Instructions For Form Pt-102 - Tax On Diesel Motor Fuel, And For Supporting Schedules

ADVERTISEMENT

-

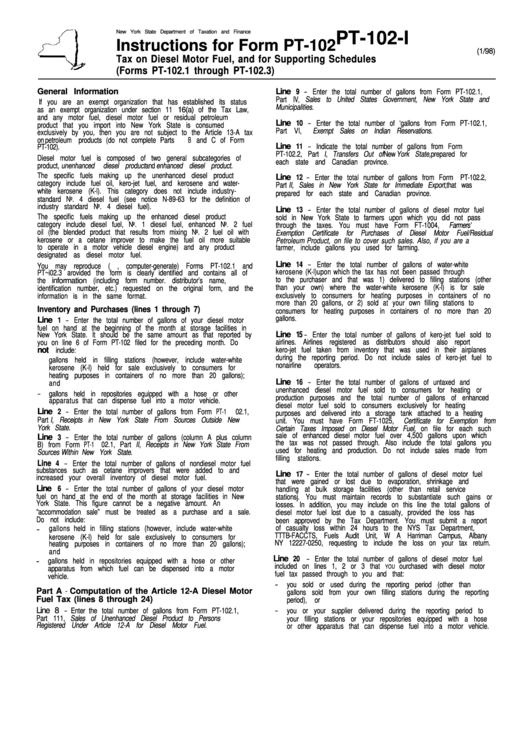

New York State Department of Taxation and Finance

PT-102-I

Instructions for Form PT-102

(1/98)

Tax on Diesel Motor Fuel, and for Supporting Schedules

(Forms PT-102.1 through PT-102.3)

General Information

Line

9 - Enter the total number of gallons from Form PT-102.1,

Part IV, Sales to United States Government, New York State and

If you are an exempt organization that has established its status

Municipalities.

as an exempt organization under section 11 16(a) of the Tax Law,

and any motor fuel, diesel motor fuel or residual petroleum

Line

10 - Enter the total number of ‘gallons from Form PT-102.1,

product that you import into New York State is consumed

Part VI, Exempt Sales on Indian Reservations.

exclusively by you, then you are not subject to the Article 13-A tax

on petroleum

products (do not complete Parts B and C of Form

Line

11 - Indicate the total number of gallons from Form

PT-102).

PT-102.2, Part I, Transfers Out of New York State, prepared for

Diesel motor fuel is composed of two general subcategories of

each state and Canadian province.

product, unenhanced

diesel product and enhanced diesel product.

The specific fuels making up the unenhanced diesel product

Line

12 - Enter the total number of gallons from Form PT-102.2,

category include fuel oil, kero-jet fuel, and kerosene and water-

Part II, Sales in New York State for Immediate Export, that was

white kerosene (K-l). This category does not include industry-

prepared for each state and Canadian province.

standard No. 4 diesel fuel (see notice N-89-63 for the definition of

industry standard No. 4 diesel fuel).

Line

13 - Enter the total number of gallons of diesel motor fuel

The specific fuels making up the enhanced diesel product

sold in New York State to farmers upon which you did not pass

category include diesel fuel, No. 1 diesel fuel, enhanced No. 2 fuel

through the taxes. You must have Form FT-1004, Farmers’

oil (the blended product that results from mixing No. 2 fuel oil with

Exemption Certificate for Purchases of Diesel Motor Fuel/Residual

kerosene or a cetane improver to make the fuel oil more suitable

Petroleum Product, on file to cover such sales. Also, if you are a

to operate in a motor vehicle diesel engine) and any product

farmer, include gallons you used for farming.

designated as diesel motor fuel.

