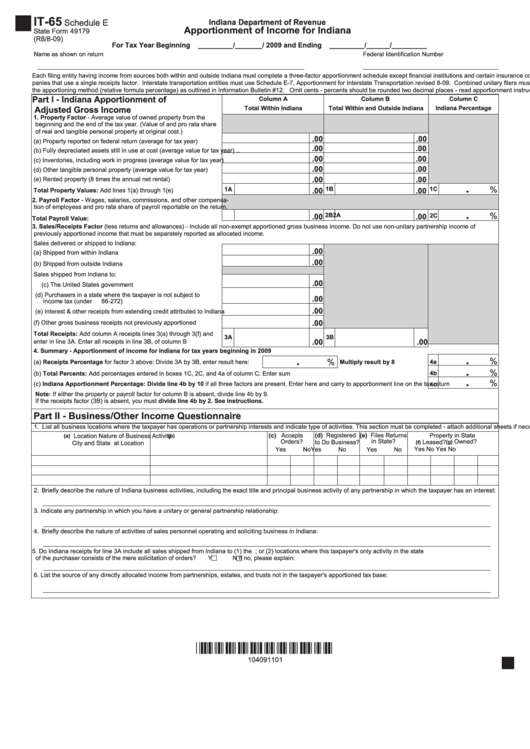

IT-65

Schedule E

Indiana Department of Revenue

Apportionment of Income for Indiana

State Form 49179

(R8/8-09)

For Tax Year Beginning

_________/_______/ 2009 and Ending

_________/______/_________

Name as shown on return

Federal Identification Number

Each filing entity having income from sources both within and outside Indiana must complete a three-factor apportionment schedule except financial institutions and certain insurance com-

panies that use a single receipts factor. Interstate transportation entities must use Schedule E-7, Apportionment for Interstate Transportation revised 8-09. Combined unitary filers must use

the apportioning method (relative formula percentage) as outlined in Information Bulletin #12. Omit cents - percents should be rounded two decimal places - read apportionment instructions.

Part I - Indiana Apportionment of

Column A

Column C

Column B

Total Within Indiana

Indiana Percentage

Adjusted Gross Income

Total Within and Outside Indiana

1. Property Factor - Average value of owned property from the

beginning and the end of the tax year. (Value of and pro rata share

of real and tangible personal property at original cost.)

.00

.00

(a) Property reported on federal return (average for tax year) .......................

.00

.00

(b) Fully depreciated assets still in use at cost (average value for tax year) ..

.00

.00

(c) Inventories, including work in progress (average value for tax year) .......

.00

.00

(d) Other tangible personal property (average value for tax year) .................

.00

.00

(e) Rented property (8 times the annual net rental) ....................................

.

%

1A

1B

1C

.00

.00

Total Property Values: Add lines 1(a) through 1(e) .............................

2. Payroll Factor - Wages, salaries, commissions, and other compensa-

tion of employess and pro rata share of payroll reportable on the return.

.

%

2A

.00

2B

.00

2C

Total Payroll Value: .............................................................................

3. Sales/Receipts Factor (less returns and allowances) - Include all non-exempt apportioned gross business income. Do not use non-unitary partnership income of

previously apportioned income that must be separately reported as allocated income.

Sales delivered or shipped to Indiana:

.00

(a) Shipped from within Indiana ........................................................

.00

(b) Shipped from outside Indiana ......................................................

Sales shipped from Indiana to:

.00

(c) The United States government ....................................................

(d) Purchasers in a state where the taxpayer is not subject to

.00

income tax (under P.L. 86-272) ....................................................

.00

(e) Interest & other receipts from extending credit attributed to Indiana

.00

(f) Other gross business receipts not previously apportioned ...........

Total Receipts: Add column A receipts lines 3(a) through 3(f) and

3A

3B

.00

.00

enter in line 3A. Enter all receipts in line 3B, of column B .....................

4. Summary - Apportionment of income for Indiana for tax years beginning in 2009

.

.

%

%

Multiply result by 8 .....................

4a

(a) Receipts Percentage for factor 3 above: Divide 3A by 3B, enter result here:

.

%

4b

(b) Total Percents: Add percentages entered in boxes 1C, 2C, and 4a of column C. Enter sum ...................................................................................

.

%

(c) Indiana Apportionment Percentage: Divide line 4b by 10 if all three factors are present. Enter here and carry to apportionment line on the tax return .....

4c

Note: If either the property or payroll factor for column B is absent, divide line 4b by 9.

If the receipts factor (3B) is absent, you must divide line 4b by 2. See instructions.

Part II - Business/Other Income Questionnaire

1. List all business locations where the taxpayer has operations or partnership interests and indicate type of activities. This section must be completed - attach additional sheets if necessary.

(d) Registered

(e) Files Returns

(c) Accepts

Property in State

(a)

Location

Nature of Business Activity

(b)

Orders?

in State?

Owned?

to Do Business?

Leased?

(g)

City and State

at Location

(f)

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

2. Briefly describe the nature of Indiana business activities, including the exact title and principal business activity of any partnership in which the taxpayer has an interest:

3. Indicate any partnership in which you have a unitary or general partnership relationship:

4. Briefly describe the nature of activities of sales personnel operating and soliciting business in Indiana:

5. Do Indiana receipts for line 3A include all sales shipped from Indiana to (1) the U.S. government; or (2) locations where this taxpayer's only activity in the state

of the purchaser consists of the mere solicitation of orders?

Y

N

If no, please explain:

6. List the source of any directly allocated income from partnerships, estates, and trusts not in the taxpayer's apportioned tax base:

*104091101*

104091101

1

1