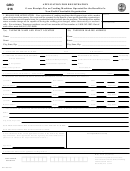

Application For Registration Service Provider Tax Form - Maine Revenue Services

ADVERTISEMENT

ADMINISTRATIVE & FINANCIAL SERVICES

STATE OF MAINE

REBECCA M. WYKE

MAINE REVENUE SERVICES

COMMISSIONER

24 STATE HOUSE STATION

AUGUSTA, MAINE

JEROME D. GERARD

04333-0024

ACTING EXECUTIVE DIRECTOR

JOHN ELIAS BALDACCI

GOVERNOR

Date Issued: June 10, 2004

IMPORTANT INFORMATION

LAW CHANGE EFFECTIVE JULY 1, 2004

SERVICE PROVIDER TAX

If your business is engaged in selling any of the following services, please pay particular

attention to this notice. It explains a major tax law change affecting your business.

Extended cable television service

Fabrication services

Rental of videotapes and video equipment

Rental of furniture and audio equipment pursuant to a “rent-to-own” contract

Telecommunications service (except sales of pre-paid phone cards)

Installation, maintenance and repair of telecommunications equipment

Private non-medical institution services

The Maine Legislature has recently enacted legislation that repeals the sales tax on certain kinds of services

and replaces it with a new Service Provider Tax. The new law imposes a 5% service provider tax, effective

July 1, 2004, on the value of the above mentioned services provided in this State. All of the services taxed

under the new law, except private non-medical institution services, are currently subject to the 5% Maine sales

tax. Thus on July 1 the tax on these services will change from a sales tax to a service provider tax. This

change should be transparent to purchasers of these services, who will simply pay a 5% service provider tax

instead of a 5% sales tax. Providers of the services taxed under the new law that are subject to sales tax under

current law will, however, experience some changes in the way the tax is administered.

Registration

Like the sales tax law, the service provider tax law includes a registration requirement. Attached to this notice

is a supplemental application for registration. Any provider selling any of the above mentioned services must

re-register for the service provider tax. These applications must be returned no later than July 9, 2004.

The new service provider tax is also imposed on private non-medical institution services. “Private non-medical

institution services” (“PNMI”) means services, including food, shelter and treatment, that are provided to

residents by a private non-medical institution licensed as such by the Department of Human Services or the

Department of Behavioral and Developmental Services. Since these services are not subject to sales tax under

current law, providers of private non-medical institution services will be required to submit a complete

application for registration as a service provider under the service provider tax law. If you have been identified

by MRS as a PNMI, you will find Section 1 from our registration booklet included in this mailing. Please

complete this page in addition to the supplemental sheet mentioned above.

Application of the tax

The major change in this legislation is that the tax is imposed on the provider not the consumer. However, the

provider can pass this tax along to the consumer if they wish. If a provider includes this tax on a customer's

bill, it must be shown as a separate line item and identified as a “service provider tax”.

Phone: (207)624-9693

TDD: (207)287-4477

Fax: (207)287-6628

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3