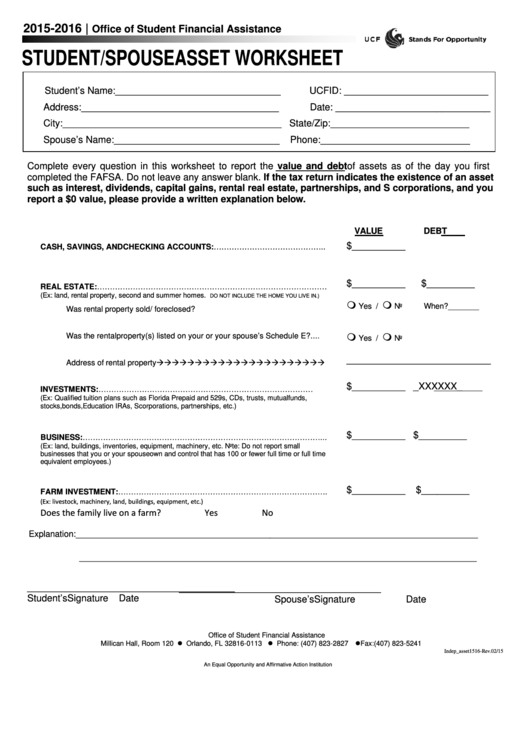

2015-2016 |

Office of Student Financial Assistance

STUDENT/SPOUSE ASSET WORKSHEET

Student’s Name:_______________________________

UCFID: ___________________________

Address:_____________________________________

Date: _____________________________

City:_________________________________________

State/Zip:__________________________

Spouse’s Name:_______________________________

Phone:____________________________

Complete every question in this worksheet to report the value and debt of assets as of the day you first

completed the FAFSA. Do not leave any answer blank. If the tax return indicates the existence of an asset

such as interest, dividends, capital gains, rental real estate, partnerships, and S corporations, and you

report a $0 value, please provide a written explanation below.

VALUE

DEBT

$__________

$_________

CASH, SAVINGS, AND CHECKING ACCOUNTS:……………………………………..

$__________

$_________

REAL ESTATE:………………………………………………………………………………

(Ex: land, rental property, second and summer homes.

DO NOT INCLUDE THE HOME YOU LIVE IN.)

Yes /

No

When?_______

Was rental property sold/ foreclosed?...............................................................

Was the rental property(s) listed on your or your spouse’s Schedule E?.........

Yes /

No

___________________________

Address of rental property

$__________

_XXXXXX_

INVESTMENTS:………………………………………………………………………….......

(Ex: Qualified tuition plans such as Florida Prepaid and 529s, CDs, trusts, mutual funds,

stocks, bonds, Education IRAs, S corporations, partnerships, etc.)

$__________

$_________

BUSINESS:…………………………………………………………………………………...

(Ex: land, buildings, inventories, equipment, machinery, etc. Note: Do not report small

businesses that you or your spouse own and control that has 100 or fewer full time or full time

equivalent employees.)

$__________

$_________

FARM INVESTMENT:……………………………………………………………………….

(Ex: livestock, machinery, land, buildings, equipment, etc.)

Does the family live on a farm?

_____

Yes

______No

Explanation:_________________________________________ ____________________________________________

___________________________________________________ ____________________________________________

____________________________________

___________________________________

Student’s Signature

Date

Spouse’s Signature

Date

Office of Student Financial Assistance

Millican Hall, Room 120 Orlando, FL 32816-0113 Phone: (407) 823-2827 Fax:(407) 823-5241

Indep_asset1516-Rev.02/15

An Equal Opportunity and Affirmative Action Institution

1

1