Failure to enclose this schedule

Print

Clear

will delay the processing of your

return.

SOCIAL SECURITY NUMBER

FIRST NAME

M.I.

LAST NAME

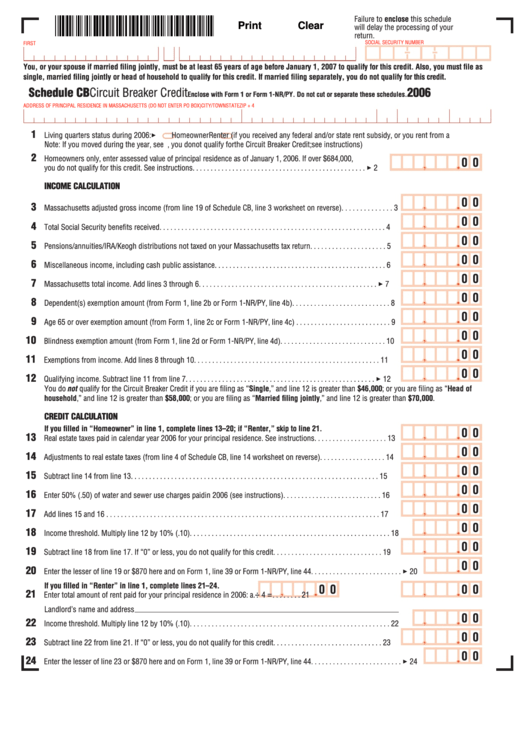

You, or your spouse if married filing jointly, must be at least 65 years of age before January 1, 2007 to qualify for this credit. Also, you must file as

single, married filing jointly or head of household to qualify for this credit. If married filing separately, you do not qualify for this credit.

Schedule CB Circuit Breaker Credit

2006

Enclose with Form 1 or Form 1-NR/PY. Do not cut or separate these schedules.

ADDRESS OF PRINCIPAL RESIDENCE IN MASSACHUSETTS (DO NOT ENTER PO BOX)

CITY/TOWN

STATE

ZIP + 4

1

Living quarters status during 2006: 3

Homeowner

Renter (if you received any federal and/or state rent subsidy, or you rent from a

Note: If you moved during the year, see reverse.

tax-exempt entity, you do not qualify for the Circuit Breaker Credit; see instructions)

2

Homeowners only, enter assessed value of principal residence as of January 1, 2006. If over $684,000,

0 0

you do not qualify for this credit. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

INCOME CALCULATION

0 0

3

Massachusetts adjusted gross income (from line 19 of Schedule CB, line 3 worksheet on reverse) . . . . . . . . . . . . . . 3

0 0

4

Total Social Security benefits received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

0 0

5

Pensions/annuities/IRA/Keogh distributions not taxed on your Massachusetts tax return . . . . . . . . . . . . . . . . . . . . . 5

0 0

6

Miscellaneous income, including cash public assistance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

0 0

7

Massachusetts total income. Add lines 3 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

0 0

8

Dependent(s) exemption amount (from Form 1, line 2b or Form 1-NR/PY, line 4b) . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

0 0

9

Age 65 or over exemption amount (from Form 1, line 2c or Form 1-NR/PY, line 4c) . . . . . . . . . . . . . . . . . . . . . . . . . . 9

0 0

10

Blindness exemption amount (from Form 1, line 2d or Form 1-NR/PY, line 4d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

0 0

11

Exemptions from income. Add lines 8 through 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

0 0

12

Qualifying income. Subtract line 11 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

You do not qualify for the Circuit Breaker Credit if you are filing as “Single,” and line 12 is greater than $46,000; or you are filing as “Head of

household,” and line 12 is greater than $58,000; or you are filing as “Married filing jointly,” and line 12 is greater than $70,000.

CREDIT CALCULATION

If you filled in “Homeowner” in line 1, complete lines 13–20; if “Renter,” skip to line 21.

0 0

13

Real estate taxes paid in calendar year 2006 for your principal residence. See instructions. . . . . . . . . . . . . . . . . . . . 13

0 0

14

Adjustments to real estate taxes (from line 4 of Schedule CB, line 14 worksheet on reverse) . . . . . . . . . . . . . . . . . . 14

0 0

15

Subtract line 14 from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

0 0

16

Enter 50% (.50) of water and sewer use charges paid in 2006 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

0 0

17

Add lines 15 and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

0 0

18

Income threshold. Multiply line 12 by 10% (.10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

0 0

19

Subtract line 18 from line 17. If “0” or less, you do not qualify for this credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

0 0

20

Enter the lesser of line 19 or $870 here and on Form 1, line 39 or Form 1-NR/PY, line 44. . . . . . . . . . . . . . . . . . . . . . . . . 3 20

If you filled in “Renter” in line 1, complete lines 21–24.

0 0

0 0

21

÷

=

Enter total amount of rent paid for your principal residence in 2006: a.

4

. . . . . . . . 21

Landlord’s name and address

0 0

22

Income threshold. Multiply line 12 by 10% (.10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

0 0

23

Subtract line 22 from line 21. If “0” or less, you do not qualify for this credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

0 0

24

Enter the lesser of line 23 or $870 here and on Form 1, line 39 or Form 1-NR/PY, line 44. . . . . . . . . . . . . . . . . . . . . . . . . 3 24

1

1