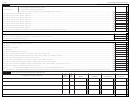

Schedule D Corporation And Partnership - Gains And Losses From Sale Or Exchange Of Property Page 4

ADVERTISEMENT

Schedule D Corporation and Partnership - Page 4

Rev. 05.05

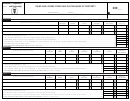

Part VIII

Determination of Alternative Tax - Capital Gain

{

(a) Form 480.10 or 480.20, Part II, line 5

35.

Net income

(b) Schedule P Incentives, Part I, line 7

(c) Others - Enter the amount from the appropriate line of the return ...............................................................................................................................

00

(35)

36.

Enter the amount from line 29, Column B ...........................................................................................................................................................................................................

00

(36)

37.

Enter the amount from line 29, Column C ...........................................................................................................................................................................................................

00

(37)

38.

Enter the amount from line 29, Column D ...........................................................................................................................................................................................................

00

(38)

39.

Enter the amount from line 29, Column E ...........................................................................................................................................................................................................

00

(39)

40.

Enter the amount from line 29, Column F ..........................................................................................................................................................................................................

00

(40)

41.

Enter the amount from line 29, Column G ..........................................................................................................................................................................................................

00

(41)

42.

00

Enter the amount from line 29, Column H ..........................................................................................................................................................................................................

(42)

43.

Enter the amount from line 29, Column I .........................................................................................................................................................................................................

00

(43)

44.

Net income for purposes of alternative tax - capital gain (Subtract lines 36 through 43 from line 35) .................................................................................................................

00

(44)

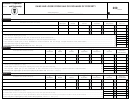

COMPUTATION OF NET INCOME TO DETERMINE ALTERNATIVE TAX

45.

Net income for purposes of partial normal tax (Enter the amount from line 44) ..................................................................................................................................................

00

(45)

46.

Less: Credit for purposes of surtax (From the appropriate line of the return) ....................................................................................................................................................

00

(46)

47.

Net income subject to partial surtax ...................................................................................................................................................................................................................

00

(47)

COMPUTATION OF ALTERNATIVE TAX

00

48.

Partial normal tax (Multiply line 45 by 20%) ........................................................................................................................................................................................................

(48)

00

49.

Surtax .................................................................................................................................................................................................................................................................

(49)

00

50.

Amount of recapture ...........................................................................................................................................................................................................................................

(50)

00

51.

Special tax .........................................................................................................................................................................................................................................................

(51)

00

52.

Total tax (Add lines 48 through 51) .....................................................................................................................................................................................................................

(52)

00

53.

Plus: 12.5% (property located in Puerto Rico) of the amount on line 36 .............................................................................................................................................................

(53)

54.

00

Plus: 6.25% (property located in Puerto Rico (Act No. 226 of 2004)) of the amount on line 37 ..........................................................................................................................

(54)

55.

Plus: 25% (other properties) of the amount on line 38 ........................................................................................................................................................................................

00

(55)

56.

Plus: 12.5% (other properties (Act No. 226 of 2004)) of the amount on line 39 ...................................................................................................................................................

00

(56)

57.

Plus 7% (shares from eligible corporation or patnership) of the amount on line 40 .............................................................................................................................................

00

(57)

58.

Plus: 3.5% (shares from eligible corporation or patnership (Act No. 226 of 2004)) of the amount on line 41 ......................................................................................................

(58)

00

59.

Plus: 20% (Act No. 40 of 2005) of the amount on line 42 ...................................................................................................................................................................................

(59)

00

60.

Plus: _____% (under special legislation) of the amount on line 43 (enter the applicable percent) ......................................................................................................................

(60)

00

61.

Alternative Tax - Capital gains (Add lines 52 through 60. Enter the total here and transfer to Form 480.10 or 480.20, Part III, line 13 or to the appropriate line of other returns)..

(61)

00

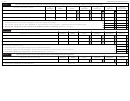

Part IX

Gains (or Losses) from Property Other than Capital Assets

(A)

(B)

(C)

(D)

(E)

(F)

Date

Date

Description and Location of Property

Sale Price

Adjusted Basis

Selling Expenses

Gain or Loss

Acquired

Sold

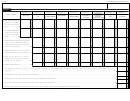

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Net gain (or loss) from property other than capital assets (Enter here and on Form 480.10 or 480.20, Part IV, line 10 or on the appropriate line of other returns) ........................

62.

(62)

00

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4