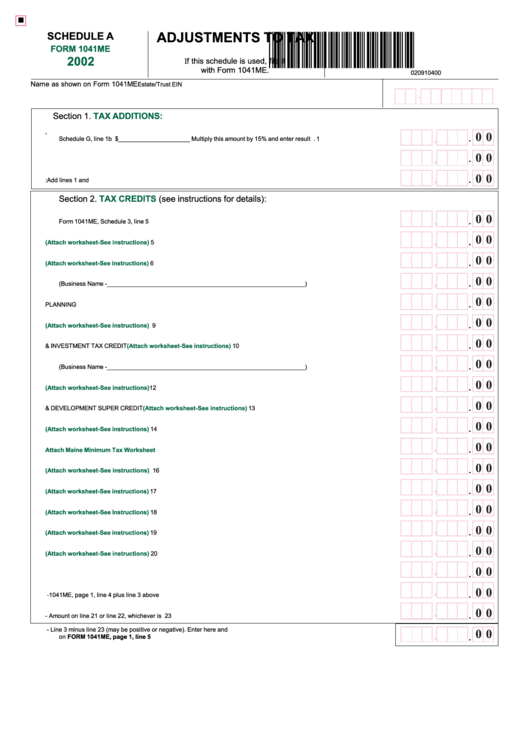

Form 1041me - Schedule A - Adjustments To Tax - 2002

ADVERTISEMENT

*020910400*

SCHEDULE A

ADJUSTMENTS TO TAX

FORM 1041ME

2002

If this schedule is used, file it

with Form 1041ME.

020910400

Name as shown on Form 1041ME

Estate/Trust EIN

-

Section 1.

TAX ADDITIONS:

1.

RETIREMENT PLAN DISTRIBUTIONS - Enter the amount from federal Form 1041,

0 0

,

Schedule G, line 1b $ _____________________ Multiply this amount by 15% and enter result here .................................... 1

.

0 0

,

2.

MAINE MINIMUM TAX - Attach Maine Minimum Tax Worksheet .............................................................................................. 2

.

0 0

,

3.

TOTAL ADDITIONS: Add lines 1 and 2 ..................................................................................................................................... 3

.

Section 2.

TAX CREDITS

(see instructions for details):

4.

CREDIT FOR INCOME TAX PAID TO ANOTHER JURISDICTION

0 0

,

Form 1041ME, Schedule 3, line 5 ............................................................................................................................................. 4

.

0 0

,

5.

MAINE SEED CAPITAL CREDIT

(Attach worksheet-See instructions) ................................................................................

5

.

0 0

,

6.

EMPLOYER-ASSISTED DAY-CARE CREDIT

(Attach worksheet-See instructions) ............................................................

6

.

7.

INVESTMENT TAX CREDIT.

0 0

,

(Business Name - __________________________________________________________ ) ............................................ 7

.

0 0

,

8.

FOREST MANAGEMENT PLANNING CREDIT ....................................................................................................................... 8

.

0 0

,

9.

EMPLOYER-PROVIDED LONG-TERM CARE CREDIT

(Attach worksheet-See instructions) .............................................

9

.

0 0

,

10. JOBS & INVESTMENT TAX CREDIT

(Attach worksheet-See instructions) ........................................................................

10

.

11. SOLID WASTE REDUCTION INVESTMENT TAX CREDIT.

0 0

,

(Business Name - __________________________________________________________ ) .......................................... 11

.

0 0

,

12. RESEARCH EXPENSE TAX CREDIT

(Attach worksheet-See instructions) .......................................................................

12

.

0 0

,

13. RESEARCH & DEVELOPMENT SUPER CREDIT

(Attach worksheet-See instructions) ...................................................

13

.

0 0

,

14. HIGH-TECHNOLOGY CREDIT

(Attach worksheet-See instructions) .................................................................................

14

.

0 0

,

15. MAINE MINIMUM TAX CREDIT -

Attach Maine Minimum Tax Worksheet

.......................................................................... 15

.

0 0

,

16. CREDIT FOR DEPENDENT HEALTH BENEFITS PAID

(Attach worksheet-See instructions) ...........................................

16

.

0 0

,

17. CLEAN FUEL CREDIT

(Attach worksheet-See instructions) ..............................................................................................

17

.

0 0

,

18. HISTORIC REHABILITATION CREDIT

(Attach worksheet-See Instructions) .....................................................................

18

.

0 0

,

19. FAMILY DEVELOPMENT ACCOUNT CREDIT

(Attach worksheet-See instructions) .........................................................

19

.

0 0

,

20. QUALITY CHILD-CARE INVESTMENT TAX CREDIT

(Attach worksheet-See instructions) ...............................................

20

.

0 0

,

21. TOTAL CREDITS - Add lines 4 through 20 ............................................................................................................................. 21

.

0 0

,

22. MAINE INCOME TAX PLUS ADDITIONS

-

1041ME, page 1, line 4 plus line 3 above ........................................................... 22

.

0 0

,

23. ALLOWABLE CREDITS

- Amount on line 21 or line 22, whichever is less. ............................................................................ 23

.

24. TOTAL TAX ADJUSTMENTS

- Line 3 minus line 23 (may be positive or negative). Enter here and

0 0

,

on FORM 1041ME, page 1, line 5 .......................................................................................................................................... 24

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1