Line

14 - Enter the total number of gallons of water-white

You may reproduce (e.g., computer-generate) Forms PT-102.1 and

kerosene (K-l) upon which the tax has not been passed through

PT~i02.3 arovided the form is clearly identified and contains all of

to the purchaser and that was 1) delivered to filling stations (other

the information (including form number. distributor’s name,

than your own) where the water-white kerosene (K-l) is for sale

identification number, etc.) requested on the original form, and the

exclusively to consumers for heating purposes in containers of no

information is in the same format.

more than 20 gallons, or 2) sold at your own filling stations to

Inventory and Purchases (lines 1 through 7)

consumers for heating purposes in containers of no more than 20

gallons.

Line

1 - Enter the total number of gallons of your diesel motor

fuel on hand at the beginning of the month at storage facilities in

Line 15

New York State. It should be the same amount as that reported by

- Enter the total number of gallons of kero-jet fuel sold to

airlines. Airlines registered as distributors should also report

you on line 6 of Form PT-102 filed for the preceding month. Do

kero-jet fuel taken from inventory that was used in their airplanes

not

include:

during the reporting period. Do not include sales of kero-jet fuel to

gallons held in filling stations (however, include water-white

nonairline

operators.

kerosene (K-l) held for sale exclusively to consumers for

heating purposes in containers of no more than 20 gallons);

Line

16 - Enter the total number of gallons of untaxed and

and

unenhanced diesel motor fuel sold to consumers for heating or

-

gallons held in repositories equipped with a hose or other

production purposes and the total number of gallons of enhanced

apparatus that can dispense fuel into a motor vehicle.

diesel motor fuel sold to consumers exclusively for heating

Line

2 - Enter the total number of gallons from Form PT-1 02.1,

purposes and delivered into a storage tank attached to a heating

Part I, Receipts in New York State From Sources Outside New

unit. You must have Form FT-1025, Certificate for Exemption from

York State.

Certain Taxes Imposed on Diesel Motor Fuel, on file for each such

sale of enhanced diesel motor fuel over 4,500 gallons upon which

Line

3 - Enter the total number of gallons (column A plus column

the tax was not passed through. Also include the total gallons you

B) from Form PT-1 02.1, Part II, Receipts in New York State From

used for heating and production. Do not include sales made from

Sources Within New York State.

filling stations.

Line

4 - Enter the total number of gallons of nondiesel motor fuel

substances such as cetane improvers that were added to and

Line

17 - Enter the total number of gallons of diesel motor fuel

increased your overall inventory of diesel motor fuel.

that were gained or lost due to evaporation, shrinkage and

Line

6 - Enter the total number of gallons of your diesel motor

handling at bulk storage facilities (other than retail service

fuel on hand at the end of the month at storage facilities in New

stationsj. You must maintain records to substantiate such gains or

York State. This figure cannot be a negative amount. An

losses. In addition, you may include on this line the total gallons of

“accommodation sale” must be treated as a purchase and a sale.

diesel motor fuel lost due to a casualty, provided the loss has

Do not include:

been approved by the Tax Department. You must submit a report

of casualty loss within 24 hours to the NYS Tax Department,

gallons held in filling stations (however, include water-white

-

TTTB-FACCTS, Fuels Audit Unit, W A Harriman Campus, Albany

kerosene (K-l) held for sale exclusively to consumers for

NY 12227-0250, requesting to include the loss on your tax return.

heating purposes in containers of no more than 20 gallons);

and

Line

20 - Enter the total number of gallons of diesel motor fuel

-

gallons held in repositories equipped with a hose or other

included on lines 1, 2 or 3 that

ourchased with diesel motor

YOU

apparatus from which fuel can be dispensed into a motor

fuel tax passed through to you and that:

vehicle.

-

you sold or used during the reporting period (other than

Part A - Computation of the Article 12-A Diesel Motor

gallons sold from your own filling stations during the reporting

Fuel Tax (lines 8 through 24)

period), or

Line 8

- Enter the total number of gallons from Form PT-102.1,

-

you or your supplier delivered during the reporting period to

Part 111, Sales of Unenhanced Diesel Product to Persons

your filling stations or your repositories equipped with a hose

Registered Under Article 12-A for Diesel Motor Fuel.

or other apparatus that can dispense fuel into a motor vehicle.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4