

through

March 31, 1998

9%

April 1, 1998

through

December 31, 1998

8%

S

I

P E C I F I C

N S T R U C T I O N S

LINE 24 - ADDITIONAL CHARGES

a)

A late filing penalty is assessed if you failed to file the original return when

COLUMN 1 - AMOUNT ORIGINALLY REPORTED

due, unless the failure was due to reasonable cause. For every month or

Enter the amounts from your New York City return as originally filed or as you

partial month that the return was late, add to the corrected amount of tax

later amended it.

(less any payments made on or before the due date and credits that may be

claimed against the tax) 5%, up to a total of 25%.

COLUMN 2 - NET CHANGE

b)

If the original return was filed more than 60 days late, you will be subject to

Enter the net increase or net decrease for each line you are changing. Use paren-

the minimum late filing penalty

. This penalty is the lesser of (1) $100 or

theses around all amounts that are decreases.

(Attach a separate schedule explain-

(2) 100% of the amount required to be shown on the form (less any pay-

ing the increases or decreases.) Submit a schedule of allocation percentages (if

ments made by the due date or credits claimed on the return).

any) utilized in making entries in column 2.

c)

A late payment penalty

is assessed if you failed to pay the tax shown on

COLUMN 3 - CORRECT AMOUNT

the original return by the prescribed filing date, unless the failure was due

to reasonable cause. For every month or partial month that your payment is

Add the increase in column 2 to the amount in column 1 or subtract the column 2

late, add to the tax (less any payments made or credits claimed against the

decrease from column 1. Enter the result in column 3. For any item not changed,

tax) 1/2% of the lesser of the amount shown on the original return or the

enter the amount from column 1 in column 3.

amount shown on this form, up to a total of 25%.

d)

The total of the additional charges in

a and c may not exceed 5% for any one

LINE 13 - 25% FIRST INSTALLMENT

month except as provided for in

b.

Enter in column 1 and column 3 the amount of the 25% first installment as report-

If you claim not to be liable for these additional charges, attach a statement to

ed on the original return.

this form explaining the delay in filing, payment or both.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1