Instructions For Form Ab-605

ADVERTISEMENT

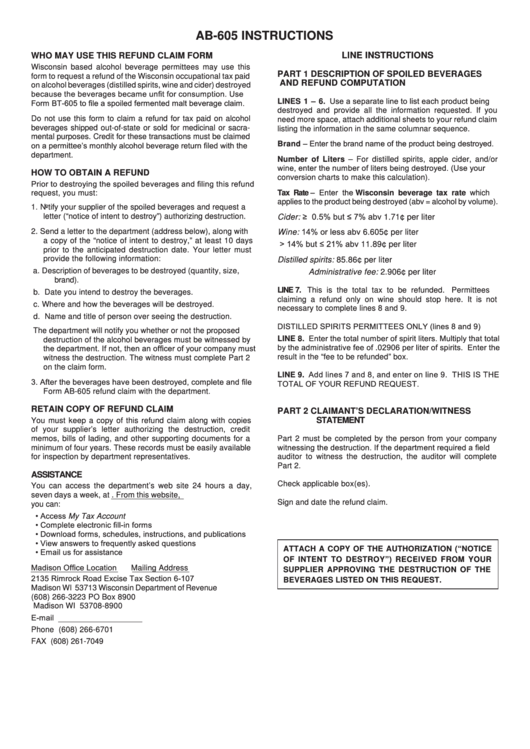

AB-605 INSTRUCTIONS

WHO MAY USE THIS REFUND CLAIM FORM

LINE INSTRUCTIONS

Wisconsin based alcohol beverage permittees may use this

PART 1 DESCRIPTION OF SPOILED BEVERAGES

form to request a refund of the Wisconsin occupational tax paid

AND REFUND COMPUTATION

on alcohol beverages (distilled spirits, wine and cider) destroyed

because the beverages became unfit for consumption. Use

LINES 1 – 6. Use a separate line to list each product being

Form BT‑605 to file a spoiled fermented malt beverage claim.

destroyed and provide all the information requested. If you

Do not use this form to claim a refund for tax paid on alcohol

need more space, attach additional sheets to your refund claim

beverages shipped out-of-state or sold for medicinal or sacra-

listing the information in the same columnar sequence.

mental purposes. Credit for these transactions must be claimed

Brand – Enter the brand name of the product being destroyed.

on a permittee’s monthly alcohol beverage return filed with the

department.

Number of Liters – For distilled spirits, apple cider, and/or

wine, enter the number of liters being destroyed. (Use your

HOW TO OBTAIN A REFUND

conversion charts to make this calculation).

Prior to destroying the spoiled beverages and filing this refund

Tax Rate – Enter the Wisconsin beverage tax rate which

request, you must:

applies to the product being destroyed (abv = alcohol by volume).

1. Notify your supplier of the spoiled beverages and request a

Cider: ≥ 0.5% but ≤ 7% abv ..................... 1.71¢ per liter

letter (“notice of intent to destroy”) authorizing destruction.

Wine: 14% or less abv ............................. 6.605¢ per liter

2. Send a letter to the department (address below), along with

a copy of the “notice of intent to destroy,” at least 10 days

> 14% but ≤ 21% abv ..................... 11.89¢ per liter

prior to the anticipated destruction date. Your letter must

provide the following information:

Distilled spirits: ........................................... 85.86¢ per liter

a. Description of beverages to be destroyed (quantity, size,

Administrative fee: ......................... 2.906¢ per liter

brand).

LINE 7.

This is the total tax to be refunded.

Permittees

b. Date you intend to destroy the beverages.

claiming a refund only on wine should stop here. It is not

c. Where and how the beverages will be destroyed.

necessary to complete lines 8 and 9.

d. Name and title of person over seeing the destruction.

DISTILLED SPIRITS PERMITTEES ONLY (lines 8 and 9)

The department will notify you whether or not the proposed

LINE 8. Enter the total number of spirit liters. Multiply that total

destruction of the alcohol beverages must be witnessed by

by the administrative fee of .02906 per liter of spirits. Enter the

the department. If not, then an officer of your company must

result in the “fee to be refunded” box.

witness the destruction. The witness must complete Part 2

on the claim form.

LINE 9. Add lines 7 and 8, and enter on line 9. THIS IS THE

3. After the beverages have been destroyed, complete and file

TOTAL OF YOUR REFUND REQUEST.

Form AB-605 refund claim with the department.

RETAIN COPY OF REFUND CLAIM

PART 2 CLAIMANT’S DECLARATION/WITNESS

STATEMENT

You must keep a copy of this refund claim along with copies

of your supplier’s letter authorizing the destruction, credit

memos, bills of lading, and other supporting documents for a

Part 2 must be completed by the person from your company

witnessing the destruction. If the department required a field

minimum of four years. These records must be easily available

for inspection by department representatives.

auditor to witness the destruction, the auditor will complete

Part 2.

ASSISTANCE

Check applicable box(es).

You can access the department’s web site 24 hours a day,

seven days a week, at From this website,

Sign and date the refund claim.

you can:

• Access My Tax Account

• Complete electronic fill‑in forms

• Download forms, schedules, instructions, and publications

• View answers to frequently asked questions

ATTACH A COPY OF THE AUTHORIZATION (“NOTICE

• Email us for assistance

OF INTENT TO DESTROY”) RECEIVED FROM YOUR

Madison Office Location

Mailing Address

SUPPLIER APPROVING THE DESTRUCTION OF THE

2135 Rimrock Road

Excise Tax Section 6‑107

BEVERAGES LISTED ON THIS REQUEST.

Madison WI 53713

Wisconsin Department of Revenue

(608) 266-3223

PO Box 8900

Madison WI 53708-8900

E‑mail excise@revenue.wi.gov

Phone (608) 266-6701

FAX (608) 261-7049

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1