Instructions For Form Sf-1120 - Corporation Income Tax Return - City Of Springfield - 2006

ADVERTISEMENT

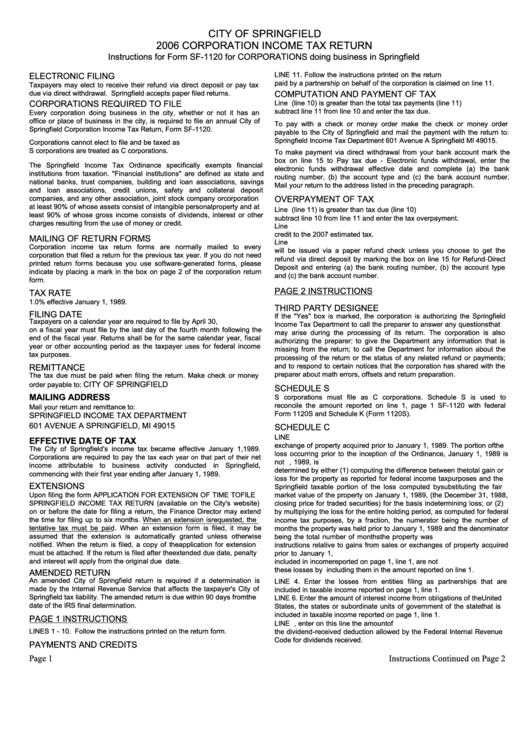

CITY OF SPRINGFIELD

2006 CORPORATION INCOME TAX RETURN

Instructions for Form SF-1120 for CORPORATIONS doing business in Springfield

LINE 11. Follow the instructions printed on the return form. Credit for tax

ELECTRONIC FILING

paid by a partnership on behalf of the corporation is claimed on line 11.

Taxpayers may elect to receive their refund via direct deposit or pay tax

due via direct withdrawal. Springfield accepts paper filed returns.

COMPUTATION AND PAYMENT OF TAX

CORPORATIONS REQUIRED TO FILE

Line 16. If tax due (line 10) is greater than the total tax payments (line 11)

subtract line 11 from line 10 and enter the tax due.

Every corporation doing business in the city, whether or not it has an

office or place of business in the city, is required to file an annual City of

To pay with a check or money order make the check or money order

Springfield Corporation Income Tax Return, Form SF-1120.

payable to the City of Springfield and mail the payment with the return to:

Springfield Income Tax Department 601 Avenue A Springfield MI 49015.

Corporations cannot elect to file and be taxed as partnerships. Subchapter

S corporations are treated as C corporations.

To make payment via direct withdrawal from your bank account mark the

box on line 15 to Pay tax due - Electronic funds withdrawal, enter the

The Springfield Income Tax Ordinance specifically exempts financial

electronic funds withdrawal effective date and complete (a) the bank

institutions from taxation. "Financial institutions" are defined as state and

routing number, (b) the account type and (c) the bank account number.

national banks, trust companies, building and loan associations, savings

Mail your return to the address listed in the preceding paragraph.

and loan associations, credit unions, safety and collateral deposit

companies, and any other association, joint stock company or corporation

OVERPAYMENT OF TAX

at least 90% of whose assets consist of intangible personal property and at

Line 12. If the total tax payments (line 11) is greater than tax due (line 10)

least 90% of whose gross income consists of dividends, interest or other

subtract line 10 from line 11 and enter the tax overpayment.

charges resulting from the use of money or credit.

Line 13. Enter all or the portion of the overpayment to be forwarded as a

credit to the 2007 estimated tax.

MAILING OF RETURN FORMS

Line 14. Enter the amount of your overpayment to be refunded. A refund

Corporation income tax return forms are normally mailed to every

will be issued via a paper refund check unless you choose to get the

corporation that filed a return for the previous tax year. If you do not need

refund via direct deposit by marking the box on line 15 for Refund-Direct

printed return forms because you use software-generated forms, please

Deposit and entering (a) the bank routing number, (b) the account type

indicate by placing a mark in the box on page 2 of the corporation return

and (c) the bank account number.

form.

