Springboro Individual Income Tax Return - 2007

ADVERTISEMENT

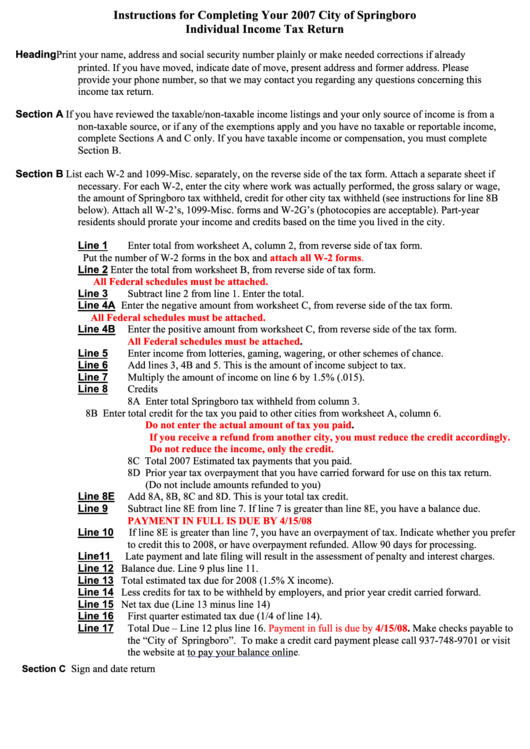

Instructions for Completing Your 2007 City of Springboro

Individual Income Tax Return

Heading

Print your name, address and social security number plainly or make needed corrections if already

printed. If you have moved, indicate date of move, present address and former address. Please

provide your phone number, so that we may contact you regarding any questions concerning this

income tax return

.

Section A

If you have reviewed the taxable/non-taxable income listings and your only source of income is from a

non-taxable source, or if any of the exemptions apply and you have no taxable or reportable income,

complete Sections A and C only. If you have taxable income or compensation, you must complete

Section B.

Section B

List each W-2 and 1099-Misc. separately, on the reverse side of the tax form. Attach a separate sheet if

necessary. For each W-2, enter the city where work was actually performed, the gross salary or wage,

the amount of Springboro tax withheld, credit for other city tax withheld (see instructions for line 8B

below). Attach all W-2’s, 1099-Misc. forms and W-2G’s (photocopies are acceptable). Part-year

residents should prorate your income and credits based on the time you lived in the city.

Line 1

Enter total from worksheet A, column 2, from reverse side of tax form.

Put the number of W-2 forms in the box and

attach all W-2 forms.

Line 2

Enter the total from worksheet B, from reverse side of tax form.

All Federal schedules must be attached.

Line 3

Subtract line 2 from line 1. Enter the total.

Line 4A

Enter the negative amount from worksheet C, from reverse side of the tax form.

All Federal schedules must be attached.

Line 4B

Enter the positive amount from worksheet C, from reverse side of the tax form.

All Federal schedules must be

attached.

Line 5

Enter income from lotteries, gaming, wagering, or other schemes of chance.

Line 6

Add lines 3, 4B and 5. This is the amount of income subject to tax.

Line 7

Multiply the amount of income on line 6 by 1.5% (.015).

Line 8

Credits

8A Enter total Springboro tax withheld from column 3.

8B Enter total credit for the tax you paid to other cities from worksheet A, column 6.

Do not enter the actual amount of tax you

paid.

If you receive a refund from another city, you must reduce the credit accordingly.

Do not reduce the income, only the credit.

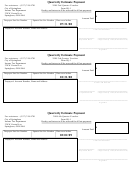

8C Total 2007 Estimated tax payments that you paid.

8D Prior year tax overpayment that you have carried forward for use on this tax return.

(Do not include amounts refunded to you)

Line 8E

Add 8A, 8B, 8C and 8D. This is your total tax credit.

Line 9

Subtract line 8E from line 7. If line 7 is greater than line 8E, you have a balance due.

PAYMENT IN FULL IS DUE BY 4/15/08

Line 10

If line 8E is greater than line 7, you have an overpayment of tax. Indicate whether you prefer

to credit this to 2008, or have overpayment refunded. Allow 90 days for processing.

Line 11

Late payment and late filing will result in the assessment of penalty and interest charges.

Line 12

Balance due. Line 9 plus line 11.

Line 13

Total estimated tax due for 2008 (1.5% X income).

Line 14

Less credits for tax to be withheld by employers, and prior year credit carried forward.

Line 15

Net tax due (Line 13 minus line 14)

Line 16

First quarter estimated tax due (1/4 of line 14).

Line 17

Total Due – Line 12 plus line 16.

Payment in full is due by

4/15/08. Make checks payable to

the “City of Springboro”. To make a credit card payment please call 937-748-9701 or visit

the website at

to pay your balance online

.

Sign and date return

Section C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5