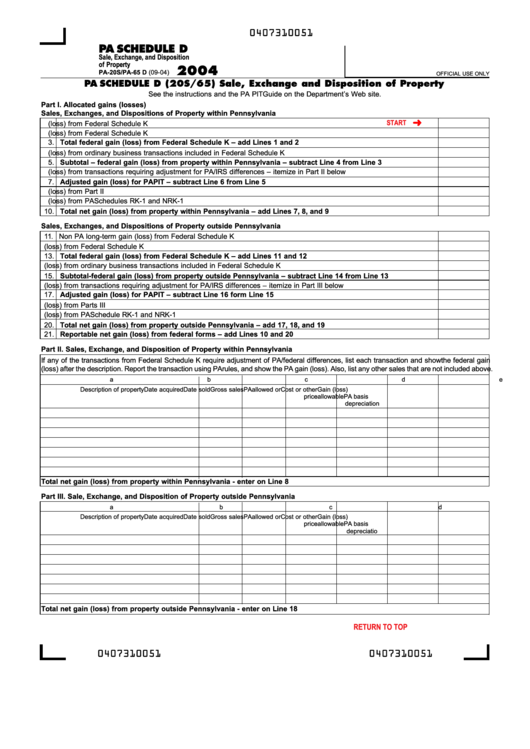

0407310051

PA SCHEDULE D

Sale, Exchange, and Disposition

of Property

2004

PA-20S/PA-65 D (09-04)

OFFICIAL USE ONLY

PA SCHEDULE D (20S/65) Sale, Exchange and Disposition of Property

See the instructions and the PA PIT Guide on the Department’s Web site.

Part I. Allocated gains (losses)

Sales, Exchanges, and Dispositions of Property within Pennsylvania

START

1. PA long-term gain (loss) from Federal Schedule K

2. PA short-term gains (loss) from Federal Schedule K

3. Total federal gain (loss) from Federal Schedule K – add Lines 1 and 2

4. Less gain (loss) from ordinary business transactions included in Federal Schedule K

5. Subtotal – federal gain (loss) from property within Pennsylvania – subtract Line 4 from Line 3

6. Less gain (loss) from transactions requiring adjustment for PA/IRS differences – itemize in Part II below

7. Adjusted gain (loss) for PA PIT – subtract Line 6 from Line 5

8. Adjusted net gain (loss) from Part II

9. Partnership and PA S corporation gain (loss) from PA Schedules RK-1 and NRK-1

10. Total net gain (loss) from property within Pennsylvania – add Lines 7, 8, and 9

Sales, Exchanges, and Dispositions of Property outside Pennsylvania

11. Non PA long-term gain (loss) from Federal Schedule K

12. Non PA short-term gain (loss) from Federal Schedule K

13. Total federal gain (loss) from Federal Schedule K – add Lines 11 and 12

14. Less gain (loss) from ordinary business transactions included in Federal Schedule K

15. Subtotal-federal gain (loss) from property outside Pennsylvania – subtract Line 14 from Line 13

16. Less gain (loss) from transactions requiring adjustment for PA/IRS differences – itemize in Part III below

17. Adjusted gain (loss) for PA PIT – subtract Line 16 form Line 15

18. Adjusted net gain (loss) from Parts III

19. Partnership and PA S corporation gain (loss) from PA Schedule RK-1 and NRK-1

20. Total net gain (loss) from property outside Pennsylvania – add 17, 18, and 19

21. Reportable net gain (loss) from federal forms – add Lines 10 and 20

Part II. Sales, Exchange, and Disposition of Property within Pennsylvania

If any of the transactions from Federal Schedule K require adjustment of PA/federal differences, list each transaction and show the federal gain

(loss) after the description. Report the transaction using PA rules, and show the PA gain (loss). Also, list any other sales that are not included above.

a

b

c

d

e

f

g

Description of property

Date acquired

Date sold

Gross sales

PA allowed or

Cost or other

Gain (loss)

price

allowable

PA basis

depreciation

Total net gain (loss) from property within Pennsylvania - enter on Line 8

Part III. Sale, Exchange, and Disposition of Property outside Pennsylvania

a

b

c

d

e

f

g

Description of property

Date acquired

Date sold

Gross sales

PA allowed or

Cost or other

Gain (loss)

price

allowable

PA basis

depreciatio

Total net gain (loss) from property outside Pennsylvania - enter on Line 18

PRINT FORM

Reset Entire Form

RETURN TO TOP

0407310051

0407310051

1

1