Form Il-1363 Instructions - Circuit Breaker And Pharmaceutical Assistance - Illinois Department Of Revenue

ADVERTISEMENT

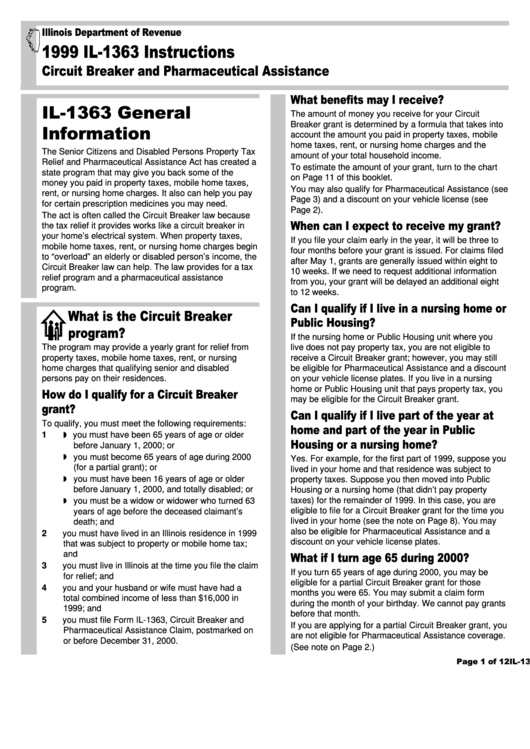

Illinois Department of Revenue

1999 IL-1363 Instructions

Circuit Breaker and Pharmaceutical Assistance

What benefits may I receive?

IL-1363 General

The amount of money you receive for your Circuit

Breaker grant is determined by a formula that takes into

Information

account the amount you paid in property taxes, mobile

home taxes, rent, or nursing home charges and the

The Senior Citizens and Disabled Persons Property Tax

amount of your total household income.

Relief and Pharmaceutical Assistance Act has created a

To estimate the amount of your grant, turn to the chart

state program that may give you back some of the

on Page 11 of this booklet.

money you paid in property taxes, mobile home taxes,

You may also qualify for Pharmaceutical Assistance (see

rent, or nursing home charges. It also can help you pay

Page 3) and a discount on your vehicle license (see

for certain prescription medicines you may need.

Page 2).

The act is often called the Circuit Breaker law because

When can I expect to receive my grant?

the tax relief it provides works like a circuit breaker in

your home’s electrical system. When property taxes,

If you file your claim early in the year, it will be three to

mobile home taxes, rent, or nursing home charges begin

four months before your grant is issued. For claims filed

to “overload” an elderly or disabled person’s income, the

after May 1, grants are generally issued within eight to

Circuit Breaker law can help. The law provides for a tax

10 weeks. If we need to request additional information

relief program and a pharmaceutical assistance

from you, your grant will be delayed an additional eight

program.

to 12 weeks.

Can I qualify if I live in a nursing home or

What is the Circuit Breaker

Public Housing?

program?

If the nursing home or Public Housing unit where you

The program may provide a yearly grant for relief from

live does not pay property tax, you are not eligible to

property taxes, mobile home taxes, rent, or nursing

receive a Circuit Breaker grant; however, you may still

home charges that qualifying senior and disabled

be eligible for Pharmaceutical Assistance and a discount

persons pay on their residences.

on your vehicle license plates. If you live in a nursing

home or Public Housing unit that pays property tax, you

How do I qualify for a Circuit Breaker

may be eligible for the Circuit Breaker grant.

grant?

Can I qualify if I live part of the year at

To qualify, you must meet the following requirements:

home and part of the year in Public

1

you must have been 65 years of age or older

Housing or a nursing home?

before January 1, 2000; or

you must become 65 years of age during 2000

Yes. For example, for the first part of 1999, suppose you

(for a partial grant); or

lived in your home and that residence was subject to

you must have been 16 years of age or older

property taxes. Suppose you then moved into Public

before January 1, 2000, and totally disabled; or

Housing or a nursing home (that didn’t pay property

taxes) for the remainder of 1999. In this case, you are

you must be a widow or widower who turned 63

eligible to file for a Circuit Breaker grant for the time you

years of age before the deceased claimant’s

lived in your home (see the note on Page 8). You may

death; and

also be eligible for Pharmaceutical Assistance and a

2

you must have lived in an Illinois residence in 1999

discount on your vehicle license plates.

that was subject to property or mobile home tax;

and

What if I turn age 65 during 2000?

3

you must live in Illinois at the time you file the claim

If you turn 65 years of age during 2000, you may be

for relief; and

eligible for a partial Circuit Breaker grant for those

4

you and your husband or wife must have had a

months you were 65. You may submit a claim form

total combined income of less than $16,000 in

during the month of your birthday. We cannot pay grants

1999; and

before that month.

5

you must file Form IL-1363, Circuit Breaker and

If you are applying for a partial Circuit Breaker grant, you

Pharmaceutical Assistance Claim, postmarked on

are not eligible for Pharmaceutical Assistance coverage.

or before December 31, 2000.

(See note on Page 2.)

IL-1363 instructions (R-12/99)

Page 1 of 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12

![Form Rpu-50 - Quarter-monthly Payment [gas, Telecommunications, Electric] - Illinois Department Of Revenue Form Rpu-50 - Quarter-monthly Payment [gas, Telecommunications, Electric] - Illinois Department Of Revenue](https://data.formsbank.com/pdf_docs_html/282/2821/282161/page_1_thumb.png)