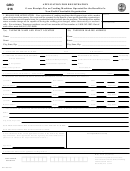

Application For Registration Service Provider Tax Form - Maine Revenue Services Page 2

ADVERTISEMENT

Returns

Beginning with the July 2004 reporting period, registered service providers will be required to file service

provider tax returns. Service provider tax return forms will be mailed to all registered service providers in late

th

July and each reporting period thereafter. The return is due no later than the 15

of the month following the

end of the reporting period. Businesses that make both sales of services subject to the service provider tax and

retail sales subject to sales tax will be required to file both returns.

Billings during the month

st

Ordinarily the invoice date governs the sale date. Sales occurring before July 1

will be subject to the 5% sales

st

tax, whereas sales occurring on or after July 1

will be subject to the 5% service provider tax. Sales of any of

st

the above mentioned services will be subject to the 5% service provider tax if billed on or after July 1

, or in

st

the case of rentals, if the rental is entered into on or after July 1

.

Exemptions

The same exemptions that existed in the sales tax law have been included in the service provider tax law.

Sales Price

The definition of sale price has likewise remained unchanged. The value to which the tax applies is the total

amount paid by the customer for the services provided and excludes any retailer discounts, allowances pursuant

to warranty, full refunds and the service provider tax itself.

Quick Answers

Quick Answers

Q. If we sell any of these services, are all our

Q. When does the new service provider tax take

sales subject to the 5% service provider tax?

effect?

A. No. Only the services mentioned are subject

A. The law change is effective July 1, 2004. As

to the 5% service provider tax. All other

a result, the first return affected is the July

sales that are currently subject to a 5% sales

return which is due on August 15, 2004.

tax, continue as a sales tax.

Q. Will there be both a 5% sales tax and a 5%

service provider tax on these services?

Q. There appears to be no difference between the

A. No.

service provider tax and the current sales tax,

so what has changed?

Q. If I currently have a sales tax registration, will

A. The major change is that the service provider

I have to re-apply for this tax?

tax is a tax imposed on the retailer rather

A. Yes, if you sell any of the services mentioned

than the consumer.

in this notice. An application form is

attached and must be submitted by July 9,

Q. Can the service provider tax be passed on to

2004.

our customers?

A. Yes, but you must identify this tax as a

Q. Will we be required to file two returns?

“service provider tax” not a sales tax.

A. Yes, if you sell tangible personal property or

taxable services subject to sales tax and sell

any of the mentioned services in this notice.

A more detailed bulletin is being developed for service providers and will be provided in July to all who

register for this tax. Additionally, this bulletin will be available on our website as soon as it is finalized.

For more information about these changes you can visit our website at

or talk to

one of our customer service representatives at (207) 624-9693. Or, you can write to us at Maine Revenue

Services, PO Box 1065, Augusta, Maine 04332-1065.

Phone: (207)624-9693

TDD: (207)287-4477

Fax: (207)287-6628

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3