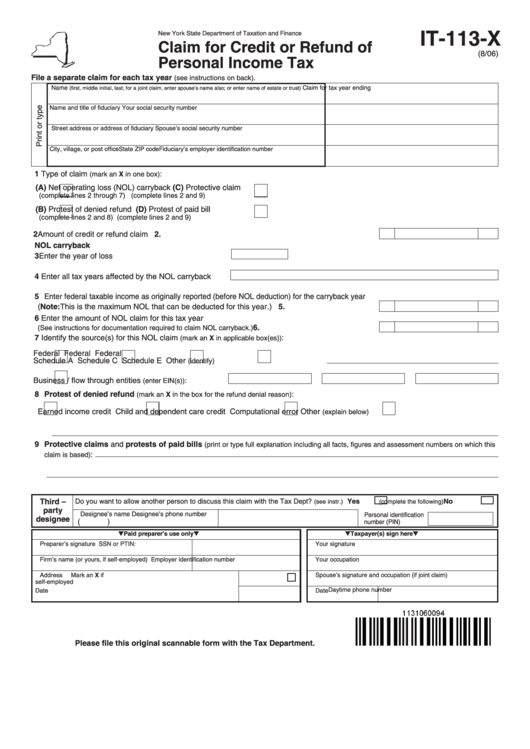

IT-113-X

New York State Department of Taxation and Finance

Claim for Credit or Refund of

(8/06)

Personal Income Tax

File a separate claim for each tax year

(see instructions on back).

Name

Claim for tax year ending

(first, middle initial, last; for a joint claim, enter spouse’s name also; or enter name of estate or trust)

Name and title of fiduciary

Your social security number

Street address or address of fiduciary

Spouse’s social security number

City, village, or post office

State

ZIP code

Fiduciary’s employer identification number

1 Type of claim

:

(mark an X in one box)

(A)

Net operating loss (NOL) carryback

(C)

Protective claim

(complete lines 2 through 7)

(complete lines 2 and 9)

(B)

(D)

Protest of denied refund

Protest of paid bill

(complete lines 2 and 8)

(complete lines 2 and 9)

2 Amount of credit or refund claim .....................................................................................................

2.

NOL carryback

3 Enter the year of loss ...................................................

4 Enter all tax years affected by the NOL carryback

5 Enter federal taxable income as originally reported (before NOL deduction) for the carryback year

5.

(Note: This is the maximum NOL that can be deducted for this year.) ........................................

6 Enter the amount of NOL claim for this tax year

6.

..................................................

(See instructions for documentation required to claim NOL carryback.)

7 Identify the source(s) for this NOL claim

:

(mark an X in applicable box(es))

Federal

Federal

Federal

Schedule A

Schedule C

Schedule E

Other

(identify)

Business / flow through entities

(enter EIN(s)):

8 Protest of denied refund

:

(mark an X in the box for the refund denial reason)

Earned income credit

Child and dependent care credit

Computational error

Other

(explain below)

9 Protective claims and protests of paid bills

(print or type full explanation including all facts, figures and assessment numbers on which this

:

claim is based)

Third –

Do you want to allow another person to discuss this claim with the Tax Dept?

Yes

No

(see instr.)

(complete the following)

party

Designee’s name

Designee’s phone number

Personal identification

designee

(

)

number (PIN)

Paid preparer’s use only

Taxpayer(s) sign here

Preparer’s signature

SSN or PTIN:

Your signature

Firm’s name (or yours, if self-employed)

Employer identification number

Your occupation

Address

Mark an X if

Spouse’s signature and occupation (if joint claim)

self-employed

Daytime phone number

Date

Date

Please file this original scannable form with the Tax Department.

1

1