Form M-1120 - Corporation Income Tax Return - State Of Michigan 2006

ADVERTISEMENT

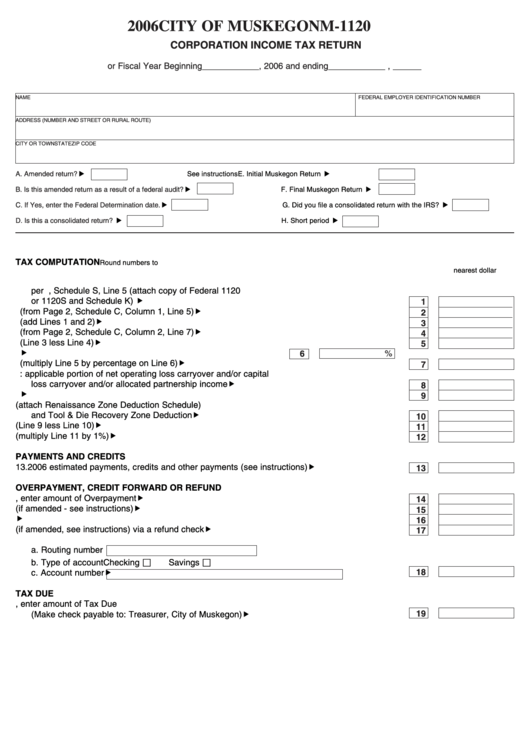

2006 CITY OF MUSKEGON M-1120

CORPORATION INCOME TAX RETURN

or Fiscal Year Beginning____________, 2006 and ending____________ , ______

NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER

ADDRESS (NUMBER AND STREET OR RURAL ROUTE)

CITY OR TOWN

STATE

ZIP CODE

A. Amended return?

See instructions

E. Initial Muskegon Return

B. Is this amended return as a result of a federal audit?

F. Final Muskegon Return

C. If Yes, enter the Federal Determination date.

G. Did you file a consolidated return with the IRS?

D. Is this a consolidated return?

H. Short period

TAX COMPUTATION

Round numbers to

nearest dollar

1. Taxable income before net operating loss deduction and special deductions

per U.S. 1120 or per Page 2, Schedule S, Line 5 (attach copy of Federal 1120

or 1120S and Schedule K) ...........................................................................................................

1

2. Enter items not deductible (from Page 2, Schedule C, Column 1, Line 5) ...................................

2

3. TOTAL (add Lines 1 and 2) ...........................................................................................................

3

4. Enter items not taxable (from Page 2, Schedule C, Column 2, Line 7) ........................................

4

5. TOTAL (Line 3 less Line 4) ...........................................................................................................

5

6. Apportionment percentage from Schedule D .............................

6

%

7. TOTAL (multiply Line 5 by percentage on Line 6) ........................................................................

7

8. ADJUSTMENTS: applicable portion of net operating loss carryover and/or capital

loss carryover and/or allocated partnership income ....................................................................

8

9. Net income ...................................................................................................................................

9

10. Renaissance Zone Deduction (attach Renaissance Zone Deduction Schedule)

and Tool & Die Recovery Zone Deduction ....................................................................................

10

11. TOTAL income subject to tax (Line 9 less Line 10) ......................................................................

11

12. Tax (multiply Line 11 by 1%) .........................................................................................................

12

PAYMENTS AND CREDITS

13. 2006 estimated payments, credits and other payments (see instructions) ..................................

13

OVERPAYMENT, CREDIT FORWARD OR REFUND

14. If Line 13 is larger than Line 12, enter amount of Overpayment ..................................................

14

15. Amount to be credited to 2007 Estimated Tax (if amended - see instructions) ............................

15

16. Amount to be donated to Annual Project ......................................................................................

16

17. Amount to be refunded (if amended, see instructions) via a refund check ..................................

17

18. Amount to be refunded via direct deposit to the following bank account

a. Routing number

b. Type of account

Checking

Savings

c. Account number ........................................................................................................................

18

TAX DUE

19. If Line 12 is larger than Line 13, enter amount of Tax Due

(Make check payable to: Treasurer, City of Muskegon) ................................................................

19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2