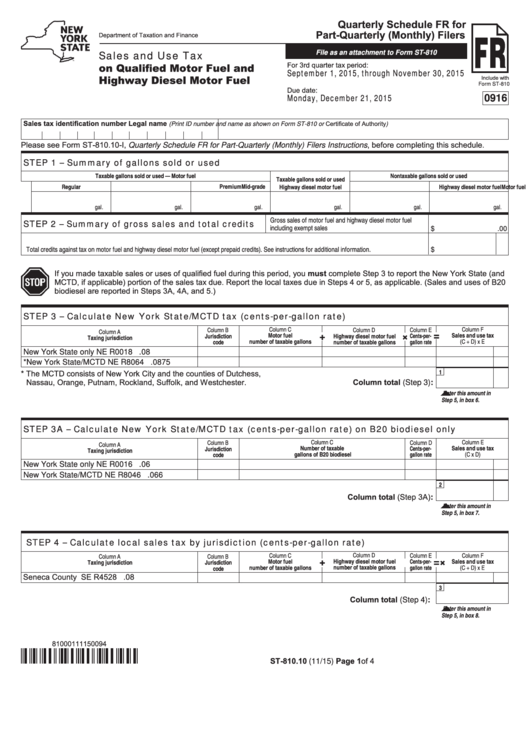

Form St-810.10 - Quarterly Schedule Fr For Part-Quarterly (Monthly) Filers - Sales And Use Tax On Qualified Motor Fuel And Highway Diesel Motor Fuel - 2015

ADVERTISEMENT

Quarterly Schedule FR for

Part-Quarterly (Monthly) Filers

Department of Taxation and Finance

Sales and Use Tax

File as an attachment to Form ST-810

on Qualified Motor Fuel and

For 3rd quarter tax period:

September 1, 2015, through November 30, 2015

Highway Diesel Motor Fuel

Include with

Form ST-810

Due date:

Monday, December 21, 2015

0916

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-810 or Certificate of Authority)

Please see Form ST-810.10-I, Quarterly Schedule FR for Part-Quarterly (Monthly) Filers Instructions, before completing this schedule.

STEP 1 – Summary of gallons sold or used

Taxable gallons sold or used — Motor fuel

Nontaxable gallons sold or used

Taxable gallons sold or used

Regular

Mid-grade

Premium

Highway diesel motor fuel

Motor fuel

Highway diesel motor fuel

gal.

gal.

gal.

gal.

gal.

gal.

Gross sales of motor fuel and highway diesel motor fuel

STEP 2 – Summary of gross sales and total credits

including exempt sales ..................................................

$

.00

Total credits against tax on motor fuel and highway diesel motor fuel (except prepaid credits). See instructions for additional information. ..............................

$

If you made taxable sales or uses of qualified fuel during this period, you must complete Step 3 to report the New York State (and

MCTD, if applicable) portion of the sales tax due. Report the local taxes due in Steps 4 or 5, as applicable. (Sales and uses of B20

biodiesel are reported in Steps 3A, 4A, and 5.)

STEP 3 – Calculate New York State/MCTD tax (cents-per-gallon rate)

Column C

Column F

Column E

Column B

Column D

Column A

Motor fuel

Cents-per-

Sales and use tax

Jurisdiction

Highway diesel motor fuel

=

+

×

Taxing jurisdiction

number of taxable gallons

gallon rate

(C + D) x E

code

number of taxable gallons

New York State only

NE R0018

.08

*New York State/MCTD

NE R8064

.0875

1

* The MCTD consists of New York City and the counties of Dutchess,

Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester.

Column total (Step 3):

Enter this amount in

Step 5, in box 6.

STEP 3A – Calculate New York State/MCTD tax (cents-per-gallon rate) on B20 biodiesel only

Column C

Column D

Column E

Column B

Column A

Number of taxable

Sales and use tax

Jurisdiction

Cents-per-

Taxing jurisdiction

gallons of B20 biodiesel

gallon rate

(C x D)

code

New York State only

NE R0016

.06

New York State/MCTD

NE R8046

.066

2

Column total (Step 3A):

Enter this amount in

Step 5, in box 7.

STEP 4 – Calculate local sales tax by jurisdiction (cents-per-gallon rate)

Column C

Column D

Column E

Column F

Column A

Column B

Motor fuel

Highway diesel motor fuel

Cents-per-

Sales and use tax

Taxing jurisdiction

Jurisdiction

+

×

=

number of taxable gallons

number of taxable gallons

gallon rate

(C + D) x E

code

Seneca County

SE R4528

.08

3

Column total (Step 4):

Enter this amount in

Step 5, in box 8.

81000111150094

ST-810.10 (11/15) Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4