Emergency And Municipal Services Tax / Occupation Privilege Tax Claim For Refund Form

ADVERTISEMENT

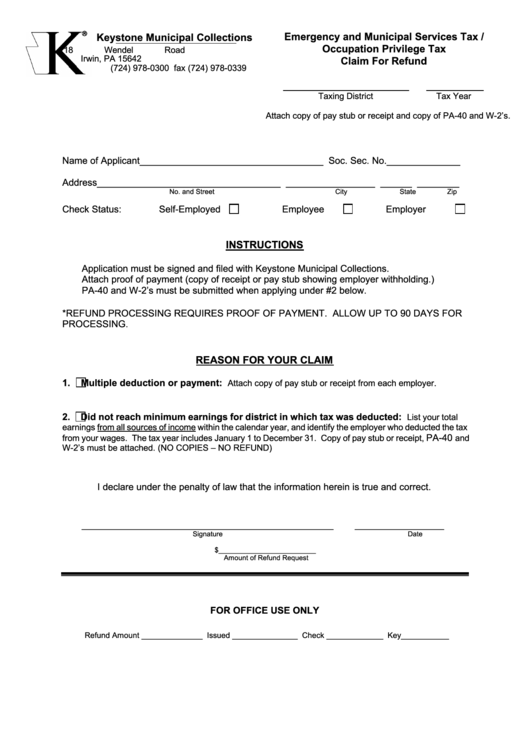

Emergency and Municipal Services Tax /

Keystone Municipal Collections

Occupation Privilege Tax

118 Wendel Road

Irwin, PA 15642

Claim For Refund

(724) 978-0300 fax (724) 978-0339

______________________

__________

Taxing District

Tax Year

Attach copy of pay stub or receipt and copy of PA-40 and W-2’s.

Name of Applicant___________________________________ Soc. Sec. No.______________

Address___________________________________ _________________ ______ ________

No. and Street

City

State

Zip

Check Status:

Self-Employed

Employee

Employer

INSTRUCTIONS

Application must be signed and filed with Keystone Municipal Collections.

Attach proof of payment (copy of receipt or pay stub showing employer withholding.)

PA-40 and W-2’s must be submitted when applying under #2 below.

*REFUND PROCESSING REQUIRES PROOF OF PAYMENT. ALLOW UP TO 90 DAYS FOR

PROCESSING.

REASON FOR YOUR CLAIM

1.

Multiple deduction or payment:

Attach copy of pay stub or receipt from each employer.

2.

Did not reach minimum earnings for district in which tax was deducted:

List your total

earnings from all sources of income within the calendar year, and identify the employer who deducted the tax

PA-40

from your wages. The tax year includes January 1 to December 31. Copy of pay stub or receipt,

and

W-2’s must be attached. (NO COPIES – NO REFUND)

I declare under the penalty of law that the information herein is true and correct.

________________________________________________

_________________

Signature

Date

$_________________________

Amount of Refund Request

FOR OFFICE USE ONLY

Refund Amount ______________ Issued _______________ Check _____________ Key___________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1