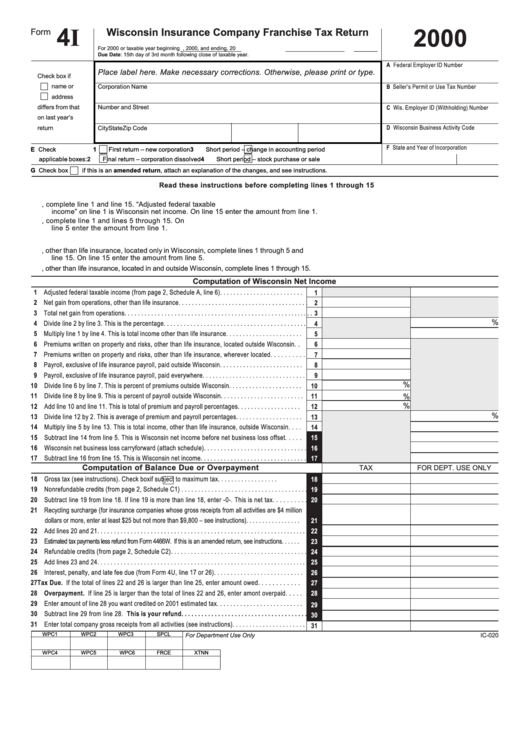

Form 4i - Wisconsin Insurance Company Franchise Tax Return - 2000

ADVERTISEMENT

4I

2000

Wisconsin Insurance Company Franchise Tax Return

Form

For 2000 or taxable year beginning

, 2000, and ending

, 20

Due Date: 15th day of 3rd month following close of taxable year.

A Federal Employer ID Number

Place label here. Make necessary corrections. Otherwise, please print or type.

Check box if

name or

Corporation Name

B Seller’s Permit or Use Tax Number

address

differs from that

Number and Street

C Wis. Employer ID (Withholding) Number

on last year’s

D Wisconsin Business Activity Code

return

City

State

Zip Code

F State and Year of Incorporation

E Check

1

First return – new corporation

3

Short period – change in accounting period

applicable boxes:

2

Final return – corporation dissolved

4

Short period – stock purchase or sale

G Check box

if this is an amended return, attach an explanation of the changes, and see instructions.

Read these instructions before completing lines 1 through 15

I. Domestic insurers not engaged in the sale of life insurance

A. If the insurer collected premiums written on property and risks located only in Wisconsin, complete line 1 and line 15. “Adjusted federal taxable

income” on line 1 is Wisconsin net income. On line 15 enter the amount from line 1.

B. If the insurer collected premiums written on property and risks located in and outside Wisconsin, complete line 1 and lines 5 through 15. On

line 5 enter the amount from line 1.

II. Domestic insurers engaged in the sale of life insurance and other insurance

A. If the insurer collected premiums written on property and risks, other than life insurance, located only in Wisconsin, complete lines 1 through 5 and

line 15. On line 15 enter the amount from line 5.

B. If the insurer collected premiums written on property and risks, other than life insurance, located in and outside Wisconsin, complete lines 1 through 15.

Computation of Wisconsin Net Income

1 Adjusted federal taxable income (from page 2, Schedule A, line 6) . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Net gain from operations, other than life insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Total net gain from operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

%

4 Divide line 2 by line 3. This is the percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Multiply line 1 by line 4. This is total income other than life insurance . . . . . . . . . . . . . . . . . . . . . . .

5

6 Premiums written on property and risks, other than life insurance, located outside Wisconsin . .

6

7 Premiums written on property and risks, other than life insurance, wherever located . . . . . . . . . .

7

8 Payroll, exclusive of life insurance payroll, paid outside Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Payroll, exclusive of life insurance payroll, paid everywhere . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

%

10 Divide line 6 by line 7. This is percent of premiums outside Wisconsin . . . . . . . . . . . . . . . . . . . . . .

10

11 Divide line 8 by line 9. This is percent of payroll outside Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . .

11

%

%

12 Add line 10 and line 11. This is total of premium and payroll percentages . . . . . . . . . . . . . . . . . . .

12

%

13 Divide line 12 by 2. This is average of premium and payroll percentages . . . . . . . . . . . . . . . . . . . .

13

14 Multiply line 5 by line 13. This is total income, other than life insurance, outside Wisconsin . . . .

14

15 Subtract line 14 from line 5. This is Wisconsin net income before net business loss offset . . . . .

15

16 Wisconsin net business loss carryforward (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Subtract line 16 from line 15. This is Wisconsin net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

Computation of Balance Due or Overpayment

TAX

FOR DEPT. USE ONLY

18 Gross tax (see instructions). Check box

if subject to maximum tax . . . . . . . . . . . . . . . . . .

18

19 Nonrefundable credits (from page 2, Schedule C1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20 Subtract line 19 from line 18. If line 19 is more than line 18, enter -0-. This is net tax . . . . . . . . . .

20

21 Recycling surcharge (for insurance companies whose gross receipts from all activities are $4 million

dollars or more, enter at least $25 but not more than $9,800 – see instructions) . . . . . . . . . . . . . . . . .

21

22 Add lines 20 and 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23 Estimated tax payments less refund from Form 4466W. If this is an amended return, see instructions . . . . . .

23

24 Refundable credits (from page 2, Schedule C2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Add lines 23 and 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26 Interest, penalty, and late fee due (from Form 4U, line 17 or 26) . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

27 Tax Due. If the total of lines 22 and 26 is larger than line 25, enter amount owed . . . . . . . . . . . .

27

28 Overpayment. If line 25 is larger than the total of lines 22 and 26, enter amont overpaid . . . . .

28

29 Enter amount of line 28 you want credited on 2001 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30 Subtract line 29 from line 28. This is your refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

31 Enter total company gross receipts from all activities (see instructions) . . . . . . . . . . . . . . . . . . . . . .

31

WPC1

WPC2

WPC3

SPCL

For Department Use Only

IC-020

WPC4

WPC5

WPC6

FRCE

XTNN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2