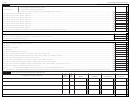

Schedule D Corporation And Partnership - Gains And Losses From Sale Or Exchange Of Property Page 3

ADVERTISEMENT

Rev. 05.05

Schedule D Corporation and Partnership - Page 3

Taxpayer's Name

Employer Identification Number

Part VII

Summary of Capital Gains and Losses

Column A

Column B

Column D

Column E

Column F

Column G

Column H

Column I

Column C

Shares Eligible

Shares Eligible

Gains or Losses

Property Located in

Property Located in

Other Properties

Under Act No. 40 of

Under Special

Corporation or

Short - Term

Other Properties

Corporation or

Partnership

Legislation

P.R.

P.R.

(Act No. 226 of 2004)

2005

(Act No. 226 of 2004)

Partnership

(Act No. 226 of 2004)

24.

Enter the gains determined

on lines 6, 10, 14, 18, 22 and

23 in the corresponding

00

00

00

00

00

00

00

00

00

Column ................................

(24)

25.

Enter the losses determined

on lines 6,10,14,18, 22 and

23 in the corresponding

00

00

00

00

00

00

00

00

Column ...............................

00

(25)

26.

If one or more of Columns B through I reflect

a loss on line 25, add them and apply the

total proportionally to the gains in the other

00

00

00

00

00

00

00

00

Columns (See instructions) ..........................

(26)

27.

Subtract line 26 from line 24. If any Column

00

00

00

00

00

00

00

00

reflected a loss on line 25, enter zero here ...

(27)

28.

Apply the loss from line 25, Column A

proportionally to the gains in Columns B

00

00

00

00

00

00

00

00

through I (See instructions)….................

(28)

00

00

00

00

00

00

00

00

29.

Subtract line 28 from line 27. ..........................

(29)

30.

Add the total of Columns B through I, line 29. However, if line 24 does not reflect any gain in Columns B through I, you must enter the total amount of line 25, Columns

00

(30)

A through I ..............................................................................................................................................................................................................................................................................................

00

(31)

31.

Net capital gain (or loss) (Add line 24, Column A and line 30) ……...........................................................................................................................................................................................................……

00

32.

(32)

Enter excess of net short-term capital gain over net long-term capital loss (See instructions) …............................................................................................................................................................…….

00

(33)

33.

Enter excess of net long-term capital gain over net short-term capital loss (See instructions) …....................................................................................................................................................................

00

(34)

34.

Net capital gain (Add lines 32 and 33. Enter here and on Form 480.10 or 480.20, Part IV, line 9 or on the appropriate line of other returns) ................................................................................................

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4