Form Rpd- 41071 - Application For Refund - 2015

ADVERTISEMENT

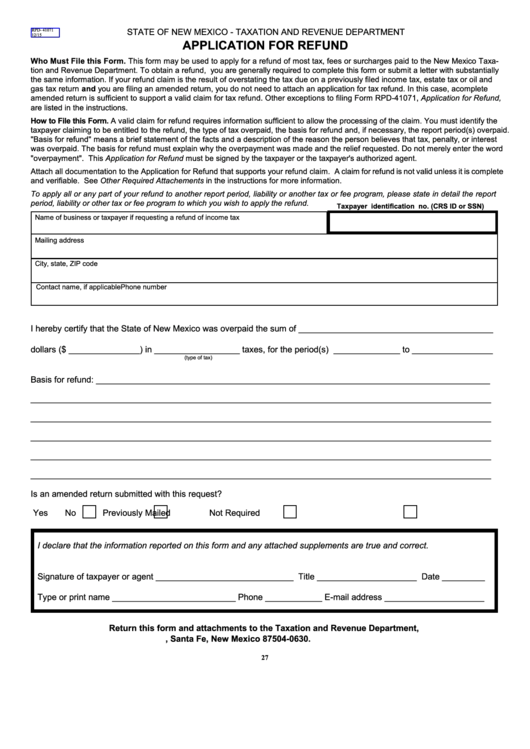

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

RPD- 41071

12/15

APPLICATION FOR REFUND

Who Must File this Form. This form may be used to apply for a refund of most tax, fees or surcharges paid to the New Mexico Taxa-

tion and Revenue Department. To obtain a refund, you are generally required to complete this form or submit a letter with substantially

the same information. If your refund claim is the result of overstating the tax due on a previously filed income tax, estate tax or oil and

gas tax return and you are filing an amended return, you do not need to attach an application for tax refund. In this case, a complete

amended return is sufficient to support a valid claim for tax refund. Other exceptions to filing Form RPD-41071, Application for Refund,

are listed in the instructions.

How to File this Form. A valid claim for refund requires information sufficient to allow the processing of the claim. You must identify the

taxpayer claiming to be entitled to the refund, the type of tax overpaid, the basis for refund and, if necessary, the report period(s) overpaid.

"Basis for refund" means a brief statement of the facts and a description of the reason the person believes that tax, penalty, or interest

was overpaid. The basis for refund must explain why the overpayment was made and the relief requested. Do not merely enter the word

"overpayment". This Application for Refund must be signed by the taxpayer or the taxpayer's authorized agent.

Attach all documentation to the Application for Refund that supports your refund claim. A claim for refund is not valid unless it is complete

and verifiable. See Other Required Attachements in the instructions for more information.

To apply all or any part of your refund to another report period, liability or another tax or fee program, please state in detail the report

period, liability or other tax or fee program to which you wish to apply the refund.

Taxpayer identification no. (CRS ID or SSN)

Name of business or taxpayer if requesting a refund of income tax

Mailing address

City, state, ZIP code

Contact name, if applicable

Phone number

I hereby certify that the State of New Mexico was overpaid the sum of _________________________________________

dollars ($ _______________) in __________________ taxes, for the period(s) ______________ to _________________

(type of tax)

Basis for refund: ___________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Is an amended return submitted with this request?

Yes

No

Previously Mailed

Not Required

I declare that the information reported on this form and any attached supplements are true and correct.

Signature of taxpayer or agent _____________________________ Title _____________________ Date _________

Type or print name __________________________ Phone ____________ E-mail address _____________________

Return this form and attachments to the Taxation and Revenue Department,

P.O. Box 630, Santa Fe, New Mexico 87504-0630.

27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2