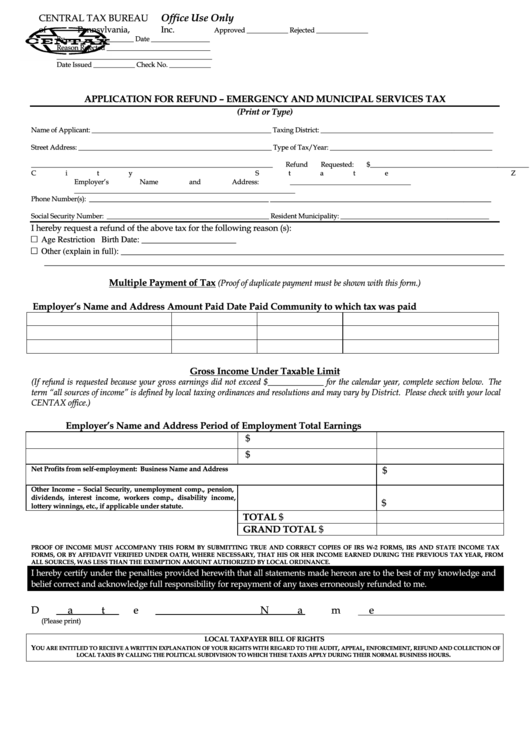

Application For Refund - Emergency And Municipal Services Tax Form

ADVERTISEMENT

Office Use Only

CENTRAL TAX BUREAU

of Pennsylvania, Inc.

Approved ____________ Rejected _______________

By____________________ Date _________________

Reason Rejected ______________________________

_____________________________________________

Date Issued ____________ Check No. ____________

APPLICATION FOR REFUND – EMERGENCY AND MUNICIPAL SERVICES TAX

(Print or Type)

Name of Applicant: ____________________________________________________

Taxing District: __________________________________________________

Street Address: ________________________________________________________

Type of Tax/Year: _______________________________________________

______________________________________________________________________

Refund Requested: $______________________________________________

City

State

Zip

Employer’s Name and Address: ___________________________________

________________________________________________________________

Phone Number(s): ____________________________________________________

________________________________________________________________

Social Security Number: _______________________________________________

Resident Municipality: ___________________________________________

I hereby request a refund of the above tax for the following reason (s):

□

Age Restriction

Birth Date: ______________________

□

Other (explain in full): _________________________________________________________________________________________

___________________________________________________________________________________________________________

Multiple Payment of Tax

(Proof of duplicate payment must be shown with this form.)

Employer’s Name and Address

Amount Paid

Date Paid

Community to which tax was paid

Gross Income Under Taxable Limit

(If refund is requested because your gross earnings did not exceed $_____________ for the calendar year, complete section below. The

term “all sources of income” is defined by local taxing ordinances and resolutions and may vary by District. Please check with your local

CENTAX office.)

Employer’s Name and Address

Period of Employment

Total Earnings

$

$

Net Profits from self-employment: Business Name and Address

$

Other Income – Social Security, unemployment comp., pension,

dividends, interest income, workers comp., disability income,

$

lottery winnings, etc., if applicable under statute.

TOTAL

$

GRAND TOTAL

$

PROOF OF INCOME MUST ACCOMPANY THIS FORM BY SUBMITTING TRUE AND CORRECT COPIES OF IRS W-2 FORMS, IRS AND STATE INCOME TAX

FORMS, OR BY AFFIDAVIT VERIFIED UNDER OATH, WHERE NECESSARY, THAT HIS OR HER INCOME EARNED DURING THE PREVIOUS TAX YEAR, FROM

ALL SOURCES, WAS LESS THAN THE EXEMPTION AMOUNT AUTHORIZED BY LOCAL ORDINANCE.

I hereby certify under the penalties provided herewith that all statements made hereon are to the best of my knowledge and

belief correct and acknowledge full responsibility for repayment of any taxes erroneously refunded to me.

Date

Name

Signature

(Please print)

LOCAL TAXPAYER BILL OF RIGHTS

Y

,

,

,

OU ARE ENTITLED TO RECEIVE A WRITTEN EXPLANATION OF YOUR RIGHTS WITH REGARD TO THE AUDIT

APPEAL

ENFORCEMENT

REFUND AND COLLECTION OF

.

LOCAL TAXES BY CALLING THE POLITICAL SUBDIVISION TO WHICH THESE TAXES APPLY DURING THEIR NORMAL BUSINESS HOURS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1