PAGE 2 INSTRUCTIONS

TAX RATE

1.0% effective January 1, 1989.

THIRD PARTY DESIGNEE

FILING DATE

If the "Yes" box is marked, the corporation is authorizing the Springfield

Taxpayers on a calendar year are required to file by April 30, 2007. Those

Income Tax Department to call the preparer to answer any questions that

on a fiscal year must file by the last day of the fourth month following the

may arise during the processing of its return. The corporation is also

end of the fiscal year. Returns shall be for the same calendar year, fiscal

authorizing the preparer: to give the Department any information that is

year or other accounting period as the taxpayer uses for federal income

missing from the return; to call the Department for information about the

tax purposes.

processing of the return or the status of any related refund or payments;

and to respond to certain notices that the corporation has shared with the

REMITTANCE

preparer about math errors, offsets and return preparation.

The tax due must be paid when filing the return. Make check or money

CITY OF SPRINGFIELD

order payable to:

SCHEDULE S

MAILING ADDRESS

S corporations must file as C corporations. Schedule S is used to

reconcile the amount reported on line 1, page 1 SF-1120 with federal

Mail your return and remittance to:

Form 1120S and Schedule K (Form 1120S).

SPRINGFIELD INCOME TAX DEPARTMENT

601 AVENUE A SPRINGFIELD, MI 49015

SCHEDULE C

LINE 1. Enter on line 1 the nondeductible portion of a loss from the sale or

EFFECTIVE DATE OF TAX

exchange of property acquired prior to January 1, 1989. The portion of the

The City of Springfield's income tax became effective January 1,1989.

loss occurring prior to the inception of the Ordinance, January 1, 1989 is

Corporations are required to pay the

net

tax each year on that part of their

not recognized. The amount of loss occurring prior to January 1, 1989, is

income attributable to business activity conducted in Springfield,

determined by either (1) computing the difference between the total gain or

commencing with their first year ending after January 1, 1989.

loss for the property as reported for federal income tax purposes and the

EXTENSIONS

Springfield taxable portion of the loss computed by substituting the fair

Upon filing the form APPLICATION FOR EXTENSION OF TIME TO FILE

market value of the property on January 1, 1989, (the December 31, 1988,

SPRINGFIELD INCOME TAX RETURN (available on the City's website)

closing price for traded securities) for the basis in determining loss; or (2)

on or before the date for filing a return, the Finance Director may extend

by multiplying the loss for the entire holding period, as computed for federal

the time for filing up to six months. When an extension is requested, the

income tax purposes, by a fraction, the numerator being the number of

tentative tax must be paid. When an extension form is filed, it may be

months the property was held prior to January 1, 1989 and the denominator

assumed that the extension is automatically granted unless otherwise

being the total number of months the property was held. See line 10 for

notified. When the return is filed, a copy of the application for extension

instructions relative to gains from sales or exchanges of property acquired

must be attached. If the return is filed after the extended due date, penalty

prior to January 1, 1989. Capital losses from US Government obligations

and interest will apply from the original due date.

included in income reported on page 1, line 1, are not deductible. Remove

these losses by including them in the amount reported on line 1.

AMENDED RETURN

An amended City of Springfield return is required if a determination is

LINE 4. Enter the losses from entities filing as partnerships that are

made by the Internal Revenue Service that affects the taxpayer's City of

included in taxable income reported on page 1, line 1.

Springfield tax liability. The amended return is due within 90 days from the

LINE 6. Enter the amount of interest income from obligations of the United

date of the IRS final determination.

States, the states or subordinate units of government of the state that is

included in taxable income reported on page 1, line 1.

PAGE 1 INSTRUCTIONS

LINE 7. If you reported dividend income, enter on this line the amount of

LINES 1 - 10. Follow the instructions printed on the return form.

the dividend-received deduction allowed by the Federal Internal Revenue

Code for dividends received.

PAYMENTS AND CREDITS

Page 1

Instructions Continued on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2