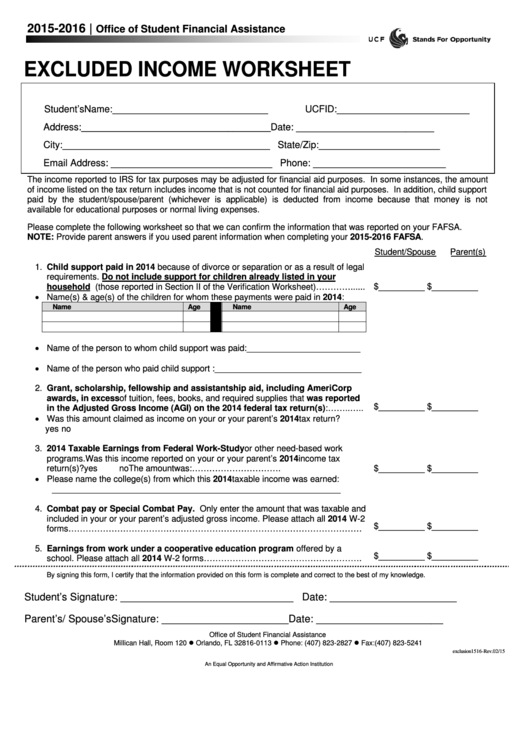

2015-2016 |

Office of Student Financial Assistance

EXCLUDED INCOME WORKSHEET

___________________________

_______________________

Student’s Name:

UCFID:

________________________

Address:

Date:

________________________________________

____________________________________

_____________________

City:

State/Zip:

____________________________

_______________________

Email Address:

Phone:

The income reported to IRS for tax purposes may be adjusted for financial aid purposes. In some instances, the amount

of income listed on the tax return includes income that is not counted for financial aid purposes. In addition, child support

paid by the student/spouse/parent (whichever is applicable) is deducted from income because that money is not

available for educational purposes or normal living expenses.

Please complete the following worksheet so that we can confirm the information that was reported on your FAFSA.

NOTE: Provide parent answers if you used parent information when completing your 2015-2016 FAFSA.

Student/Spouse

Parent(s)

1. Child support paid in 2014 because of divorce or separation or as a result of legal

requirements. Do not include support for children already listed in your

________

________

$

$

household (those reported in Section II of the Verification Worksheet)…………......

• Name(s) & age(s) of the children for whom these payments were paid in 2014:

Name

Age

Name

Age

• Name of the person to whom child support was paid:________________________

• Name of the person who paid child support :_______________________________

2. Grant, scholarship, fellowship and assistantship aid, including AmeriCorp

awards, in excess of tuition, fees, books, and required supplies that was reported

________

________

$

$

in the Adjusted Gross Income (AGI) on the 2014 federal tax return(s):……..…..

• Was this amount claimed as income on your or your parent’s 2014 tax return?

yes

no

3. 2014 Taxable Earnings from Federal Work-Study or other need-based work

programs. Was this income reported on your or your parent’s 2014 income tax

________

________

$

$

return(s)? yes ____no

The amount was:…………..................……………….

• Please name the college(s) from which this 2014 taxable income was earned:

_____________________________________________________________

4. Combat pay or Special Combat Pay. Only enter the amount that was taxable and

included in your or your parent’s adjusted gross income. Please attach all 2014 W-2

________

________

$

$

forms…………………………………………………………………………………………

5. Earnings from work under a cooperative education program offered by a

________

________

$

$

school. Please attach all 2014 W-2 forms……………………………………………….

By signing this form, I certify that the information provided on this form is complete and correct to the best of my knowledge.

Student’s Signature: ______________________________

Date: ______________________

Parent’s/ Spouse’s Signature: ______________________

Date: ______________________

Office of Student Financial Assistance

Millican Hall, Room 120 Orlando, FL 32816-0113 Phone: (407) 823-2827 Fax:(407) 823-5241

exclusion1516-Rev.02/15

An Equal Opportunity and Affirmative Action Institution

1

1