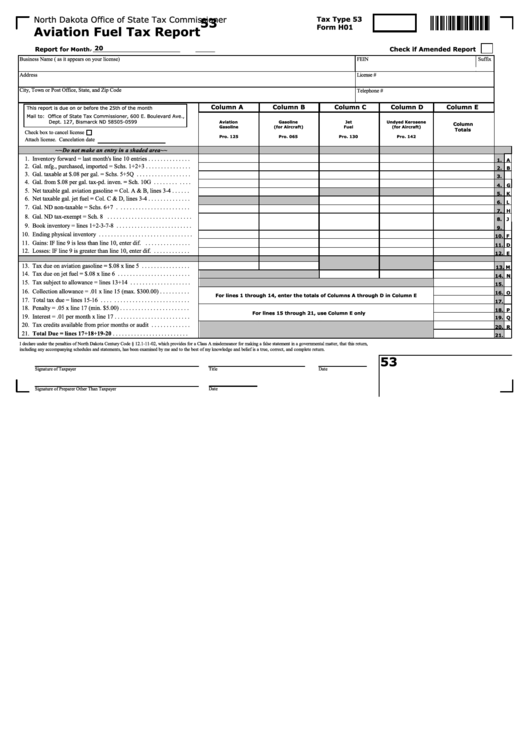

North Dakota Office of State Tax Commissioner

Tax Type 53

53

Form H01

Aviation Fuel Tax Report

, 20

Check if Amended Report

Report f

or Month

Business Name ( as it appears on your license)

FEIN

Suffix

Address

License #

City, Town or Post Office, State, and Zip Code

Telephone #

Column A

Column B

Column C

Column D

Column E

This report is due on or before the 25th of the month

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Ave.,

Dept. 127, Bismarck ND 58505-0599

Aviation

Gasoline

Jet

Undyed Kerosene

Column

Gasoline

(for Aircraft)

Fuel

(for Aircraft)

Totals

Check box to cancel license

Pro. 125

Pro. 065

Pro. 130

Pro. 142

Attach license. Cancelation date

~~Do not make an entry in a shaded area~~

1. Inventory forward = last month's line 10 entries . . . . . . . . . . . . . .

1. A

2. Gal. mfg., purchased, imported = Schs. 1+2+3 . . . . . . . . . . . . . . .

2. B

3. Gal. taxable at $.08 per gal. = Schs. 5+5Q . . . . . . . . . . . . . . . . . .

3.

4. Gal. from $.08 per gal. tax-pd. inven. = Sch. 10G . . . . . . . . . . . .

4. G

5. Net taxable gal. aviation gasoline = Col. A & B, lines 3-4 . . . . . .

5. K

6. Net taxable gal. jet fuel = Col. C & D, lines 3-4 . . . . . . . . . . . . . .

6. L

7. Gal. ND non-taxable = Schs. 6+7 . . . . . . . . . . . . . . . . . . . . . . . .

7. H

8. Gal. ND tax-exempt = Sch. 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. J

9. Book inventory = lines 1+2-3-7-8 . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Ending physical inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. F

11. Gains: IF line 9 is less than line 10, enter dif. . . . . . . . . . . . . . . .

11. D

12. Losses: IF line 9 is greater than line 10, enter dif. . . . . . . . . . . . .

12. E

13. Tax due on aviation gasoline = $.08 x line 5 . . . . . . . . . . . . . . . .

13. M

14. Tax due on jet fuel = $.08 x line 6 . . . . . . . . . . . . . . . . . . . . . . . .

14. N

15. Tax subject to allowance = lines 13+14 . . . . . . . . . . . . . . . . . . . .

15.

16. Collection allowance = .01 x line 15 (max. $300.00) . . . . . . . . . .

16. O

For lines 1 through 14, enter the totals of Columns A through D in Column E

17. Total tax due = lines 15-16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

18. Penalty = .05 x line 17 (min. $5.00) . . . . . . . . . . . . . . . . . . . . . . .

18. P

For lines 15 through 21, use Column E only

19. Interest = .01 per month x line 17 . . . . . . . . . . . . . . . . . . . . . . . . .

19. Q

20. Tax credits available from prior months or audit . . . . . . . . . . . . .

20. R

21. Total Due = lines 17+18+19-20 . . . . . . . . . . . . . . . . . . . . . . . . .

21.

I declare under the penalties of North Dakota Century Code § 12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a governmental matter, that this return,

including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

53

Signature of Taxpayer

Title

Date

Date

Signature of Preparer Other Than Taxpayer

1

1