0407610054

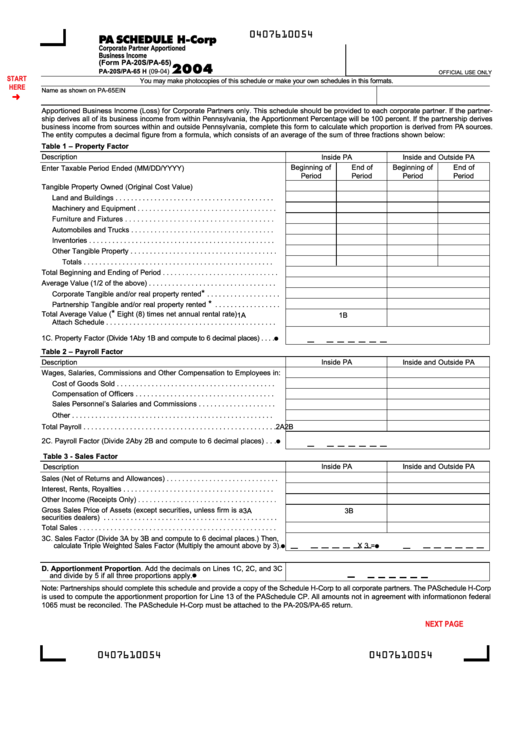

PA SCHEDULE H-Corp

Corporate Partner Apportioned

Business Income

(Form PA-20S/PA-65)

2004

PA-20S/PA-65 H (09-04)

OFFICIAL USE ONLY

START

You may make photocopies of this schedule or make your own schedules in this formats.

HERE

Name as shown on PA-65

EIN

Apportioned Business Income (Loss) for Corporate Partners only. This schedule should be provided to each corporate partner. If the partner-

ship derives all of its business income from within Pennsylvania, the Apportionment Percentage will be 100 percent. If the partnership derives

business income from sources within and outside Pennsylvania, complete this form to calculate which proportion is derived from PA sources.

The entity computes a decimal figure from a formula, which consists of an average of the sum of three fractions shown below:

Table 1 – Property Factor

Description

Inside PA

Inside and Outside PA

Beginning of

End of

Beginning of

End of

Enter Taxable Period Ended (MM/DD/YYYY)

Period

Period

Period

Period

Tangible Property Owned (Original Cost Value)

Land and Buildings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Machinery and Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Furniture and Fixtures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Automobiles and Trucks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Tangible Property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Beginning and Ending of Period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Average Value (1/2 of the above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

*

Corporate Tangible and/or real property rented

. . . . . . . . . . . . . . . . . . .

*

Partnership Tangible and/or real property rented

. . . . . . . . . . . . . . . . .

*

Total Average Value (

Eight (8) times net annual rental rate)

1A

1B

Attach Schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1C. Property Factor (Divide 1A by 1B and compute to 6 decimal places) . . . .

●

Table 2 – Payroll Factor

Inside PA

Description

Inside and Outside PA

Wages, Salaries, Commissions and Other Compensation to Employees in:

Cost of Goods Sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Compensation of Officers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Sales Personnel’s Salaries and Commissions . . . . . . . . . . . . . . . . . . . .

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2A

2B

2C. Payroll Factor (Divide 2A by 2B and compute to 6 decimal places) . . .

●

Table 3 - Sales Factor

Description

Inside PA

Inside and Outside PA

Sales (Net of Returns and Allowances) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest, Rents, Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Income (Receipts Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

Gross Sales Price of Assets (except securities

unless firm is a

3A

3B

securities dealers) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3C. Sales Factor (Divide 3A by 3B and compute to 6 decimal places.) Then,

calculate Triple Weighted Sales Factor (Multiply the amount above by 3).

●

X 3 =

●

D. Apportionment Proportion. Add the decimals on Lines 1C, 2C, and 3C

●

and divide by 5 if all three proportions apply.

Note: Partnerships should complete this schedule and provide a copy of the Schedule H-Corp to all corporate partners. The PA Schedule H-Corp

is used to compute the apportionment proportion for Line 13 of the PA Schedule CP. All amounts not in agreement with information on federal

1065 must be reconciled. The PA Schedule H-Corp must be attached to the PA-20S/PA-65 return.

PRINT FORM

Reset Entire Form

NEXT PAGE

0407610054

0407610054

1

1