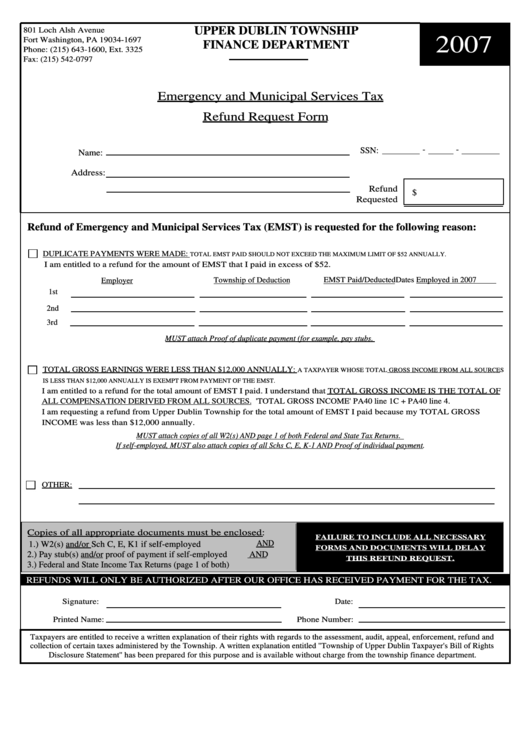

UPPER DUBLIN TOWNSHIP

801 Loch Alsh Avenue

2007

Fort Washington, PA 19034-1697

FINANCE DEPARTMENT

Phone: (215) 643-1600, Ext. 3325

Fax: (215) 542-0797

Emergency and Municipal Services Tax

Refund Request Form

-

-

SSN:

Name:

Address:

Refund

$

Requested

Refund of Emergency and Municipal Services Tax (EMST) is requested for the following reason:

DUPLICATE PAYMENTS WERE MADE:

TOTAL EMST PAID SHOULD NOT EXCEED THE MAXIMUM LIMIT OF $52 ANNUALLY.

I am entitled to a refund for the amount of EMST that I paid in excess of $52.

Township of Deduction

EMST Paid/Deducted

Dates Employed in 2007

Employer

1st

2nd

3rd

MUST attach Proof of duplicate payment (for example, pay stubs.

TOTAL GROSS EARNINGS WERE LESS THAN $12,000 ANNUALLY:

A TAXPAYER WHOSE TOTAL GROSS INCOME FROM ALL SOURCES

IS LESS THAN $12,000 ANNUALLY IS EXEMPT FROM PAYMENT OF THE EMST.

I am entitled to a refund for the total amount of EMST I paid. I understand that TOTAL GROSS INCOME IS THE TOTAL OF

ALL COMPENSATION DERIVED FROM ALL SOURCES. 'TOTAL GROSS INCOME' PA40 line 1C + PA40 line 4.

- -

I am requesting a refund from Upper Dublin Township for the total amount of EMST I paid because my TOTAL GROSS

INCOME was less than $12,000 annually.

MUST attach copies of all W2(s) AND page 1 of both Federal and State Tax Returns.

If self-employed, MUST also attach copies of all Schs C, E, K-1 AND Proof of individual payment.

OTHER:

Copies of all appropriate documents must be enclosed:

FAILURE TO INCLUDE ALL NECESSARY

AND

1.) W2(s) and/or Sch C, E, K1 if self-employed

FORMS AND DOCUMENTS WILL DELAY

2.) Pay stub(s) and/or proof of payment if self-employed

AND

THIS REFUND REQUEST.

3.) Federal and State Income Tax Returns (page 1 of both)

REFUNDS WILL ONLY BE AUTHORIZED AFTER OUR OFFICE HAS RECEIVED PAYMENT FOR THE TAX.

Signature:

Date:

Printed Name:

Phone Number:

Taxpayers are entitled to receive a written explanation of their rights with regards to the assessment, audit, appeal, enforcement, refund and

collection of certain taxes administered by the Township. A written explanation entitled ''Township of Upper Dublin Taxpayer's Bill of Rights

Disclosure Statement'' has been prepared for this purpose and is available without charge from the township finance department.

1

1