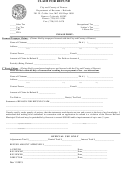

Form Pet 354 - Specialized Equipment Claim For Refund - Tennessee Department Of Revenue Page 2

ADVERTISEMENT

For additional information, contact the Taxpayer Services Division in one of our Department of Revenue Offices:

Jackson

Johnson City

Knoxville

Memphis

Nashville

Chattanooga

(731) 423-5747

(423) 854-5321

(901) 213-1400

(615) 253-0600

(423) 634-6266

(865) 594-6100

3150 Appling Road

Andrew Jackson Building

Suite 203

Suite 340

204 High Point Drive

Suite 209

Bartlett, TN

500 Deaderick Street

1301 Riverfront

Lowell Thomas Building

7175 Strawberry

Parkway

225 Martin Luther King Blvd.

Plains Pike

Tennessee residents can also call our statewide toll free number at 1-800-342-1003.

Out-of-state callers must dial (615) 253-0600.

INSTRUCTIONS

Please follow instructions carefully. Incomplete or improperly completed claims will be returned without action. This could result in

denial of claim. These instructions correspond to line numbers as they appear on the reverse side of this form.

Please sign your claim in the appropriate space and attach all supporting documentation to the claim. Documentation should include

such items as inventories, withdrawal summaries, equipment references, invoices, suppliers name, etc. Mail this claim to the Tennessee

Department of Revenue, Andrew Jackson Building, 500 Deaderick Street, Nashville, Tennessee 37242.

Claim Period: January -June; filing period ninety (90) days following end of June.

Claim period: July-December; filing period ninety (90) days following end of December.

The minimum amount of refund payable is $50.00.

Line 1

Name and mailing address. Enter your complete name and mailing address.

Line 2

Account Number. Enter your account number.

Line 3

Amount Claimed. Enter the total amount claimed after completing the remaining sections of this claim.

Line 4

Date of Claim and Semi-Annual Period Ending. Enter the date that you complete and file this claim. Also, enter the semi-

annual period for which claim is filed.

Line 5

Total gallons from tax-paid bulk storage. Enter in the appropriate column the total fuel you withdrew from your tax-paid bulk

storage for use in approved equipment.

Line 6

Total gallons purchased from service stations. Enter in the appropriate column the total fuel you purchased from retail

service centers for use in approved equipment.

Line 7

Total Gallons. Add the total of lines 5 and 6 and enter in the space provided.

Line 8

Diesel Refund. If you are using diesel, enter the gallons consumed or the number of unloadings, in appropriate spaces

according to equipment type and permit prefix (reference Line 2). Make computations according to formulas listed and extend

to money column. Enter total of column on Total Amount Claimed.

Line 9

Gasoline Refund. If you are using gasoline, refer to instructions found on Line 8, and complete the gasoline refund section.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2