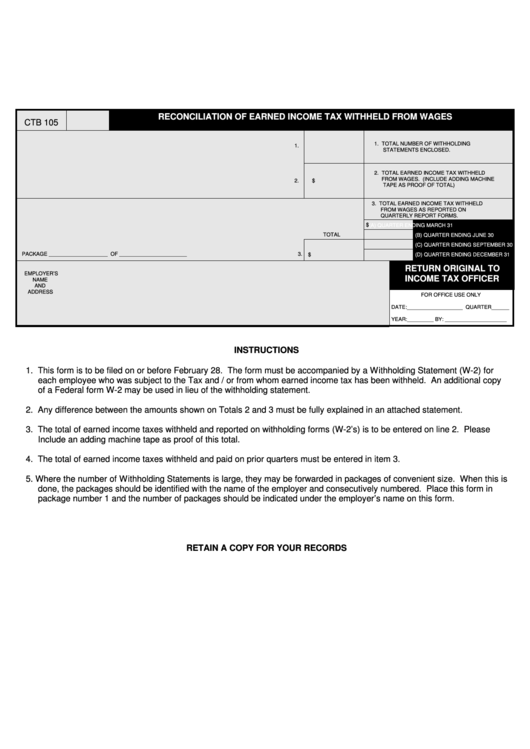

Form Ctb 105 - Reconciliation Of Earned Income Tax Withheld From Wages

ADVERTISEMENT

RECONCILIATION OF EARNED INCOME TAX WITHHELD FROM WAGES

CTB 105

1. TOTAL NUMBER OF WITHHOLDING

1.

STATEMENTS ENCLOSED.

2. TOTAL EARNED INCOME TAX WITHHELD

FROM WAGES. (INCLUDE ADDING MACHINE

2.

$

TAPE AS PROOF OF TOTAL)

3. TOTAL EARNED INCOME TAX WITHHELD

FROM WAGES AS REPORTED ON

QUARTERLY REPORT FORMS.

$

(A) QUARTER ENDING MARCH 31

TOTAL

(B) QUARTER ENDING JUNE 30

(C) QUARTER ENDING SEPTEMBER 30

PACKAGE ____________________ OF _______________________

3.

$

(D) QUARTER ENDING DECEMBER 31

RETURN ORIGINAL TO

EMPLOYER’S

INCOME TAX OFFICER

NAME

AND

ADDRESS

FOR OFFICE USE ONLY

DATE:___________________ QUARTER______

YEAR:_________ BY: _____________________

INSTRUCTIONS

1. This form is to be filed on or before February 28. The form must be accompanied by a Withholding Statement (W-2) for

each employee who was subject to the Tax and / or from whom earned income tax has been withheld. An additional copy

of a Federal form W-2 may be used in lieu of the withholding statement.

2. Any difference between the amounts shown on Totals 2 and 3 must be fully explained in an attached statement.

3. The total of earned income taxes withheld and reported on withholding forms (W-2’s) is to be entered on line 2. Please

Include an adding machine tape as proof of this total.

4. The total of earned income taxes withheld and paid on prior quarters must be entered in item 3.

5. Where the number of Withholding Statements is large, they may be forwarded in packages of convenient size. When this is

done, the packages should be identified with the name of the employer and consecutively numbered. Place this form in

package number 1 and the number of packages should be indicated under the employer’s name on this form.

RETAIN A COPY FOR YOUR RECORDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1