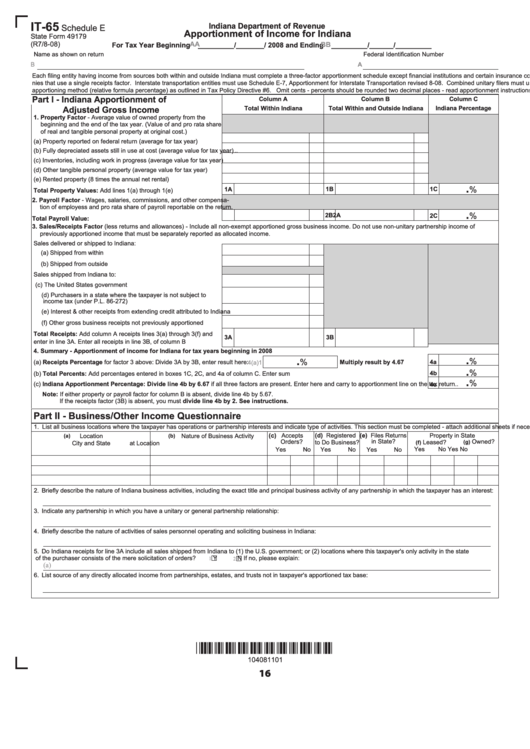

Form It-65 - Schedule E - Apportionment Of Income For Indiana

ADVERTISEMENT

IT-65

Indiana Department of Revenue

Apportionment of Income for Indiana

(R7/8-08)

AA

For Tax Year Beginning

_________/_______/ 2008 and Ending

BB

_________/______/_________

A

-

Part I - Indiana Apportionment of

Column A

Column B

Column C

Total Within Indiana

Indiana Percentage

Total Within and Outside Indiana

Adjusted Gross Income

1. Property Factor

.......................

..

.......

.................

(e) Rented property (8 times the annual net rental) ....................................

.

1A

1B

1C

Total Property Values:

.............................

2. Payroll Factor

tion of employess and pro rata share of payroll reportable on the return.

.

2A

2B

2C

Total Payroll Value: .............................................................................

3. Sales/Receipts Factor

(a) Shipped from within Indiana ........................................................

(b) Shipped from outside Indiana......................................................

Sales shipped from Indiana to:

....................................................

....................................................

...........

Total Receipts:

3A

3B

.....................

4. Summary - Apportionment of income for Indiana for tax years beginning in 2008

.

.

4a

(a) Receipts Percentage

Multiply result by 4.67 ................

4(a)1

.

4b

(b) Total Percents:

...................................................................................

.

Indiana Apportionment Percentage: Divide line 4b by 6.67

..

4c

Note:

divide line 4b by 2. See instructions.

Part II - Business/Other Income Questionnaire

if

.

(d)

(e) Files Returns

Property in State

(c)

(a)

(b)

(g)

(f)

1

2

(a)

104081101

16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1