Form Rp-467-D - Instructions - State Of New York

ADVERTISEMENT

RP-467-d (1/99)

INSTRUCTIONS

1.

Authorization for exemption

Section 467-d of the Real Property Law authorizes the Town of Cortlandt, Westchester

County, to adopt a local law authorizing a partial exemption from town taxes and special ad

valorem levies equal to the increase in value to residential property as the result of the

construction or reconstruction of dwelling space for persons who are at least 65 years of age or

who are disabled and receiving social security disability payments. In addition, (1) the towns

zoning must permit such construction, (2)the construction must be within the geographic area

where such construction is permitted, (3) construction or reconstruction of the living quarters

must have occurred subsequent to January 1,1999 and (4) the property must be the ownerÕs

principal residence.

2.

Duration and computation

The exemption is limited to the lesser of (1) the increase in the assessed value

attributable to the new dwelling space, (2) twenty {20} percent of the total assessed value of the

property, or (3) [20] percent of the median sale price of residential property in the county. In

addition, if the senior citizen or disabled resident changes his or her legal residence, the

exemption ends.

3.

Filing of application

Application for the exemption or for the renewal of the exemption must be filed

annually with the Town of Cortlandt Assessor on or before the June 1 taxable status date.

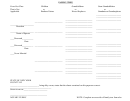

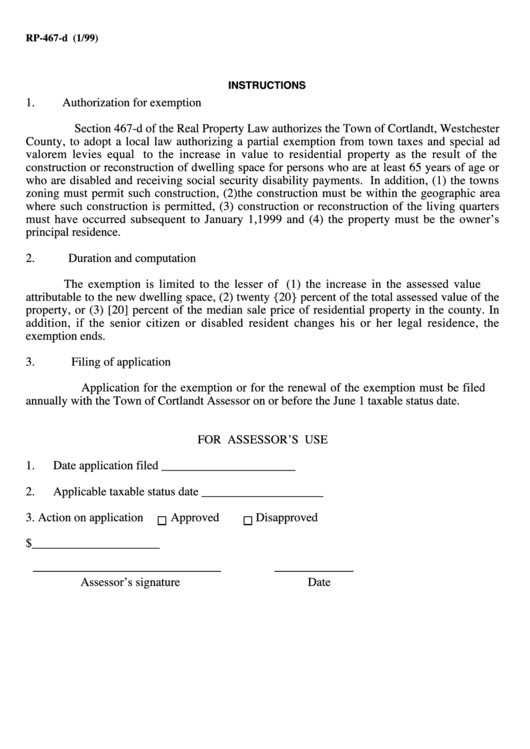

FOR ASSESSORÕS USE

1.

Date application filed ______________________

2.

Applicable taxable status date ____________________

3. Action on application

Approved

Disapproved

4.Exempt assessed value $_____________________

AssessorÕs signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1