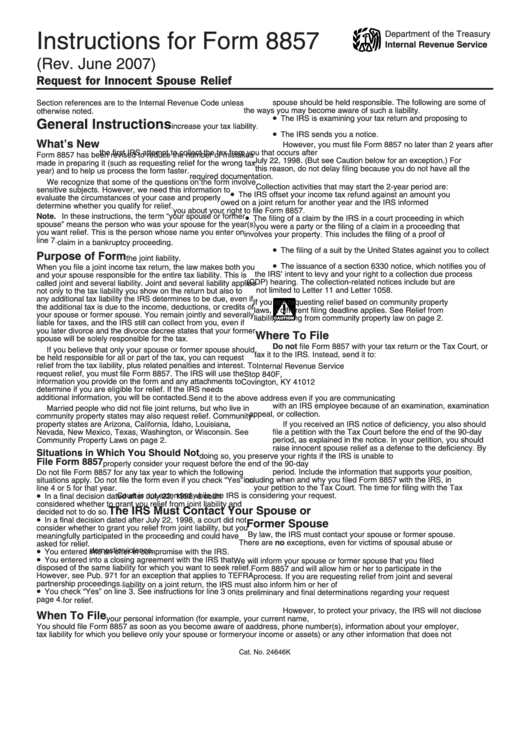

Instructions For Form 8857 (Rev. June 2007)

ADVERTISEMENT

Department of the Treasury

Instructions for Form 8857

Internal Revenue Service

(Rev. June 2007)

Request for Innocent Spouse Relief

spouse should be held responsible. The following are some of

Section references are to the Internal Revenue Code unless

the ways you may become aware of such a liability.

otherwise noted.

•

The IRS is examining your tax return and proposing to

General Instructions

increase your tax liability.

•

The IRS sends you a notice.

What’s New

However, you must file Form 8857 no later than 2 years after

the first IRS attempt to collect the tax from you that occurs after

Form 8857 has been revised to reduce the number of mistakes

July 22, 1998. (But see Caution below for an exception.) For

made in preparing it (such as requesting relief for the wrong tax

this reason, do not delay filing because you do not have all the

year) and to help us process the form faster.

required documentation.

We recognize that some of the questions on the form involve

Collection activities that may start the 2-year period are:

sensitive subjects. However, we need this information to

•

The IRS offset your income tax refund against an amount you

evaluate the circumstances of your case and properly

owed on a joint return for another year and the IRS informed

determine whether you qualify for relief.

you about your right to file Form 8857.

•

Note. In these instructions, the term “your spouse or former

The filing of a claim by the IRS in a court proceeding in which

spouse” means the person who was your spouse for the year(s)

you were a party or the filing of a claim in a proceeding that

you want relief. This is the person whose name you enter on

involves your property. This includes the filing of a proof of

line 7.

claim in a bankruptcy proceeding.

•

The filing of a suit by the United States against you to collect

Purpose of Form

the joint liability.

•

The issuance of a section 6330 notice, which notifies you of

When you file a joint income tax return, the law makes both you

the IRS’ intent to levy and your right to a collection due process

and your spouse responsible for the entire tax liability. This is

(CDP) hearing. The collection-related notices include but are

called joint and several liability. Joint and several liability applies

not limited to Letter 11 and Letter 1058.

not only to the tax liability you show on the return but also to

any additional tax liability the IRS determines to be due, even if

If you are requesting relief based on community property

the additional tax is due to the income, deductions, or credits of

!

laws, a different filing deadline applies. See Relief from

your spouse or former spouse. You remain jointly and severally

liability arising from community property law on page 2.

CAUTION

liable for taxes, and the IRS still can collect from you, even if

you later divorce and the divorce decree states that your former

Where To File

spouse will be solely responsible for the tax.

Do not file Form 8857 with your tax return or the Tax Court, or

If you believe that only your spouse or former spouse should

fax it to the IRS. Instead, send it to:

be held responsible for all or part of the tax, you can request

relief from the tax liability, plus related penalties and interest. To

Internal Revenue Service

request relief, you must file Form 8857. The IRS will use the

Stop 840F, P.O. Box 120053

information you provide on the form and any attachments to

Covington, KY 41012

determine if you are eligible for relief. If the IRS needs

additional information, you will be contacted.

Send it to the above address even if you are communicating

with an IRS employee because of an examination, examination

Married people who did not file joint returns, but who live in

appeal, or collection.

community property states may also request relief. Community

property states are Arizona, California, Idaho, Louisiana,

If you received an IRS notice of deficiency, you also should

Nevada, New Mexico, Texas, Washington, or Wisconsin. See

file a petition with the Tax Court before the end of the 90-day

Community Property Laws on page 2.

period, as explained in the notice. In your petition, you should

raise innocent spouse relief as a defense to the deficiency. By

Situations in Which You Should Not

doing so, you preserve your rights if the IRS is unable to

File Form 8857

properly consider your request before the end of the 90-day

period. Include the information that supports your position,

Do not file Form 8857 for any tax year to which the following

including when and why you filed Form 8857 with the IRS, in

situations apply. Do not file the form even if you check “Yes” on

your petition to the Tax Court. The time for filing with the Tax

line 4 or 5 for that year.

•

Court is not extended while the IRS is considering your request.

In a final decision dated after July 22, 1998, a court

considered whether to grant you relief from joint liability and

The IRS Must Contact Your Spouse or

decided not to do so.

•

In a final decision dated after July 22, 1998, a court did not

Former Spouse

consider whether to grant you relief from joint liability, but you

By law, the IRS must contact your spouse or former spouse.

meaningfully participated in the proceeding and could have

There are no exceptions, even for victims of spousal abuse or

asked for relief.

•

domestic violence.

You entered into an offer in compromise with the IRS.

•

You entered into a closing agreement with the IRS that

We will inform your spouse or former spouse that you filed

disposed of the same liability for which you want to seek relief.

Form 8857 and will allow him or her to participate in the

However, see Pub. 971 for an exception that applies to TEFRA

process. If you are requesting relief from joint and several

partnership proceedings.

liability on a joint return, the IRS must also inform him or her of

•

You check “Yes” on line 3. See instructions for line 3 on

its preliminary and final determinations regarding your request

page 4.

for relief.

However, to protect your privacy, the IRS will not disclose

When To File

your personal information (for example, your current name,

You should file Form 8857 as soon as you become aware of a

address, phone number(s), information about your employer,

tax liability for which you believe only your spouse or former

your income or assets) or any other information that does not

Cat. No. 24646K

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4