Form Ct-33-C - Captive Insurance Company Franchise Tax Return - 1999

ADVERTISEMENT

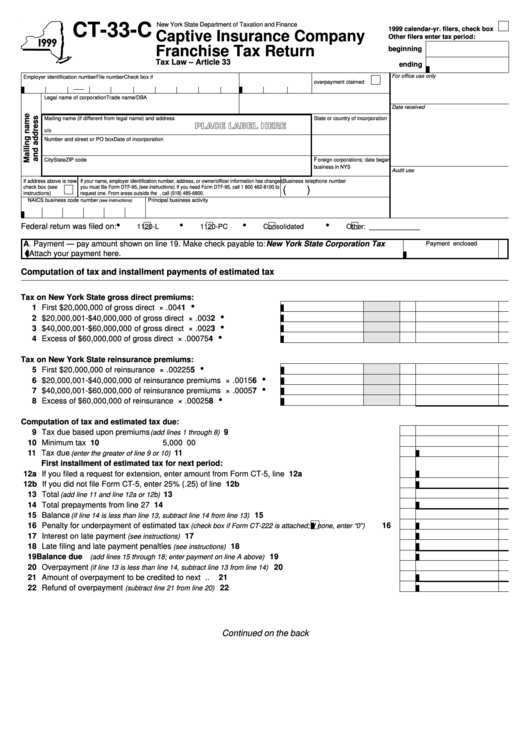

CT-33-C

New York State Department of Taxation and Finance

1999 calendar-yr. filers, check box

Captive Insurance Company

Other filers enter tax period:

Franchise Tax Return

beginning

Tax Law – Article 33

ending

For office use only

Employer identification number

File number

Check box if

overpayment claimed

Legal name of corporation

Trade name/DBA

Date received

Mailing name (if different from legal name) and address

State or country of incorporation

PLACE LABEL HERE

c/o

Number and street or PO box

Date of incorporation

F

City

State

ZIP code

oreign corporations; date began

business in NYS

Audit use

If address above is new, If your name, employer identification number, address, or owner/officer information has changed, Business telephone number

check box (see

you must file Form DTF-95, (see instructions). If you need Form DTF-95, call 1 800 462-8100 to

(

)

instructions)

request one. From areas outside the U.S. and outside Canada, call (518) 485-6800.

NAICS business code number

Principal business activity

(see instructions)

•

•

•

•

Federal return was filed on:

1120-L

1120-PC

Consolidated

Other: _____________

A. Payment — pay amount shown on line 19. Make check payable to: New York State Corporation Tax

Payment enclosed

....... Attach your payment here.

Computation of tax and installment payments of estimated tax

Tax on New York State gross direct premiums:

•

1 First $20,000,000 of gross direct premiums .......................................

× .004

1

•

2 $20,000,001-$40,000,000 of gross direct premiums .........................

× .003

2

•

3 $40,000,001-$60,000,000 of gross direct premiums .........................

× .002

3

•

4 Excess of $60,000,000 of gross direct premiums ..............................

× .00075

4

Tax on New York State reinsurance premiums:

•

5 First $20,000,000 of reinsurance premiums .......................................

× .00225

5

•

6 $20,000,001-$40,000,000 of reinsurance premiums .........................

× .0015

6

•

7 $40,000,001-$60,000,000 of reinsurance premiums .........................

× .0005

7

•

8 Excess of $60,000,000 of reinsurance premiums ..............................

× .00025

8

Computation of tax and estimated tax due:

9 Tax due based upon premiums

...............................................................................

9

(add lines 1 through 8)

10 Minimum tax ..............................................................................................................................................

10

5,000 00

11 Tax due

......................................................................................................

11

(enter the greater of line 9 or 10)

First installment of estimated tax for next period:

12a If you filed a request for extension, enter amount from Form CT-5, line 2 ................................................ 12a

12b If you did not file Form CT-5, enter 25% (.25) of line 11 ........................................................................... 12b

13 Total

...........................................................................................................

13

(add line 11 and line 12a or 12b)

14 Total prepayments from line 27 .................................................................................................................

14

15 Balance

.................................................................

15

(if line 14 is less than line 13, subtract line 14 from line 13)

16 Penalty for underpayment of estimated tax

......

16

(check box if Form CT-222 is attached

; if none, enter “0”)

17 Interest on late payment

.................................................................................................

17

(see instructions)

18 Late filing and late payment penalties

(see instructions)

............................................................................

18

19 Balance due

..........................................................

19

(add lines 15 through 18; enter payment on line A above)

20 Overpayment

........................................................

20

(if line 13 is less than line 14, subtract line 13 from line 14)

21 Amount of overpayment to be credited to next period ..............................................................................

21

22 Refund of overpayment

.................................................................................

22

(subtract line 21 from line 20)

Continued on the back

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2