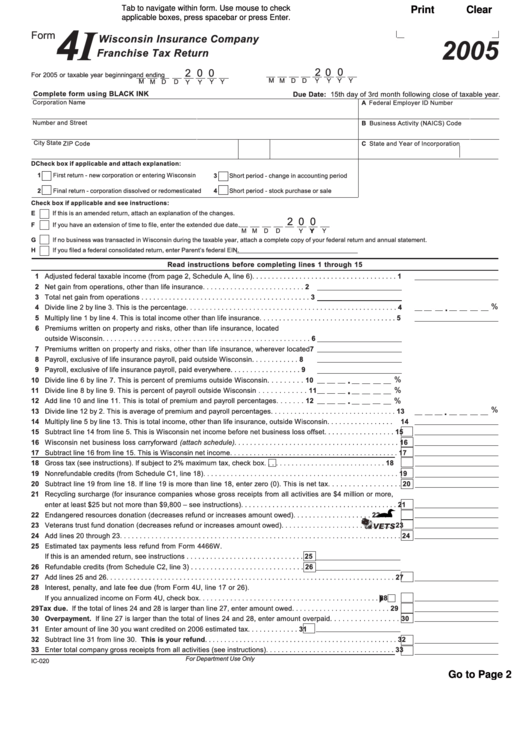

Tab to navigate within form. Use mouse to check

Print

Clear

applicable boxes, press spacebar or press Enter.

4I

Form

Wisconsin Insurance Company

2005

Franchise Tax Return

2

0

0

2 0

0

For 2005 or taxable year beginning

and ending

M

M D

D

Y

Y

Y

Y

M

M D

D

Y Y

Y

Y

Complete form using BLACK INK

Due Date: 15th day of 3rd month following close of taxable year.

Corporation Name

A Federal Employer ID Number

Number and Street

B Business Activity (NAICS) Code

City

State

C State and Year of Incorporation

ZIP Code

D Check box if applicable and attach explanation:

1

First return - new corporation or entering Wisconsin

3

Short period - change in accounting period

2

Final return - corporation dissolved or redomesticated

4

Short period - stock purchase or sale

Check box if applicable and see instructions:

E

If this is an amended return, attach an explanation of the changes.

2 0

0

F

If you have an extension of time to file, enter the extended due date

.

M

M

D

D

Y

Y

Y

Y

G

If no business was transacted in Wisconsin during the taxable year, attach a complete copy of your federal return and annual statement.

H

If you filed a federal consolidated return, enter Parent’s federal EIN

.

Read instructions before completing lines 1 through 15

1 Adjusted federal taxable income (from page 2, Schedule A, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Net gain from operations, other than life insurance . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Total net gain from operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

.

%

4 Divide line 2 by line 3. This is the percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Multiply line 1 by line 4. This is total income other than life insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Premiums written on property and risks, other than life insurance, located

outside Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Premiums written on property and risks, other than life insurance, wherever located 7

8 Payroll, exclusive of life insurance payroll, paid outside Wisconsin . . . . . . . . . . . .

8

9 Payroll, exclusive of life insurance payroll, paid everywhere . . . . . . . . . . . . . . . . . .

9

.

%

10 Divide line 6 by line 7. This is percent of premiums outside Wisconsin . . . . . . . . .

10

.

.

%

11 Divide line 8 by line 9. This is percent of payroll outside Wisconsin . . . . . . . . . . . .

11

.

%

12 Add line 10 and line 11. This is total of premium and payroll percentages . . . . . . .

12

%

.

13 Divide line 12 by 2. This is average of premium and payroll percentages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Multiply line 5 by line 13. This is total income, other than life insurance, outside Wisconsin . . . . . . . . . . . . . . . . .

14

15 Subtract line 14 from line 5. This is Wisconsin net income before net business loss offset . . . . . . . . . . . . . . . . . .

15

16 Wisconsin net business loss carryforward (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Subtract line 16 from line 15. This is Wisconsin net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Gross tax (see instructions). If subject to 2% maximum tax, check box

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19 Nonrefundable credits (from Schedule C1, line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20 Subtract line 19 from line 18. If line 19 is more than line 18, enter zero (0). This is net tax . . . . . . . . . . . . . . . . . .

20

21 Recycling surcharge (for insurance companies whose gross receipts from all activities are $4 million or more,

enter at least $25 but not more than $9,800 – see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22 Endangered resources donation (decreases refund or increases amount owed) . . . . . . . . . . . . . . . . . . . .

22

23 Veterans trust fund donation (decreases refund or increases amount owed) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24 Add lines 20 through 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Estimated tax payments less refund from Form 4466W.

If this is an amended return, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Refundable credits (from Schedule C2, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Add lines 25 and 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28 Interest, penalty, and late fee due (from Form 4U, line 17 or 26).

If you annualized income on Form 4U, check box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29 Tax due. If the total of lines 24 and 28 is larger than line 27, enter amount owed . . . . . . . . . . . . . . . . . . . . . . . . .

29

30 Overpayment. If line 27 is larger than the total of lines 24 and 28, enter amount overpaid . . . . . . . . . . . . . . . . .

30

31 Enter amount of line 30 you want credited on 2006 estimated tax . . . . . . . . . . . . . 31

32 Subtract line 31 from line 30. This is your refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

33 Enter total company gross receipts from all activities (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

For Department Use Only

IC-020

Go to Page 2

1

1 2

2